Quant Macro Finance#

Quant Macro Finance (QuantMFR) is an online research resource repository. The website includes both written pedagogical discussions and software support for relevant computations. It currently features several chapters of the book entitled, “Risk, Uncertainty and Value” by Lars Peter Hansen, Thomas J. Sargent and Jaroslav Borovička, along with associated notebooks that provide access to computational support. This book develops concepts and tools to support uncertainty characterizations and quantifications as they apply to potentially nonlinear stochastic equilibrium models. The QuantMFR website also includes complementary materials on model comparisons for classes on macro-finance models along with other published pedagogical discussions of tools and methods of analysis for stochastic equilibrium models. In addition, the QuantMFR website offers a variety of user-friendly code for interested scholars who wish to apply the methods.

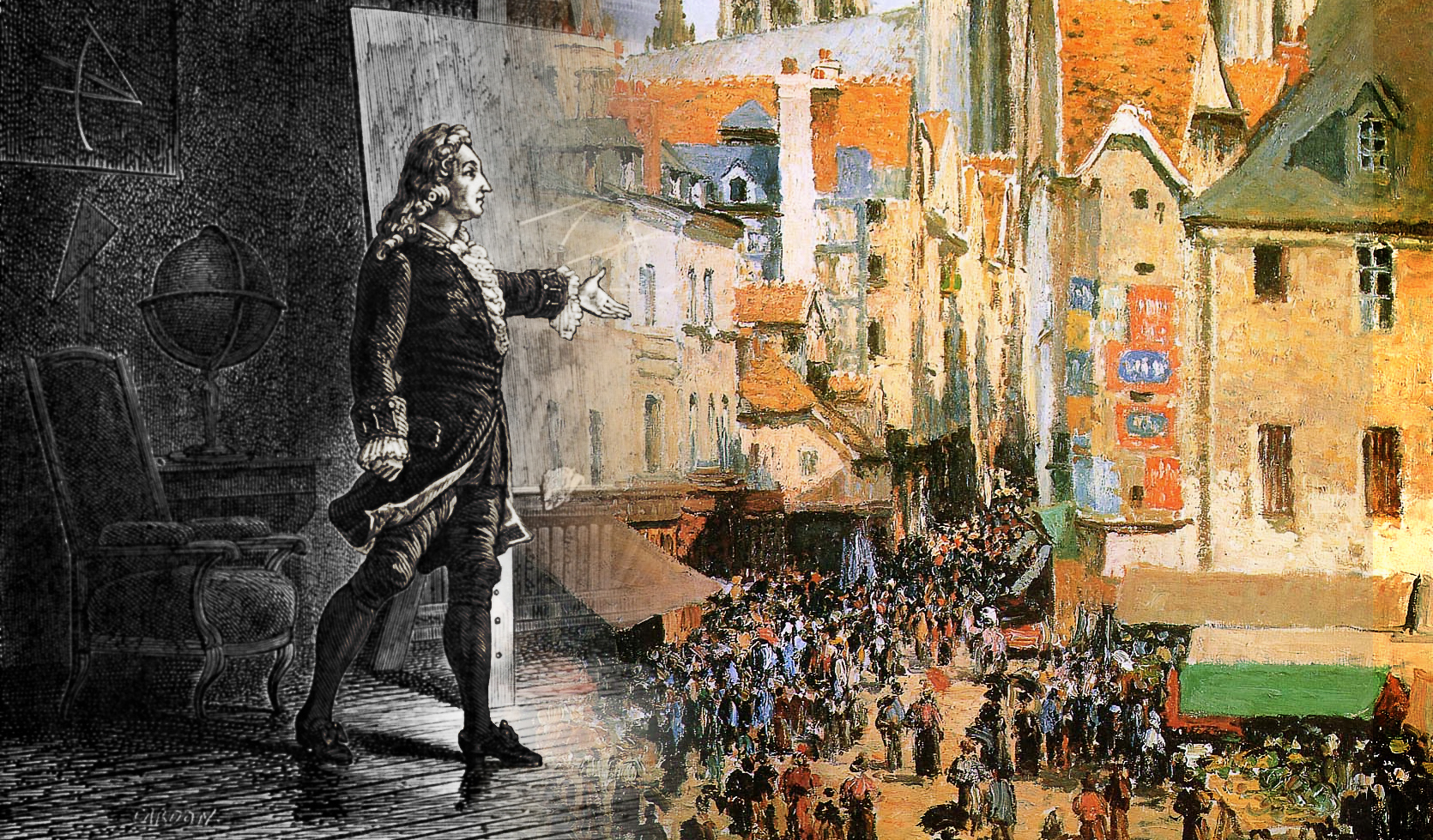

Over three hundred years ago, Jakob Bernoulli extended the use of probability from games of chance to the study of observable social phenomenon including economic outcomes as illustrated by the Pissarro painting of a marketplace in Rouen. Bernoulli derived a version of the Law of Large Numbers to justify empirical measurements of interest. See Stephen Stigler’s paper ‘’Soft Questions, Hard Answers: Jacob Bernoulli’s Probability in Historical Context,’’ published in the International Statistical Review in 2014 for a revealing discussion of Bernoulli’s contribution.

If you wish to print out any of the pages, we recommend using an A3 setting to preserve the layout.

Currently, a preliminary HTML version of our first 12 chapters are available:

Other notes and material that may eventually be incorporated into chapters are also available below:

Please let us know if you have any feedback regarding the QuantMFR website below: