Notebook: Continuous Time#

Shock elasticities quantify the (local) exposures of macroeconomic cash flows to shocks over alternative investment horizons and the corresponding prices or investors’ compensations. Here, we cover shock elasticities for models with equilibrium outcomes represented as a continuous-time diffusion. This notebook implements methods and formulas developed in [1] and [2].

Section 1 gives the continuous-time formulation with a Brownian motion information structure.

Section 2 provides an illustration using an intermediary asset pricing model, see [3], [4], and [5].

This notebook provides both written explanations and accompanying code. The simplest way to run the code is to open the Google Colab link at the top of this page. Otherwise, the reader can copy the code snippets onto their local machine.

import os

import sys

workdir = os.getcwd()

from IPython.display import display, HTML

display(HTML("<style>.container { width:97% !important; }</style>"))

import numpy as np

np.set_printoptions(suppress=True)

from scipy.interpolate import RegularGridInterpolator

from scipy import interpolate

from shockElasModules import computeElas

from stationaryDensityModules import computeDent

import pickle

import itertools

import json

---------------------------------------------------------------------------

ModuleNotFoundError Traceback (most recent call last)

/var/folders/w8/yzmpdfnn56n_rrj09q0r6spc0000gn/T/ipykernel_36892/2813065489.py in <module>

8 from scipy.interpolate import RegularGridInterpolator

9 from scipy import interpolate

---> 10 from shockElasModules import computeElas

11 from stationaryDensityModules import computeDent

12 import pickle

ModuleNotFoundError: No module named 'shockElasModules'

1. Continuous-time framework#

1.1 Basic setup#

Suppose a continuous-time diffusion model:

where \(X\) is an \(n\)-dimensional process and \(W\) is an \(m\)-dimensional Brownian motion and \(Y = \log M.\)

The two types of shock elasticities of interest are:

The code computes

by using the Feynman_Kac formula. Define

Then \(\phi_t\) satisfies:

where \(\phi_0 = 1\) for (4) and \(\phi_0 = \nu \cdot \sigma_M\) for (5).

1.2 Stochastic discount factor process#

Represent the stochastic discount factor evolution and the evolution of its logarithm as:

where \({\hat \mu}_S(X_t) = \mu_S(X_t) - \frac 1 2 \vert \sigma_S(X_t) \vert^2.\) The instantaneous risk-free rate is \(- \mu_S(X_t)\) and the local price vector for exposure to the Brownian increment is \(-\sigma_S(X_t).\)

Also represent the consumption and continuation value evolution and the evolution of their logarithm as:

where \({\hat \mu}_C(X_t) = \mu_C(X_t) - \frac 1 2 \vert \sigma_C(X_t) \vert^2\) and \({\hat \mu}_V(X_t) = \mu_V(X_t) - \frac 1 2 \vert \sigma_V(X_t) \vert^2.\)

The code computes the evolutions in terms of logarithms for reasons of numerically convenient.

Given the consumption and continuation-value evolution,

where

The martingale uncertainty contribution to the stochastic discount factor process and the evolution of its logarithmic counterpart are of particular interest.

where

Use \(N\) in place of \(S\) to obtain the uncertainty component to the shock price elasticities.

1.3 Shock Exposure Elasticity and Price Elasticity#

For this continuous-time setup, the code computes the shock exposure elasticity or impulse response function for a process, \(G\), using formula \eqref{eq:shock1} and \eqref{eq:shock2}, the corresponding shock price elasticity using

2. An Illustration using an intermediary asset pricing model [3], [4], [5]#

2.1 Computing Shock Elasticities: computeElas#

computeElas is the function that computes the shock exposure and price elasticities (both the first and second types). It takes in the following arguments:

stateMat: (Tuple)

A tuple containing a numpy-array formatted domain for each of the states. For example, suppose the model has two state variables and each state variable has 100 grid points. The stateMat argument would be a tuple containing two numpy arrays of shape \((100\),\() .\)

model:(Dictionary)

A dictionary that contains the information described in (1), (8), and (9). Specifically, it has the following keys:

muX: (Function)A function that computes the drifts of the state variables (i.e. \(\mu_X\) as in (1)) for each of the grid points in stateMat. Suppose there are \(n\) state variables. Given a \(k \times n\) numpy matrix points, where each row represents a point,

model['muX'](points)must return a \(k \times n\) numpy matrix, with each row corresponding to the drift vector of the state variables.

sigmaX:(List of functions) A list of functions, where each function computes the diffusion of a state variable (i.e. \(\sigma_X\) as in (1)) in order of the list (i.e. the first element of the list computes the diffusion of the first state variable in stateMat). For example, suppose there are \(n\) state variables and \(m\) shocks.

model['sigmaX']is a list of two elements. Further suppose that points is a \(k \times n\) matrix, where each row represents a point. Thenmodel['sigmaX'][0](points)returns a \(k \times m\) matrix that contains the diffusion of the first state variable at these points.

muC: (Function)Similar to muX, a function that computes \(\mu_C\), the drift of the perturbed process, as in (9). Suppose there are \(n\) state variables.

model['muC'](points)must return a \(k \times 1\) numpy matrix, where points is a \(k \times n\) matrix. Note: the number of columns of points is \(n\), but the dimensions of the output are \(k \times 1\). Note that \(C\) is not limited to consumption process. It could be a general process \(G\) as shown in section 2.3.

sigmaC: (Function)A function that computes \(\sigma_C\), the diffusion of the perturbed process, as in (9). Suppose points is a \(k \times n\) matrix. Then

model['sigmaC'](points)must return a \(k \times m\) matrix, where \(n\) is the number of state variables and \(m\) is the number of shocks (Note that \(m\) is not necessarily equal to \(n\) ). Note that \(C\) is not limited to consumption process. It could be a general process \(G\) as shown in section 2.3.

muS: (Function)Similar to muX and muC, a function that computes \(\mu_S\), the drift of the stochastic discount factor, as in (6). Using the same example,

model['muS'](points)must return a \(k \times 1\) numpy matrix, where points is a \(k \times n\) matrix.

sigmaS: (Function)A function that computes \(\sigma_S\), the diffusion of the perturbed process, as in (6). Suppose points is a \(k \times n\) matrix. Then

model['sigmaS'](points)must return a \(k \times m\) matrix, where \(n\) is the number of state variables and \(m\) is the number of shocks.

dt: (Float)The length of time step;

T: (Integer)Total number of time periods. Suppose

dt=1/12 implies one month andmodel['T']=120. The total time that the elasticities are solved for is 10 years.

bc: (Dictionary)

A dictionary that specifies the boundary conditions in this form: $\( 0=a_0+a_1\phi+a_2 \cdot \frac{\partial}{\partial x'}\phi \label{eq:what}\tag{10} \)\( for all \)t\( where \)a_0, a_1\( are scalars, and \)a_2\( is a \)1 \times n$ vectors. The user should configure

bcin this way:a0: a scalar that corresponds to \(a_0\) in \eqref{eq:what}level: a scalar that corresponds to \(a_1\) in \eqref{eq:what}first: a \(1 \times n\) numpy matrix that corresponds to \(a_2\) in \eqref{eq:what}natural: a boolean (True or False) that determines whether to use natural boundaries; if True, the fields above would be ignored. ``Natural boundaries’’ are implemented by effectly assuming constant second derivatives at boundaries.

For example, to implement the boundary conditions \(0= \begin{bmatrix} 1 & 1 & 1 \end{bmatrix} \cdot \frac{\partial}{\partial x} \phi\), one should set up bc by doing:

bc = {}

bc['a0'] = 0

bc['first'] = np.matrix([1, 1, 1], 'd')

bc['level'] = np.matrix([0])

bc['natural'] = False

x0 : (numpy matrix)

A numpy matrix that contains all the starting points (i.e. \(x\) in (6)). For \(l\) starting points, \(\mathrm{x} 0\) should be an \(l \times n\) matrix ( \(n\) being the number of states).

usePardiso: (Boolean)

A boolean option to use the Intel package called Pardiso to solve the linear system. Defaults to False.

iparms: (Dictionary)

If usePardiso is set to True, Pardiso’s default parameters will be used. The iparms parameter allows the user to input a dictionary with changes for those default parameters. Note that while the Pardiso site indexes the parameters at one, this function argument indexes them at zero. For example, a user wishing to set what is listed on the website as iparm(1) to \(-1\) would set iparms \(=\{0:-1\}\).

Finally, we have one optional argument:

betterCP: (Boolean)

True by default. If False, the program will use the following finite difference approximation scheme for cross partials:

if True, the program will use the alternative finite difference approximation for cross partials. With the alternative approximation, one can have a better chance of preserving monotonicity:

The function returns exposure and price elasticities. Suppose the user inputs \(l\) starting points (i.e. \(\mathrm{x} 0\) has \(l\) rows) and \(T\) time periods. Then the function will return the following:

expoElas:

an object with two attributes: the firstType and secondType. Each attribute is an \(l \times k \times T\) matrix. The first index corresponds to the starting point, the second index corresponds to the shock number, and the third corresponds to time. As the name suggests, firstType is the first type shock exposure elasticities for the \(i\) th starting point (the \(i\) th row in input \(\mathrm{x} 0\) ) up to \(T\) time periods, whereas secondType is the second type shock exposure elasticities.

priceElas:

similar to expoElas, but contains the price elasticities.

## modelsol includes the state variable grids, variable drift and diffusion term information from exogenous solutions

# 'muCe' stands for the drift term for Expert Consumption, 'muCh' stands for the drift term for Households Consumption

# 'sigmaCe' stands for the diffusion term for Expert Consumption, 'muCh' stands for the diffusion term for Households Consumption

# 'muSe' stands for the drift term for Expert SDF, 'muNe' stands for the drift term for Expert Uncertainty Component of SDF,

# 'muX', stands for the drift term for state variables, wealth share (W), growth rate (Z), and stochastic volatility (V)

# The diffusion term and households have similar notation

# Please feel free to check the dimension of each element in modelsol

modelsol = pickle.load(open("model_ela_sol.pkl", "rb"))

# We compute the shock elasticities for 48 years with natural boundary

T = 48

dt = 1

bc = {'natural':True}

# The Toolbox takes python function as inputs, but usually the solution for drift and diffusion terms are the value evaluted at grid points, so we interpolate them as functions below.

muXs = []; stateVols = []

SDFeVols = []; SDFhVols = []

sigmaChVols = []; sigmaCeVols = []

sigmaNhVols = []; sigmaNeVols = []

stateVolsList = []; sigmaXs = []

commonInput = {}

# Iterate over state dimensions

for n in range(modelsol['nDims']):

muXs.append(RegularGridInterpolator(modelsol['stateMatInput'],modelsol['muX'][:,n].reshape(modelsol['gridSizeList'], order = 'F')))

if n == 0:

commonInput['muCh'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muCh'].reshape(modelsol['gridSizeList'], order = 'F'))

commonInput['muCe'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muCe'].reshape(modelsol['gridSizeList'], order = 'F'))

commonInput['muSe'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muSe'].reshape(modelsol['gridSizeList'], order = 'F'))

commonInput['muSh'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muSh'].reshape(modelsol['gridSizeList'], order = 'F'))

commonInput['muNe'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muNe'].reshape(modelsol['gridSizeList'], order = 'F'))

commonInput['muNh'] = RegularGridInterpolator(modelsol['stateMatInput'], modelsol['muNh'].reshape(modelsol['gridSizeList'], order = 'F'))

# Iterate over shocks dimensions

for s in range(modelsol['nShocks']):

stateVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaX'][n][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

if n == 0:

SDFeVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaSe'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

SDFhVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaSh'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

sigmaChVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaCh'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

sigmaCeVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaCe'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

sigmaNhVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaNh'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

sigmaNeVols.append(RegularGridInterpolator(modelsol['stateMatInput'], modelsol['sigmaNe'][:,s].reshape(modelsol['gridSizeList'], order = 'F')))

stateVolsList.append(stateVols)

def sigmaXfn(n):

return lambda x: np.transpose([vol(x) for vol in stateVolsList[n] ])

sigmaXs.append(sigmaXfn(n))

stateVols = []

if n == 0:

commonInput['sigmaSe'] = lambda x: np.transpose([vol(x) for vol in SDFeVols])

commonInput['sigmaSh'] = lambda x: np.transpose([vol(x) for vol in SDFhVols])

commonInput['sigmaCe'] = lambda x: np.transpose([vol(x) for vol in sigmaCeVols])

commonInput['sigmaCh'] = lambda x: np.transpose([vol(x) for vol in sigmaChVols])

commonInput['sigmaNe'] = lambda x: np.transpose([vol(x) for vol in sigmaNeVols])

commonInput['sigmaNh'] = lambda x: np.transpose([vol(x) for vol in sigmaNhVols])

commonInput['sigmaX'] = sigmaXs

commonInput['muX'] = lambda x: np.transpose([mu(x) for mu in muXs])

commonInput['T'] = T; commonInput['dt'] = dt;

%%time

## Below provides an example to use stationary distribution toolbox calculate the quantile of shock elasticities for state variable Wealth Share, the results for all three variables have been provided in the modelsol['x0']

# Form state grids using meshgrid

stateMat = tuple(modelsol['stateMatInput'])

stateGrid = np.meshgrid(*stateMat, indexing='ij'); stateGrid = [np.matrix(x.flatten(order='F')).T for x in stateGrid]

stateGrid = np.concatenate(stateGrid, axis = 1)

## The `computeDent` takes similar input as shock elasticities toolbox, instead of function, we can directly input the drift and diffusion term evaluted at grid points with the form of np.matrix

dent = computeDent(stateGrid,{'muX': np.matrix(modelsol['muX']), 'sigmaX':[np.matrix(i) for i in modelsol['sigmaX']]}, bc = {'natural':True})

## Calculate Inverse CDFs

marginals = {}

inverseCDFs = {}

nRange = list(range(modelsol['nDims']))

axes = list(filter(lambda x: x != 0,nRange))

condDent = dent[0].reshape(modelsol['gridSizeList'], order = 'F').sum(axis = tuple(axes))

marginals['W'] = condDent.copy()

cumden = np.cumsum(marginals['W'])

cdf = interpolate.interp1d(cumden, modelsol['stateMatInput'][0], fill_value= (modelsol['stateMatInput'][0][1], modelsol['stateMatInput'][0][-2]), bounds_error = False)

inverseCDFs['W'] = cdf

## Using Inverse CDFs to compute the median for the wealth share state variable

inverseCDFs['W'](0.5)

CPU times: user 23min 51s, sys: 5min 59s, total: 29min 51s

Wall time: 5min 28s

array(0.25329026)

%%time

## Compute shock elasticities for experts consumption

modelInput = commonInput.copy()

modelInput['sigmaC'] = commonInput['sigmaCe']

modelInput['muC'] = commonInput['muCe']

modelInput['sigmaS'] = commonInput['sigmaSe']

modelInput['muS'] = commonInput['muSe']

expoElasExperts, priceElasExperts, linSysExpo, linSysE = computeElas(modelsol['stateMatInput'], modelInput, bc, modelsol['x0'])

CPU times: user 56min 47s, sys: 14min 52s, total: 1h 11min 40s

Wall time: 14min 16s

%%time

## Compute shock elasticities for households consumption

modelInput = commonInput.copy()

modelInput['sigmaC'] = commonInput['sigmaCh']

modelInput['muC'] = commonInput['muCh']

modelInput['sigmaS'] = commonInput['sigmaSh']

modelInput['muS'] = commonInput['muSh']

expoElasHouseholds, priceElasHouseholds, linSysExpo, linSysH = computeElas(modelsol['stateMatInput'], modelInput, bc, modelsol['x0'])

CPU times: user 57min 48s, sys: 17min 19s, total: 1h 15min 8s

Wall time: 16min 48s

%%time

## Compute uncertain component for experts consumption using N instead of S

modelInput = commonInput.copy()

modelInput['sigmaC'] = commonInput['sigmaCe']

modelInput['muC'] = commonInput['muCe']

modelInput['sigmaS'] = commonInput['sigmaNe']

modelInput['muS'] = commonInput['muNe']

expoElasExpertsN, priceElasExpertsN, linSysExpo, linSysE = computeElas(modelsol['stateMatInput'], modelInput, bc, modelsol['x0'])

CPU times: user 56min 44s, sys: 15min 52s, total: 1h 12min 36s

Wall time: 14min 56s

%%time

## Compute uncertain component for households consumption using N instead of S

modelInput = commonInput.copy()

modelInput['sigmaC'] = commonInput['sigmaCh']

modelInput['muC'] = commonInput['muCh']

modelInput['sigmaS'] = commonInput['sigmaNh']

modelInput['muS'] = commonInput['muNh']

expoElasHouseholdsN, priceElasHouseholdsN, linSysExpo, linSysH = computeElas(modelsol['stateMatInput'], modelInput, bc, modelsol['x0'])

CPU times: user 1h 4s, sys: 17min 3s, total: 1h 17min 8s

Wall time: 16min 59s

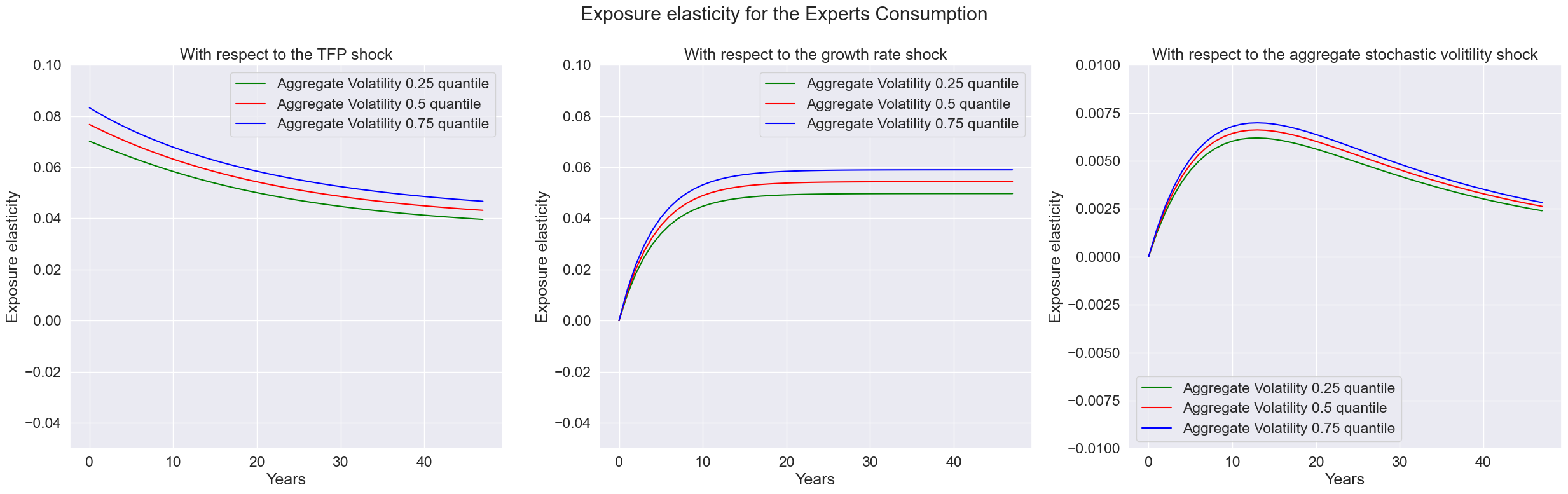

2.2 Shock Elasticities Plots#

import matplotlib.pyplot as plt

import seaborn as sns

import pandas as pd

pd.options.display.float_format = '{:.3g}'.format

sns.set(font_scale = 1.5)

T = 48

# Calculate the shock elasticity at 0.25, 0.5 and 0.75 quantile for Stochastic Volatility

quantile = [0.25, 0.5, 0.75]

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),expoElasExperts.firstType[0,0,:],expoElasExperts.firstType[1,0,:],expoElasExperts.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),expoElasExperts.firstType[0,1,:],expoElasExperts.firstType[1,1,:],expoElasExperts.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),expoElasExperts.firstType[0,2,:],expoElasExperts.firstType[1,2,:],expoElasExperts.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Exposure elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.05,0.1])

axes[1].set_ylim([-0.05,0.1])

axes[2].set_ylim([-0.01,0.01])

fig.suptitle('Exposure elasticity for the Experts Consumption')

fig.tight_layout()

plt.show()

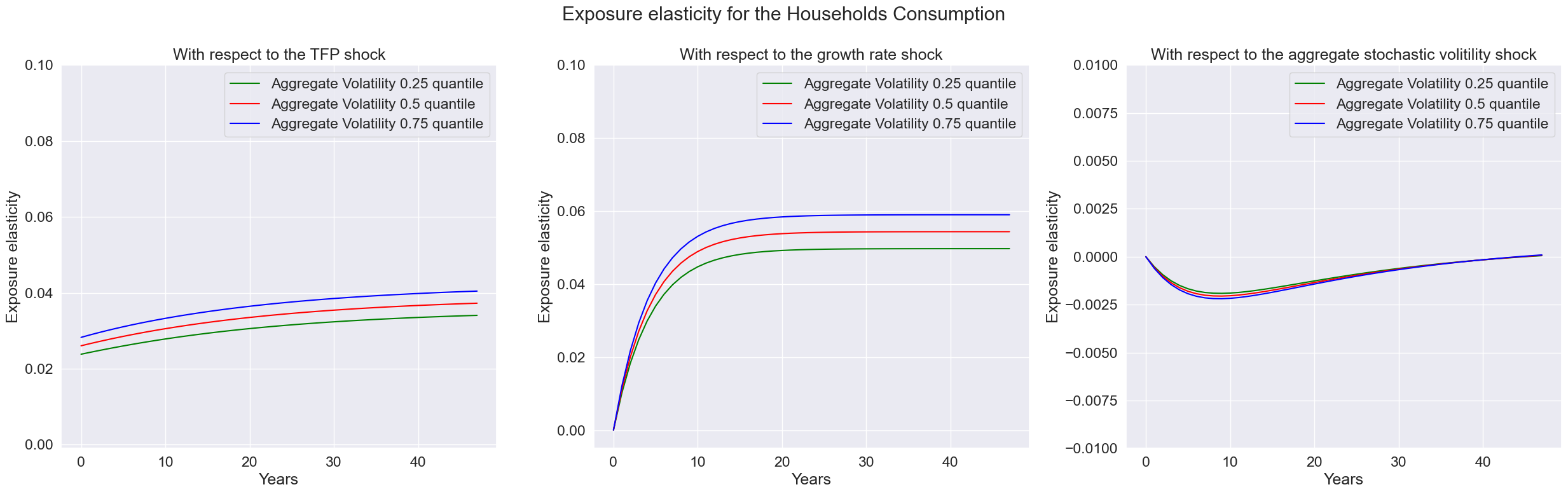

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),expoElasHouseholds.firstType[0,0,:],expoElasHouseholds.firstType[1,0,:],expoElasHouseholds.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),expoElasHouseholds.firstType[0,1,:],expoElasHouseholds.firstType[1,1,:],expoElasHouseholds.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),expoElasHouseholds.firstType[0,2,:],expoElasHouseholds.firstType[1,2,:],expoElasHouseholds.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Exposure elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.001,0.1])

axes[1].set_ylim([-0.005,0.1])

axes[2].set_ylim([-0.01,0.01])

fig.suptitle('Exposure elasticity for the Households Consumption')

fig.tight_layout()

plt.show()

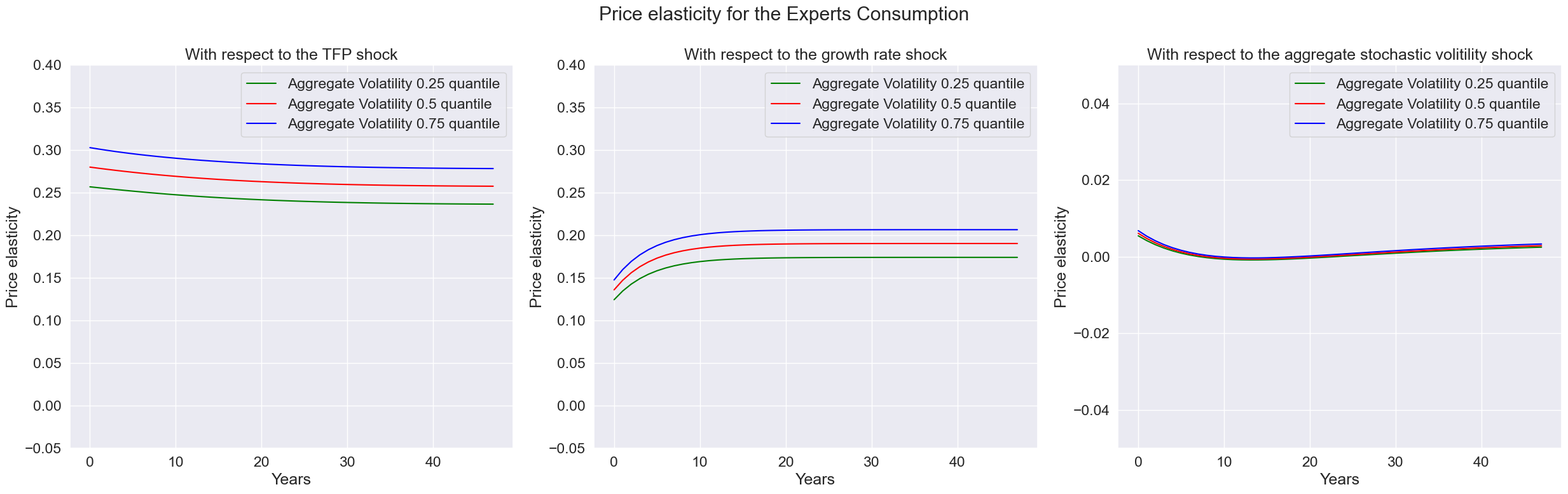

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasExperts.firstType[0,0,:],priceElasExperts.firstType[1,0,:],priceElasExperts.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasExperts.firstType[0,1,:],priceElasExperts.firstType[1,1,:],priceElasExperts.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasExperts.firstType[0,2,:],-priceElasExperts.firstType[1,2,:],-priceElasExperts.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.05,0.4])

axes[1].set_ylim([-0.05,0.4])

axes[2].set_ylim([-0.05,0.05])

fig.suptitle('Price elasticity for the Experts Consumption')

fig.tight_layout()

plt.show()

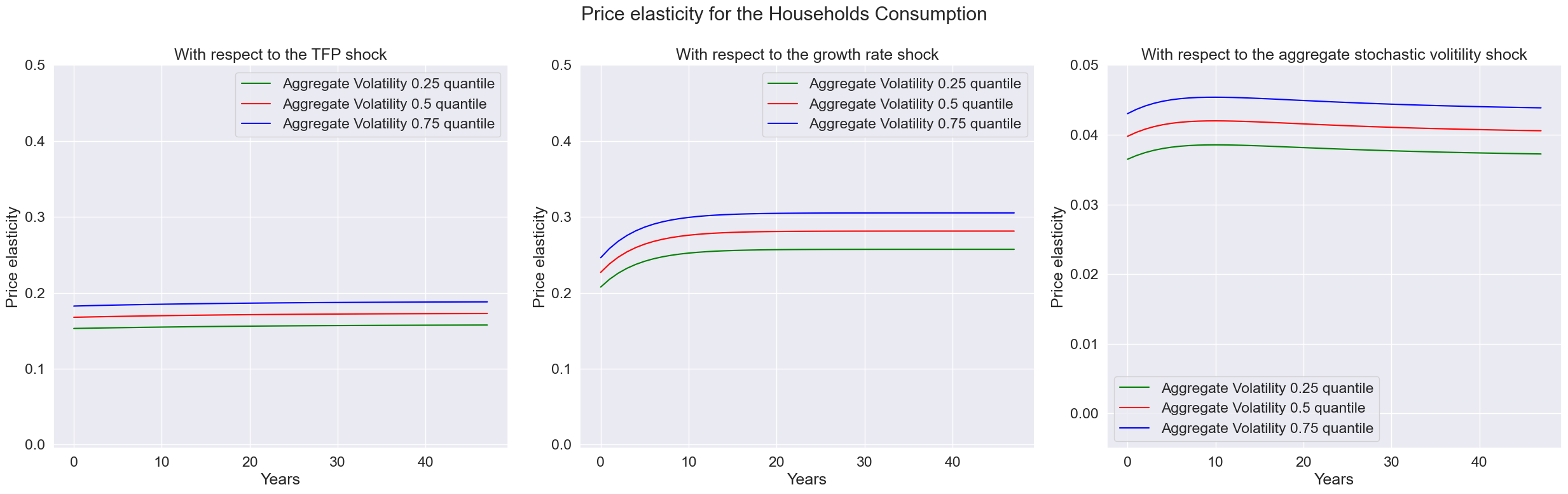

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasHouseholds.firstType[0,0,:],priceElasHouseholds.firstType[1,0,:],priceElasHouseholds.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasHouseholds.firstType[0,1,:],priceElasHouseholds.firstType[1,1,:],priceElasHouseholds.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasHouseholds.firstType[0,2,:],-priceElasHouseholds.firstType[1,2,:],-priceElasHouseholds.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.005,0.5])

axes[1].set_ylim([-0.005,0.5])

axes[2].set_ylim([-0.005,0.05])

fig.suptitle('Price elasticity for the Households Consumption')

fig.tight_layout()

plt.show()

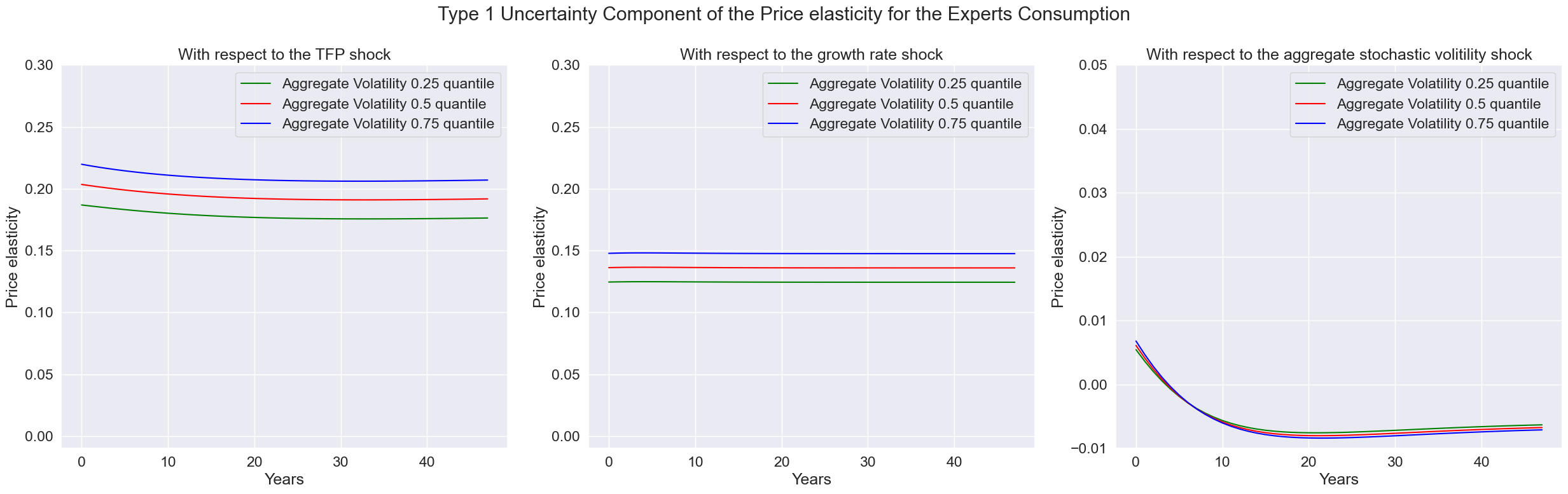

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasExpertsN.firstType[0,0,:],priceElasExpertsN.firstType[1,0,:],priceElasExpertsN.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasExpertsN.firstType[0,1,:],priceElasExpertsN.firstType[1,1,:],priceElasExpertsN.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasExpertsN.firstType[0,2,:],-priceElasExpertsN.firstType[1,2,:],-priceElasExpertsN.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.01,0.3])

axes[1].set_ylim([-0.01,0.3])

axes[2].set_ylim([-0.01,0.05])

fig.suptitle('Type 1 Uncertainty Component of the Price elasticity for the Experts Consumption')

fig.tight_layout()

plt.show()

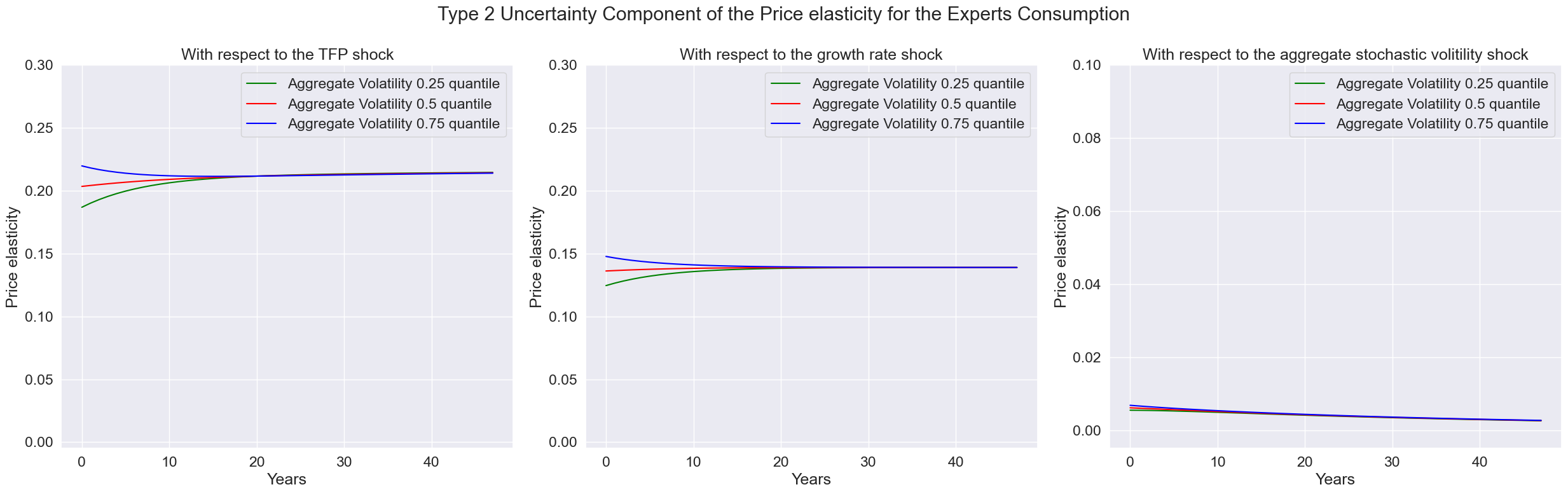

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasExpertsN.secondType[0,0,:],priceElasExpertsN.secondType[1,0,:],priceElasExpertsN.secondType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasExpertsN.secondType[0,1,:],priceElasExpertsN.secondType[1,1,:],priceElasExpertsN.secondType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasExpertsN.secondType[0,2,:],-priceElasExpertsN.secondType[1,2,:],-priceElasExpertsN.secondType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.005,0.3])

axes[1].set_ylim([-0.005,0.3])

axes[2].set_ylim([-0.005,0.1])

fig.suptitle('Type 2 Uncertainty Component of the Price elasticity for the Experts Consumption')

fig.tight_layout()

plt.show()

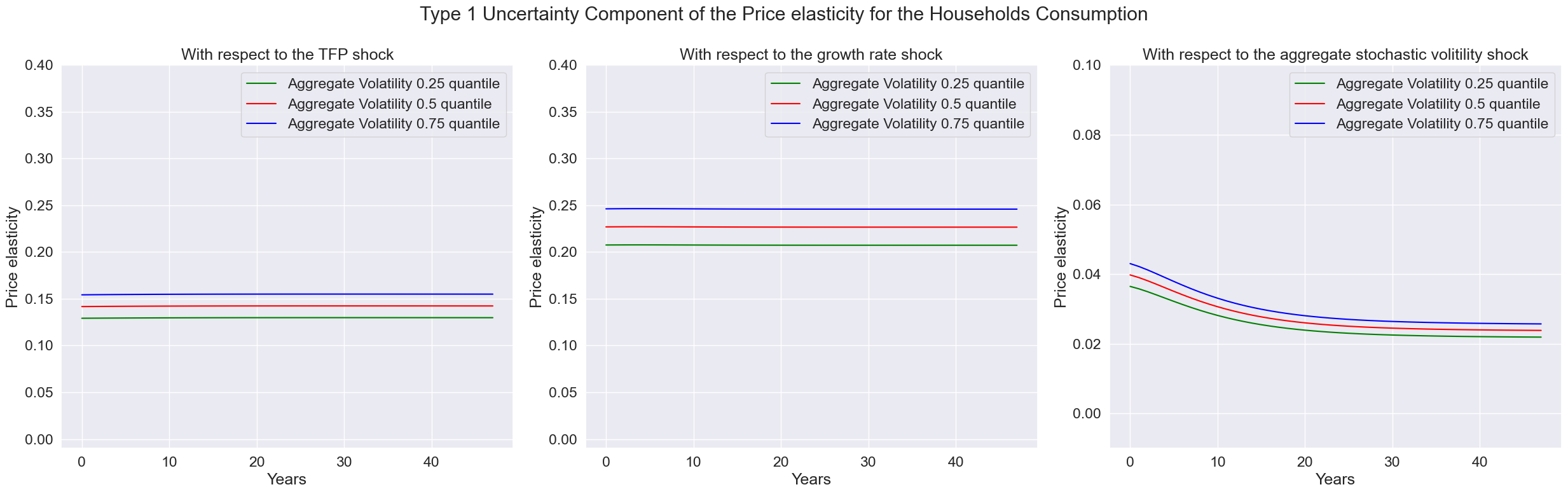

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasHouseholdsN.firstType[0,0,:],priceElasHouseholdsN.firstType[1,0,:],priceElasHouseholdsN.firstType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasHouseholdsN.firstType[0,1,:],priceElasHouseholdsN.firstType[1,1,:],priceElasHouseholdsN.firstType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasHouseholdsN.firstType[0,2,:],-priceElasHouseholdsN.firstType[1,2,:],-priceElasHouseholdsN.firstType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.01,0.4])

axes[1].set_ylim([-0.01,0.4])

axes[2].set_ylim([-0.01,0.1])

fig.suptitle('Type 1 Uncertainty Component of the Price elasticity for the Households Consumption')

fig.tight_layout()

plt.show()

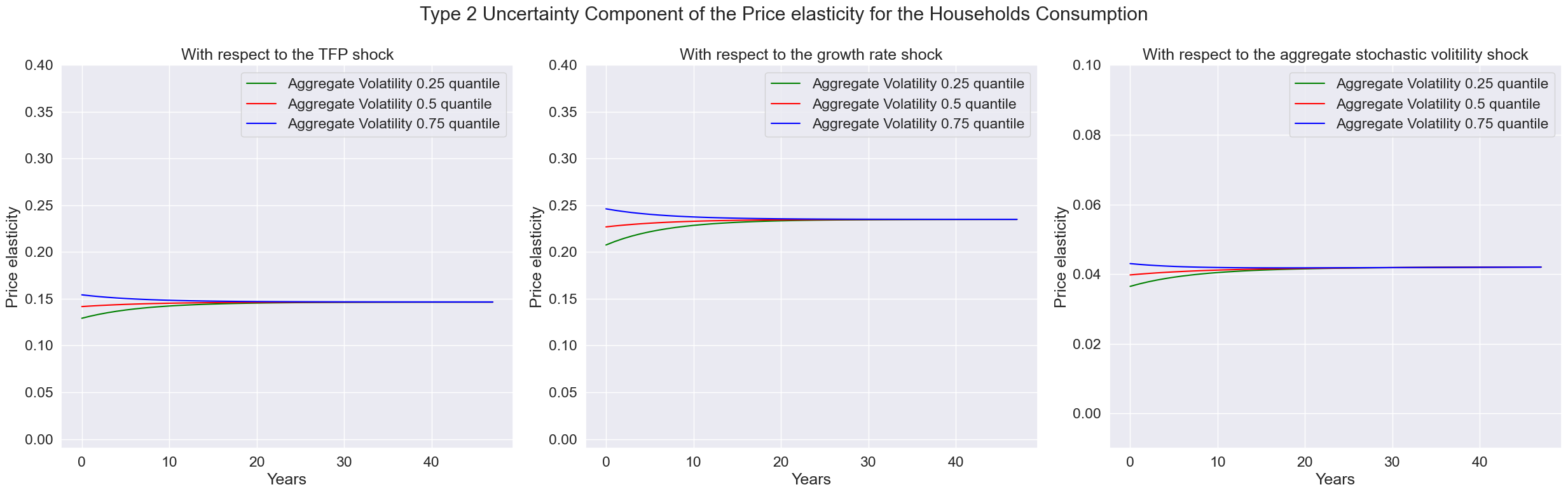

index = ['T','Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

fig, axes = plt.subplots(1,3, figsize = (25,8))

expo_elas_shock_0 = pd.DataFrame([np.arange(T),priceElasHouseholdsN.secondType[0,0,:],priceElasHouseholdsN.secondType[1,0,:],priceElasHouseholdsN.secondType[2,0,:]], index = index).T

expo_elas_shock_1 = pd.DataFrame([np.arange(T),priceElasHouseholdsN.secondType[0,1,:],priceElasHouseholdsN.secondType[1,1,:],priceElasHouseholdsN.secondType[2,1,:]], index = index).T

expo_elas_shock_2 = pd.DataFrame([np.arange(T),-priceElasHouseholdsN.secondType[0,2,:],-priceElasHouseholdsN.secondType[1,2,:],-priceElasHouseholdsN.secondType[2,2,:]], index = index).T

n_qt = len(quantile)

plot_elas = [expo_elas_shock_0, expo_elas_shock_1, expo_elas_shock_2]

shock_name = ['TFP shock', 'growth rate shock', 'aggregate stochastic volitility shock']

qt = ['Aggregate Volatility 0.25 quantile','Aggregate Volatility 0.5 quantile','Aggregate Volatility 0.75 quantile']

colors = ['green','red','blue']

for i in range(len(plot_elas)):

for j in range(n_qt):

sns.lineplot(data = plot_elas[i], x = 'T', y = qt[j], ax=axes[i], color = colors[j], label = qt[j])

axes[i].set_xlabel('Years')

axes[i].set_ylabel('Price elasticity')

axes[i].set_title('With respect to the ' + shock_name[i])

axes[0].set_ylim([-0.01,0.4])

axes[1].set_ylim([-0.01,0.4])

axes[2].set_ylim([-0.01,0.1])

fig.suptitle('Type 2 Uncertainty Component of the Price elasticity for the Households Consumption')

fig.tight_layout()

plt.show()

Reference#

[1] Borovička, Jaroslav, Lars Peter Hansen, and José A. Scheinkman. “Shock elasticities and impulse responses.” Mathematics and Financial Economics 8 (2014): 333-354.

[2] Hansen, Lars Peter. “Dynamic valuation decomposition within stochastic economies.” Econometrica 80, no. 3 (2012): 911-967.

[3], Brunnermeier, Markus K., and Yuliy Sannikov. “A macroeconomic model with a financial sector.” American Economic Review 104, no. 2 (2014): 379-421.

[4] Brunnermeier, Markus K., and Yuliy Sannikov. “Macro, money, and finance: A continuous-time approach.” In Handbook of Macroeconomics, vol. 2, pp. 1497-1545. Elsevier, 2016.

[5] Hansen, Lars Peter, Paymon Khorrami, and Fabrice Tourre. Comparative valuation dynamics in models with financing restrictions. Working Paper, 2018.