Notebook: Expansion Suite#

We previously covered the small-noise expansion method and the recursive utility framework. This section covers the usage of Expansion Suite, an open source Python toolbox which uses these methods to solve discrete nonlinear DSGE models.

This notebook provides both written explanations and accompanying code. The simplest way to run the code is to open the Google Colab link at the top of this page. Otherwise, the reader can copy the code snippets onto their local machine.

Consider the framework previously introduced:

The Expansion Suite uses the function uncertain_expansion to approximate a solution to the above system locally. It takes the following inputs:

Input |

Type |

Description |

|---|---|---|

|

callable |

Function which takes state and jump variables and outputs error of equilibrium conditions, i.e. RHS of equation (1) |

|

callable |

Function which takes model parameters and outputs steady-state values of state and jump variables |

|

tuple of int |

Triple of integers \((n_J,n_X,n_W)\) where \(n_J\) is the number of jump variables, \(n_X\) is the number of state variables, and \(n_W\) is the number of shocks. |

|

tuple of float or ndarray |

Array of preference and model parameters |

|

callable |

Function which takes in variables and outputs log-growth of consumption |

|

tuple of float/ndarray |

Preference and model parameters |

|

callable |

Function which takes in variables and outputs log-growth of consumption |

|

string |

If equal to ‘1’, then solve the model using approach 1 (default, see Appendix C); If equal to ‘2’, then use approach 2 (see Appendix D). The function raises an exception if other values are provided |

|

dict, or None |

Dictionary for initialization of the expansion coefficients \(\mu^0, \Upsilon_0^2, \Upsilon_1^2,\) and \(\Upsilon_2^2\). The keys are: |

|

float |

Iteration stops when the maximum absolute difference between the approximated variables in the current and previous iteration is below |

|

int |

Maximum number of iterations |

The output is of class ModelSolution, which stores the coefficients for the linear-quadratic approximation for the jump and state variables; continuation values; consumption growth; and log change of measure, as well as the steady-state values of each variables.

We will now walk through the computation using a simple example.

1 AK Model with Recursive Utility#

1.1 Model Setup #

Consider the following recursive utility maximization problem with AK technology:

such that

where \(\psi\) is adjustment cost parameter which determines the efficiency of converting investment to capital, and \(\eta_k\) is depreciation. \(Z_t\) governs the (scalar) conditional mean of (stochastic) technology growth while \(\sigma_k\) governs the stochastic volatility of technology growth. \(W_{t+1}\) is a two-dimensional Wiener process which provides the exogenous shocks to this model.

For the purposes of computation, we divide the first two equations by \(K_t\).

1.2 First-Order Conditions #

Let \({\widehat G}_t = {\widehat K}_t,\) \(X_t = Z_t,\) and \(D_t = \frac {I_t }{K_t}.\) We can rewrite the previous equations as:

Apply the general form of FOC and costate equations and notice in this special case \(\psi^x_d = 0\), we have

The FOC is

The law of motion of costate \(\widetilde{MG}\) is

Finally, we can express our system of equations as

The model has thre e jump variables (In the expansion suite, \(J_t\) is used to represent the array of jump variables):

\(\log C_t - \log G_t\) : Log consumption over capital

\(\log D_t\) : Log investment over capital

\(\log MG_t\) : Log co-state variable

and two state variables (In the expansion suite, \(X_t\) is used to represent state variables):

\(\log G_{t} - \log G_{t-1}\) : Log capital growth process

\(Z_{t}\) : Exogenous technology

2 Inputs #

2.1 Libraries #

Begin by installing the following libraries and downloading RiskUncertaintyValue, which contains the functions required to solve the model:

import os

import sys

workdir = os.getcwd()

!git clone https://github.com/lphansen/RiskUncertaintyValue

workdir = os.getcwd() + '/RiskUncertaintyValue'

sys.path.insert(0, workdir+'/src')

import numpy as np

import autograd.numpy as anp

from scipy import optimize

np.set_printoptions(suppress=True)

np.set_printoptions(linewidth=200)

from IPython.display import display, HTML

from BY_example_sol import disp

display(HTML("<style>.container { width:97% !important; }</style>"))

import warnings

warnings.filterwarnings("ignore")

from lin_quad import LinQuadVar

from lin_quad_util import E, concat, next_period, cal_E_ww, lq_sum, N_tilde_measure, E_N_tp1

from uncertain_expansion import uncertain_expansion

np.set_printoptions(suppress=True)

fatal: destination path 'RiskUncertaintyValue' already exists and is not an empty directory.

2.2 Equilibrium Condition Function #

The first input for uncertain_expansion requires us to define the equilibrium conditions for the model. Therefore we define a function eq which takes in a list of jump and state variables as inputs, and outputs the equilibrium equations in the form of equations 1 and 2. The inputs required:

Variable |

Type |

Description |

Corresponds to |

|---|---|---|---|

|

array-like |

Vector of jump and state variables in the current period |

\((J_t, X_t)\) |

|

array-like |

Vector of jump and state variables in the next period |

\((J_{t+1}, X_{t+1})\) |

|

array-like |

Vector of shock variables in the next period |

\((W_{t+1})\) |

|

float |

Perturbation parameter |

\(q\) |

|

string |

By default, this function returns the LHS of equation (1) and (2). Set mode to ‘psi1’, ‘psi2’, or ‘phi’ to return the corresponding function in the equilibrium conditions |

|

|

tuple of float/ndarray |

Preference and model parameters |

While writing out eq, ensure that:

The first components of

Var_tandVar_tp1are fixed asq_torq_tp1.State variables follow jump variables.

The number of jump variables (except

q_tandq_tp1) equals the number of forward-looking equilibrium conditions.The number of state variables equals to the number of state evolution equations.

All values are expressed as type

float. Otherwise, this may cause type errors.

Note that the log change of measure is skipped in the specification of equilibrium conditions.

Notice that the first 3 parameters and \(q\) in variables should be defined and called in the given order.

For the example model, we write:

Show code cell content

def eq_onecap_2d(Var_t, Var_tp1, W_tp1, q, mode, *args):

# Unpack model parameters

γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z, sigma_k, sigma_z1, sigma_z2 = args

w1_tp1, w2_tp1 = W_tp1.ravel()

# Unpack model variables

q_t, cmk_t, imk_t, mk_t, Z_t, gk_t = Var_t.ravel()

q_tp1, cmk_tp1, imk_tp1, mk_tp1, Z_tp1, gk_tp1 = Var_tp1.ravel()

# Intermedite varibles that facilitates computation

sdf_ex = anp.log(β) - ρ*(cmk_tp1+gk_tp1-cmk_t)

g_dep = -α_k + beta_k*Z_t + sigma_k*w1_tp1 - 0.5 * (sigma_k**2)

## Forward-looking conditions

psi1_1 = 0.

psi1_2 = anp.exp(sdf_ex + gk_tp1) * 1/(1 + ϕ_2*anp.exp(imk_t)) * mk_tp1

psi1_3 = anp.exp(sdf_ex + gk_tp1) * mk_tp1

psi2_1 = -a + anp.exp(cmk_t) + anp.exp(imk_t)

psi2_2 = 1.

psi2_3 = mk_t - anp.exp(cmk_t)

# State evoluion processes

phi_1 = Z_tp1 - beta_z*Z_t - sigma_z1*w1_tp1 - sigma_z2*w2_tp1

phi_2 = gk_tp1 - ϕ_1 * anp.log(1.+ϕ_2*anp.exp(imk_t)) - g_dep

if mode == 'psi1':

return np.array([psi1_1, psi1_2, psi1_3])

return anp.array([

psi1_1 * anp.exp(q_tp1) - psi2_1,

psi1_2 * anp.exp(q_tp1) - psi2_2,

psi1_3 * anp.exp(q_tp1) - psi2_3,

phi_1, phi_2])

2.3 Steady State Function #

This function takes model parameters as input and outputs the steady states for each variable following the variable order specified in Var_t and Var_tp1. To find the steady state, we remove the time subscripts from each variable and solve the system of equations.

Note that the first entry of the output array will always be 0, since the steady state of q_t is 0.

Show code cell content

def ss_onecap_2d(*args):

γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z, sigma_k, sigma_z1, sigma_z2 = args

def f(imk):

g_k = ϕ_1 * np.log(1.+ ϕ_2 * np.exp(imk)) - α_k - 0.5 * (sigma_k**2)

sdf_ex = np.log(β) - ρ*g_k

cmk = np.log(a - np.exp(imk))

mk = 1./(anp.exp(sdf_ex + g_k)* 1/(1 + ϕ_2*anp.exp(imk)))

return mk - anp.exp(cmk) - anp.exp(sdf_ex + g_k) * mk

imk = optimize.bisect(f,-10,-2.5)

cmk = np.log(a - np.exp(imk))

g_k = ϕ_1 * np.log(1. + ϕ_2 * np.exp(imk)) - α_k - 0.5 * (sigma_k**2)

sdf_ex = np.log(β) - ρ*g_k

mk = 1./(anp.exp(sdf_ex + g_k)* 1/(1 + ϕ_2*anp.exp(imk)))

return np.array([0., cmk, imk, mk, 0., g_k])

2.4 Specifying Number of Variables #

We need to specify the number of jump variables, state and shock variables as an array (n_J, n_X, n_W).

Show code cell content

var_shape = (3, 2, 2)

2.5 Model Parameters #

Next, we need to specify all the model parameters using a Python tuple.

The first three parameters should be γ, β, ρ, respectively. The package is designed for recursive utlity.

Please use 1.00001 for γ and ρ as approximation for 1.0.

We suggest not using matrix when specifying the equilibrium conditions and parameters.

Show code cell content

σ_k = 0.477*2

sigmaz1 = 0.011*2

sigmaz2 = 0.025*2

delta = 0.01

alpha = 0.0922

a = alpha

ϕ_1 = 1/8

ϕ_2 = 8

beta_k = 0.01

beta_z1 = np.exp(-0.056)

beta_z2 = np.exp(-0.145)

beta_z3 = np.exp(-0.1)

sigma_k = σ_k*0.01

sigma_z1 = sigmaz1

sigma_z2 = sigmaz2

α_k = 0.04

β = np.exp(-delta)

γ = 12.0

ρ = 1.5

args = (γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z1, sigma_k, sigma_z1, sigma_z2)

2.6 Log Consumption Growth #

Finally, we need to specify how to compute the log-growth of consumption \(\log{C_{t+1}/C_t}\) using the defined variables Var_t and Var_tp1 in the equilibrium conditions.

In this example, we simply use the decomposition:

The reason to specify log consumtion growth is that we need to approximate recursive utility as described in the notes section 3.2.2 and section 3.2.3

In habit formation models, \(C_t\) is replaced with \(U_t\), in which case we would specify the log growth process for \(U_t\) correspondingly.

Show code cell content

def gc_onecap_2d(Var_t, Var_tp1, W_tp1, q, *args):

# Unpack model parameters

γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z, sigma_k, sigma_z1, sigma_z2 = args

# Unpack model variables

q_t, cmk_t, imk_t, mk_t, Z_t, gk_t = Var_t.ravel()

q_tp1, cmk_tp1, imk_tp1, mk_tp1, Z_tp1, gk_tp1 = Var_tp1.ravel()

# Compute log consumption growth

gc_tp1 = cmk_tp1 + gk_tp1 - cmk_t

return gc_tp1

2.7 Computing ModelSol #

Now we are able to use steps 2.1 to 2.5 as inputs to the uncertain_expansion function. The solution is stored in a class named ModelSolution(Please refer to uncertainexpansion.ipynb for details.) under the Linear Quadratic Framework.

See src/uncertain_expansion.py for the source code of the expansion suite.

Show code cell content

# Solve the One-Capital Adjustment Model

eq = eq_onecap_2d

ss = ss_onecap_2d

gc = gc_onecap_2d

var_shape = (3, 2, 2)

args = (γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z1, sigma_k, sigma_z1, sigma_z2)

approach = '1' # See Exploring Recursive Utility Appendix for difference about approach '1' and '2'

ModelSol = uncertain_expansion(eq, ss, var_shape, args, gc, approach = '1')

Iteration 1: error = 0.0211794947

Iteration 2: error = 1.38777878e-17

3 Outputs#

3.1 List of Outputs #

We now examine the contents of ModelSol, which contains the attributes listed below. Each approximation is stored in a class LinQuadVar, which contains the coefficients for \(X_{1,t}, X_{2,t}, X_{1,t}'X_{1,t}, W_{t+1}, W_{t+1}'W_{t+1}, X_{1,t}'W_{t+1}\) and the constant.

Input |

Type |

Description |

|---|---|---|

|

LinQuadVar |

Approximation of jump and state variables at time \(t\). Replace |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

dict |

Dictionary containing solutions of the continuation values, including \(\mu^0, \Upsilon_0^2, \Upsilon_1^2,\) and \(\Upsilon_2^2\) etc. |

|

LinQuadVar |

Approximation of continuation values \(\widehat{V}^1_{t+1}-\widehat{R}^1_t\) . Replace |

|

LinQuadVar |

Approximation of consumption growth \(\widehat{C}_{t+1}-\widehat{C}_t\) . Replace |

|

dict |

Steady states for state and jump variables |

|

LinQuadVar |

Approximation for the log change of measure |

For example, we can obtain the coefficients for the first-order contribution of \(\log{C_t/K_t}\) in the following way, noting that cmk_t was listed as the first jump variable when we specified the equilibrum conditions.

## Log consumption over capital approximation results, shown in the LinQuadVar coefficients form

ModelSol['JX1_t'][0].coeffs

{'c': array([[-0.02117949]]), 'x': array([[ 0.04344641, -0. ]])}

We can also display the full second-order approximation of \(\log{C_t/K_t}\) using the disp function, which renders a LinQuadVar object in LATEX form.

## Log consumption over capital approximation results, shown in the Latex analytical form

disp(ModelSol['JX_t'][0],'\\log\\frac{C_t}{K_t}')

Another example:

## Log capital growth process second order approximation results

disp(ModelSol['X2_tp1'][0],'\\log\\frac{K_{t+1}^2}{K_t^2}')

3.3 Simulate Variables #

Given a series of shock processes, we can simulate the path of our state and jump variables using the ModelSolution.simulate method. Here, we simulate 400 periods of i.i.d standard multivariate normal shocks.

Ws = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 400)

JX_sim = ModelSol.simulate(Ws)

3.4 Shock Elasticities and IRF #

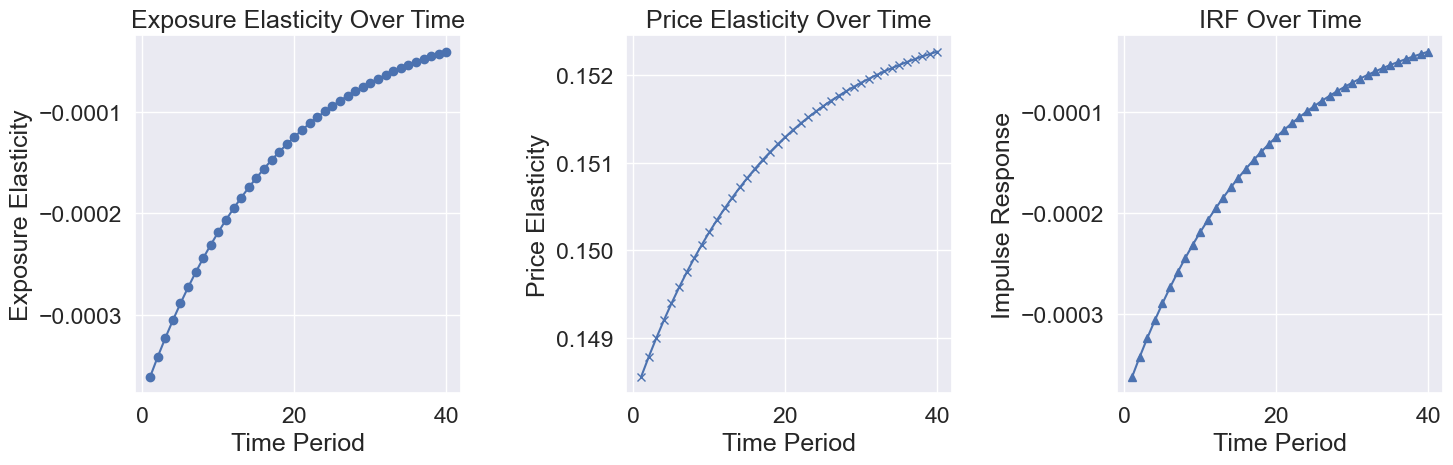

ModelSolution contains a method elasticities used to compute the shock elasticities of jump and state variables. We do this by defining a log_SDF_ex function, which expresses the log stochastic discount factor exclusive of the change of measure \({N}^*_{t+1}\) and variable \(Q_{t+1}^*\). Shock elasticities are great tools for nonlinear impulsive response analyses, and in linear models, the shock elasticities correspond to the traditional impulse response function (IRF).

ModelSolution also has a method IRF to compute the traditional IRF of all jump and state variables. Below we calculate the IRF of all variables with respect to the first shock for 400 periods.

The figure plots elasticities and IRF of investment rate with regard to shock 1.

Show code cell content

def log_SDF_ex(Var_t, Var_tp1, W_tp1, q, *args):

# Log stochastic discount factor exclusive of the change of measure N and Q.

# Parameters for the model

γ, β, ρ, a, ϕ_1, ϕ_2, α_k, beta_k, beta_z, sigma_k1, sigma_k2, sigma_z = args

# Variables: (q_t, q_tp1 is excluded when using the method in `ModelSolution`)

cmk_t, imk_t, mk_t, Z_t, gk_t = Var_t.ravel()

cmk_tp1, imk_tp1, mk_tp1, Z_tp1, gk_tp1 = Var_tp1.ravel()

sdf_ex = anp.log(β) - ρ*(cmk_tp1+gk_tp1-cmk_t)

return sdf_ex

expo_elas, price_elas = ModelSol.elasticities(log_SDF_ex, T=40, shock=0)

states, controls = ModelSol.IRF(T = 40, shock = 0)

Show code cell content

import matplotlib.pyplot as plt

time_periods = list(range(1, 41)) # 40 time periods starting from 1

fig, axs = plt.subplots(1, 3, figsize=(15, 5)) # Adjust the figure size as needed

# Plotting Exposure Elasticity in the first subfigure

axs[0].plot(time_periods, expo_elas[:, 1], label='Exposure Elasticity', marker='o')

axs[0].set_xlabel('Time Period')

axs[0].set_ylabel('Exposure Elasticity')

axs[0].set_title('Exposure Elasticity Over Time')

axs[0].grid(True)

# Plotting Price Elasticity in the second subfigure

axs[1].plot(time_periods, price_elas[:, 1], label='Price Elasticity', marker='x')

axs[1].set_xlabel('Time Period')

axs[1].set_ylabel('Price Elasticity')

axs[1].set_title('Price Elasticity Over Time')

axs[1].grid(True)

# Plotting IRF in the third subfigure

axs[2].plot(time_periods, controls[:, 1], label='IRF', marker='^')

axs[2].set_xlabel('Time Period')

axs[2].set_ylabel('Impulse Response')

axs[2].set_title('IRF Over Time')

axs[2].grid(True)

plt.tight_layout()

plt.show()

4 Using LinQuadVar in Computation #

In the previous section, we saw how to use uncertain_expansion to approximate variables and store their coefficients as LinQuadVar objects. In this section, we explore how to manipulate LinQuadVar objects for different uses.

To aid our examples, we first extract the steady states for the state evolution processes from the previous model solution:

See src/lin_quad.py for source code of LinQuadVar definition.

n_J, n_X, n_W = ModelSol['var_shape']

X0_tp1 = LinQuadVar({'c':np.array([[ModelSol['ss'][1]],[ModelSol['ss'][2]]])}, shape = (2, n_X, n_W))

X0_tp1.coeffs

{'c': array([[-2.71057934],

[ 1.5576879 ]])}

4.1 LinQuadVar Operations #

We can sum multiple LinQuads together in two different ways. Here we demonstrate this with an example by summing the zeroth, first and second order contributions of our approximation for capital growth.

gk_tp1 = X0_tp1[0] + ModelSol['X1_tp1'][0] + 0.5 * ModelSol['X2_tp1'][0]

disp(gk_tp1,'\\log\\frac{K_{t+1}}{K_t}')

In the next example, we sum together the contributions for both capital growth and technology:

lq_sum([X0_tp1, ModelSol['X1_tp1'], 0.5 * ModelSol['X2_tp1']]).coeffs

{'c': array([[-2.71057934],

[ 1.55804585]]),

'x': array([[0.94553914, 0. ],

[0.00928281, 0. ]]),

'w': array([[0.022 , 0.05 ],

[0.00954, 0. ]]),

'x2': array([[0.47276957, 0. ],

[0.00463556, 0. ]]),

'xx': array([[ 0. , 0. , 0. , 0. ],

[-0.00001424, -0. , 0. , 0. ]])}

4.2 LinQuadVar Split and Concat #

split breaks multiple dimensional LinQuad into one-dimensional LinQuads, while concat does the inverse.

gk_tp1, Z_tp1 = ModelSol['X1_tp1'].split()

concat([gk_tp1, Z_tp1])

<lin_quad.LinQuadVar at 0x7fd482a310d0>

4.3 Evaluate a LinQuadVar #

We can evaluate a LinQuad at specific state \((X_{t},W_{t+1})\) in time. As an example, we evaluate all 5 variables under steady state with a multivariate random normal shock.

x1 = np.zeros([n_X ,1])

x2 = np.zeros([n_X ,1])

w = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 1).T

ModelSol['JX_tp1'](*(x1,x2,w))

array([[-3.68477708],

[-2.70160922],

[ 1.56188201],

[-0.04541874],

[ 0.03643626]])

4.4 Next period expression for LinQuadVar #

ModelSol allows us to express a jump variable \(J_t\) as a function of \(t\) state and shock variables. Suppose we would like to compute its next period expression \(J_{t+1}\) with shocks. The function next_period expresses \(J_{t+1}\) in terms of \(t\) state variables and \(t+1\) shock variables. For example, we can express the \(t+1\) expression for the first-order contribution to consumption over capital as:

cmk1_tp1 = next_period(ModelSol['J1_t'][0], ModelSol['X1_tp1'])

disp(cmk1_tp1, '\\log\\frac{C_{t+1}^1}{K_{t+1}^1}')

cmk2_tp1 = next_period(ModelSol['J2_t'][0], ModelSol['X1_tp1'], ModelSol['X2_tp1'])

disp(cmk2_tp1, '\\log\\frac{C_{t+1}^2}{K_{t+1}^2}')

4.6 Compute the Expectation of time \(t+1\) LinQuadVar #

Suppose the distribution of shocks has a constant mean and variance (not state dependent). Then, we can use the E function to compute the expectation of a time \(t+1\) LinQuadVar as follows:

E_w = ModelSol['util_sol']['μ_0']

cov_w = np.eye(n_W)

E_ww = cal_E_ww(E_w, cov_w)

E_cmk2_tp1 = E(cmk2_tp1, E_w, E_ww)

disp(E_cmk2_tp1, '\mathbb{E}[\\log\\frac{C_{t+1}^2}{K_{t+1}^2}|\mathfrak{F_t}]')

Suppose the distribution of shock has a state-dependent mean and variance (implied by \(\tilde{N}_{t+1}\) shown in the notes), we can use E_N_tp1 and N_tilde_measure to compute the expectation of time \(t+1\) LinQuadVar.

N_cm = N_tilde_measure(ModelSol['util_sol']['log_N_tilde'],(1,n_X,n_W))

E_cmk2_tp1_tilde = E_N_tp1(cmk2_tp1, N_cm)

disp(E_cmk2_tp1_tilde, '\mathbb{\\tilde{E}}[\\log\\frac{C_{t+1}^2}{K_{t+1}^2}|\mathfrak{F_t}]')