Uncertainty Expansion - Computation Process#

1 Preliminaries #

1.1 Model Setup#

In addition, there is a set of first-order conditions and co-state equations detailed in Chapter 10 of the book. Function compile_equations in uncertain_expansion.py pack the state equations, FOC and costate equations for planner’s problem outlined in Appendix 10.A. By default, compile_equations solves the social planner problems. For more general implications, user needs to modify the function compile_equations. The source codes and other dependencies can be found in the src folder of our Github.

1.2 Inputs#

The function uncertain_expansion solves models. The function conducts the following steps:

create_args: initialize the model parametersSet up control variables \(D_t\), state variables \(X_t\), growth variables \(\hat G_t\), and static constraints \(\phi\)

Input an initial guess for \(\left[ {\widehat V_t} - {\widehat C_t}, \widehat C_t - \widehat G_t, D_t, MX_t, MG_t, \widehat G_{t+1} - \widehat G_t, X_t \right]\) in order in

initial_guessSolve the model using

uncertain_expansionPlot shock elasticity using

plot_exposure_elasticityandplot_price_elasticity

The user must specify several sets of inputs. Define the relevant variables:

Input |

Description |

Notation in text |

|

Variables chosen by the decision-maker at time \(t\) |

\(D_t\) |

|

Variables that describe the current state of the system |

\(X_t\) |

|

Variables representing different entries of the Brownian motion variable |

\(W_t\) |

The \(t+1\) variables will be automatically created from this. For example, if a state variable is inputted as Z_t, an additional state variable Z_tp1 will be automatically generated.

We also need to define the equilibrium conditions:

Input |

Description |

Notation in text |

|

Log share of capital not allocated to consumption |

\(\kappa(X_t(q),D_t(q))\) |

|

Law of motion for \(\hat{G}_{t+1}-\hat{G}_t\) |

\(\psi^g(D_t(q),X_t(q),qW_{t+1},q)\) |

|

Law of motion for state variables |

\(\psi^x(D_t(q),X_t(q),qW_{t+1},q)\) |

The remaining equilibrium conditions will be automatically computed by the code. The user must also define a list of parameters and their corresponding values. This can be done by specifying pairs of inputs such as beta = 0.99 or gamma = 1.01 within the body of the function create_args.

Note that the user must define the variables and parameters before defining the equations. Make sure that the equations use the same expressions for variables and parameters as previously defined by the user.

The output is of class ModelSolution, which stores the coefficients for the linear-quadratic approximation for the jump and state variables; continuation values; consumption growth; and log change of measure, as well as the steady-state values of each variables.

2 Example#

We will first solve the internal habit model which is easier to implement as compile_equations compiles FOC and costate equation for social planner problem automatically. Then we will show how to modify compile_equations function to change the FOC condition to external habit model.

We will solve the internal habit model and plot the exposure and price elasticity to replicate figures 10.7-10.10.

import os

import sys

import sympy as sp

workdir = os.getcwd()

# !git clone https://github.com/lphansen/RiskUncertaintyValue

# workdir = os.getcwd() + '/RiskUncertaintyValue'

sys.path.insert(0, workdir+'/src')

import numpy as np

import seaborn as sns

import autograd.numpy as anp

import matplotlib.pyplot as plt

import pandas as pd

import matplotlib.ticker as mticker

import matplotlib.cm as cm

from scipy import optimize

np.set_printoptions(suppress=True)

np.set_printoptions(linewidth=200)

from IPython.display import display, HTML

from BY_example_sol import disp_new

display(HTML("<style>.container { width:97% !important; }</style>"))

import warnings

warnings.filterwarnings("ignore")

import matplotlib.pyplot as plt

from scipy.stats import norm

from lin_quad import LinQuadVar

from lin_quad_util import E, concat, next_period, cal_E_ww, lq_sum, N_tilde_measure, E_N_tp1, log_E_exp, kron_prod, distance

from utilities import mat, vec, sym

from uncertain_expansion import uncertain_expansion, generate_symbols_and_args, compile_equations, get_parameter_value, \

generate_ss_function, automate_step_1, change_parameter_value, approximate_fun ,next_period

from elasticity import exposure_elasticity, price_elasticity

np.set_printoptions(suppress=True)

import pickle

from scipy.optimize import fsolve

# import sympy as sp

2.1 Parameters#

Use the function create_args to define and set the parameter values.

def create_args():

"""

Parameter dictionary for the quarterly calibration (ε = 0.25).

"""

# ---------- Diffusion parameters (Table 1, continuous-time, annual) ----------

# We store exactly those continuous-time σ's here.

sigma_k1 = 0.92 * anp.sqrt(12.0)

sigma_k2 = 0.40 * anp.sqrt(12.0)

sigma_k3 = 0.0

sigma_z1 = 0.0

sigma_z2 = 5.7 * anp.sqrt(12.0)

sigma_z3 = 0.0

sigma_y1 = 0.0

sigma_y2 = 0.0

sigma_y3 = 0.00031 * anp.sqrt(12.0)

# ---------- Time step and preferences ----------

# One model step = one quarter, so ε = 0.25 years.

epsilon = 0.25 # Δt in the discretization (years per step)

delta = 0.01 # annual subjective discount rate

beta = anp.exp(-delta * epsilon) # per-quarter discount factor

# Preferences

gamma = 1.001

rho = 1.001

# ---------- Technology / adjustment-cost parameters ----------

a = 0.0922 # level in log(a - i), unit-free

# Our equation is: (1/ζ) log(1 + ζ I/K).

# We encode 1/ζ as phi_1 and ζ as phi_2:

zeta = 8.0

phi_1 = 1.0 / zeta # = 1/ζ

phi_2 = zeta # = ζ

# These are *not* time-intensity parameters; they shape the curvature in I/K.

# ---------- Drifts of state processes (annual, from Table 1) ----------

alpha_k = 0.04 # capital drift (per year)

beta_k = 0.04 # loading of Z_t (per year)

beta_z = 0.056 # Z_t mean reversion (per year)

beta_2 = 0.194 # Y_t mean reversion (per year)

mu_2 = 6.3e-6 # level in Y_t dynamics (unit-free)

# for habit model

# nu_h = 0.025 Quarterly habit depreciation rate

nu_h = 0.1 * epsilon

tau = 1.01

llambda = -0.

return locals()

2.2 Variables#

Define your variables as below. You may only have one growth variable and one perturbation variable. Apart from this, you may add more variables to the list as you wish.

Control variable : \(D_t = [\frac{I_{h,t}}{K_t}, \frac{I_{k,t}}{K_t}]'\)

State variable: \(X_t = [Z_{1,t}, Z_{2,t}, X_{1,t}]'\)

Growth variable: \( \hat G_t = \log K_t\)

Perturbation variable: \(q_t\)

Shock Variable: \(W_t = [W_{1,t},W_{2,t},W_{3,t}]\)

# Define variable names

control_variables = ["imh_t", "imk_t"]

state_variables = ["Z_t", "Y_t","X_t"]

growth_variables = ["log_gk_t"]

perturbation_variable = ["q_t"]

shock_variables = ["W1_t", "W2_t", "W3_t"]

The user does not need to change the following code, which creates symbols for the defined parameters and variables.

parameter_names, args = generate_symbols_and_args(create_args)

globals().update(parameter_names)

variables = control_variables + state_variables + growth_variables + perturbation_variable + shock_variables

variables_tp1 = [var + "p1" for var in variables]

symbols = {var: sp.Symbol(var) for var in variables + variables_tp1}

globals().update(symbols)

2.3 Define Equilibrium Conditions#

Ensure that you use the same names for your variables and parameters from before. You must have one output constraint and one capital growth equation, but you may add as many state equations as you wish. The first-order conditions and co-state equations will be automatically handled and do not need to be specified.

State Variable Processes:

# Technology growth equation

technology_growth = Z_t - epsilon * beta_z * Z_t \

+ sp.sqrt(epsilon) * sp.exp(0.5 * Y_t) * (sigma_z1 * W1_tp1 + sigma_z2 * W2_tp1 + sigma_z3 * W3_tp1)

# Volatility growth equation

volatility_growth = Y_t - epsilon * beta_2 * (1 - mu_2 * sp.exp(-Y_t)) \

- q_t**2 * 0.5 * (sigma_y1**2 + sigma_y2**2 + sigma_y3**2) * sp.exp(-Y_t) * epsilon \

+ sp.exp(-0.5 * Y_t) * (sigma_y1 * W1_tp1 + sigma_y2 * W2_tp1 + sigma_y3 * W3_tp1) * sp.sqrt(epsilon)

habit_growth = sp.log(sp.exp( - nu_h + X_t) + (1 - sp.exp(-nu_h)) * imh_t ) \

- epsilon * (phi_1 * sp.log(1. + phi_2 * imk_t) - alpha_k + beta_k * Z_t \

- q_t**2 * 0.5 * (sigma_k1**2 + sigma_k2**2 + sigma_k3**2) * sp.exp(Y_t)) \

- sp.sqrt(epsilon) * sp.exp(0.5 * Y_t) * (sigma_k1 * W1_tp1 + sigma_k2 * W2_tp1 + sigma_k3 * W3_tp1)

Growth Process:

# Capital growth equation

capital_growth = epsilon * (phi_1 * sp.log(1. + phi_2 * imk_t) - alpha_k + beta_k * Z_t \

- q_t**2 * 0.5 * (sigma_k1**2 + sigma_k2**2 + sigma_k3**2) * sp.exp(Y_t)) \

+ sp.sqrt(epsilon) * sp.exp(0.5 * Y_t) * (sigma_k1 * W1_tp1 + sigma_k2 * W2_tp1 + sigma_k3 * W3_tp1)

Output constraint: $\({\hat C}_t - \hat G_{t}=\kappa(D_t, X_t) = \frac{1}{1 - \tau} \log( (1 - \lambda) D^{1 - \tau} + \lambda \exp((1 - \tau) X) )\)$

# Output constraint

kappa = 1/(1 - tau) * sp.log( (1 - llambda) * imh_t**(1 - tau) + llambda * sp.exp((1 - tau) * X_t ))

The static constraint: \(0 = \alpha - \frac{I_{h,t}}{K_t} - \frac{I_{k,t}}{K_t}\)

# static constraints

phi1 = a -imh_t - imk_t

output_constraint = kappa

static_constraints = [phi1]

state_equations = [technology_growth, volatility_growth,habit_growth]

2.4 Code Settings#

You may additionally set the following:

Initial guess for steady-state variables. This must have the same length as the number of variables

Convergence tolerance. How small the maximum error across the approximated terms must be before the algorithm is considered to have converged.

Maximum iterations. The maximum number of iterations for the algorithm can take.

Save location. Save the model solution to this location so that it can be accessed later.

The order of the initial guess is as follows:

initial_guess = np.array([ -3.0599204508041717, -3.1433984583550463, (1 - anp.exp(-0.01 * 0.25)) / 0.0257233 , 0.0257233 , 0.0922 - 0.0257233, 0.02039991, 0. , 0.2 , \

1. , 0.01330655, 0. , -11.97496092, -3.51858229])

savepath = None

init_util = None

iter_tol = 1e-5

max_iter = 500

2.5 Run Code#

You are now ready to run the function uncertain_expansion. You do not need to change anything in the following code.

ModelSol = uncertain_expansion(control_variables, state_variables, shock_variables, variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints, initial_guess, parameter_names,

args, approach = '1', init_util = init_util, iter_tol = iter_tol, max_iter = max_iter,

savepath=savepath)

ModelSol.ss

Show code cell output

Iteration 1: mu_0 error = 3.04931861e-19

Iteration 1: J1 error = 0.000561672114

Iteration 1: J2 error = 0.000554623791

Iteration 1: error = 0.000561672114

The iteration is not making good progress, as measured by the

improvement from the last ten iterations.

Iteration 2: mu_0 error = 5.08219768e-20

Iteration 2: J1 error = 8.52838789e-08

Iteration 2: J2 error = 7.83537071e-08

Iteration 2: error = 8.52838789e-08

array([ -4.12667104, 0.15503472, 0.01613651, 0.07606349, 0.60576715, 0. , -0. , 1. , 0.00485334, -0. , -11.97496092, -4.30652983])

In the homework, you are asked to solve the models with different parameters and compare the results. Here we give an example to loops over \(\gamma\) and \(\lambda\) and saves them to appropriately.

Good initial guesses are important for solving the model successfully. Models with negative \(\lambda\) are easier to solve. We use the trick that solving easier model first, and use the solution as initial guess for models with larger \(\lambda\). We stored the solved model in the folder output.

gamma_values = [1.001, 4.0, 8.0]

lambda_values = [-9.0, -5.0, -4.0,-3.0,-2.0 ,-1.0,0.0, 0.1, 0.2, 0.3, 0.4,0.5,0.6, 0.7, 0.8, 0.9]

initial_guess_baseline = initial_guess.copy()

preloadpath = None

for gamma_i in gamma_values:

# update gamma once per outer loop

args = change_parameter_value('gamma', parameter_names, args, gamma_i)

print(f"gamma: {gamma_i}")

# store the last solution’s steady state for this gamma

prev_ss = None

for llambda_i in lambda_values:

llambda_i = round(llambda_i, 2)

args = change_parameter_value('llambda', parameter_names, args, llambda_i)

print(f"lambda: {llambda_i}")

savepath = f'output/res_gamma_{gamma_i}_lambda_{llambda_i}.pkl'

# 0. If this parameter combo was already solved before, just load & move on

if os.path.exists(savepath):

with open(savepath, 'rb') as f:

res = pickle.load(f)

prev_ss = res['ss']

print(" -> loaded existing solution from disk")

continue

# 1. Choose initial_guess:

if prev_ss is not None:

# use solution from previous λ for this γ

initial_guess = np.concatenate([np.array([-3.40379947]), prev_ss])

elif preloadpath is not None and os.path.exists(preloadpath):

# optional: use some external “easy” case as a starting point

with open(preloadpath, 'rb') as f:

preload = pickle.load(f)

initial_guess = np.concatenate([np.array([-3.40379947]), preload['ss']])

else:

# fall back to your original global guess

initial_guess = initial_guess_baseline

# 2. Solve at (gamma_i, llambda_i)

res = uncertain_expansion(

control_variables, state_variables, shock_variables,

variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints,

initial_guess, parameter_names,

args, approach='1', init_util=init_util,

iter_tol=iter_tol, max_iter=max_iter,

savepath=savepath, # still writes to disk inside

)

# 3. Store this steady state to warm-start the next λ

prev_ss = res['ss']

# and optionally make this the preload for future runs / sessions

preloadpath = savepath

# Grids

gamma_values = [1.001, 4.0, 8.0]

# 0.5-step grid from 0 down to -9

# lambda_values = [round(l, 1) for l in np.arange(0.0, -0.8, -0.1)]

lambda_values = [ -1.0]

# lambda_values = [round(l, 2) for l in np.arange(-0.7, -1.0, -0.01)]

# lambda_values = [ -4, -6]

tau_fixed = 1.001

# tau_fixed = 0.01

initial_guess_baseline = initial_guess.copy()

preloadpath = None

for gamma_i in gamma_values:

args = change_parameter_value('gamma', parameter_names, args, gamma_i)

print(f"gamma: {gamma_i}")

# fix tau = 2.0

args = change_parameter_value('tau', parameter_names, args, tau_fixed)

print(f" tau: {tau_fixed}")

prev_ss_lambda = None # warm-start across lambda at tau=2.0 for this gamma

for llambda_i in lambda_values:

llambda_i = float(llambda_i)

args = change_parameter_value('llambda', parameter_names, args, llambda_i)

print(f" lambda: {llambda_i}")

tau_str = f"{tau_fixed:.2f}"

lambda_str = f"{llambda_i:.2f}"

# file for this (gamma, lambda, tau=2.0)

savepath = f'output/res_gamma_{gamma_i}_lambda_{lambda_str}_tau_{tau_str}.pkl'

# 0. If already solved, load and move on

if os.path.exists(savepath):

with open(savepath, 'rb') as f:

res = pickle.load(f)

prev_ss_lambda = res['ss']

print(" -> loaded existing (gamma, lambda, tau=2.0) solution from disk")

continue

# 1. initial_guess hierarchy (NO tau=1.01 baseline)

if prev_ss_lambda is not None:

# previous lambda at tau=2.0 for this gamma

initial_guess = np.concatenate([np.array([-10.40379947]), prev_ss_lambda])

elif preloadpath is not None and os.path.exists(preloadpath):

# last solved parameter combo (any gamma, lambda)

with open(preloadpath, 'rb') as f:

preload = pickle.load(f)

initial_guess = np.concatenate([np.array([-10.40379947]), preload['ss']])

else:

# global fallback

initial_guess = initial_guess_baseline

# 2. Solve at (gamma_i, llambda_i, tau_fixed)

res = uncertain_expansion(

control_variables, state_variables, shock_variables,

variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints,

initial_guess, parameter_names,

args, approach='2', init_util=init_util,

iter_tol=iter_tol, max_iter=max_iter,

savepath=savepath,

)

# 3. warm-start next lambda and remember last solved solution

prev_ss_lambda = res['ss']

preloadpath = savepath

gamma: 1.001

tau: 1.001

lambda: -1.0

-> loaded existing (gamma, lambda, tau=2.0) solution from disk

gamma: 4.0

tau: 1.001

lambda: -1.0

-> loaded existing (gamma, lambda, tau=2.0) solution from disk

gamma: 8.0

tau: 1.001

lambda: -1.0

The iteration is not making good progress, as measured by the

improvement from the last ten iterations.

Iteration 1: mu_0 error = 9.15933995e-16

Iteration 1: J1 error = 0.0236735392

Iteration 1: J2 error = 0.0490929176

Iteration 1: error = 0.0490929176

Iteration 2: mu_0 error = 2.22044605e-16

Iteration 2: J1 error = 2.65994357e-05

Iteration 2: J2 error = 5.99795346e-06

Iteration 2: error = 2.65994357e-05

Iteration 3: mu_0 error = 1.11022302e-15

Iteration 3: J1 error = 3.68514702e-08

Iteration 3: J2 error = 1.11329649e-08

Iteration 3: error = 3.68514702e-08

# Figure 10.5 with different tau

# Solve models

# Grids

gamma_values = [1.001, 4.0, 8.0]

# lambda_values = [0.9, 0.0, -0.9]

lambda_values = [ -1.0]

# tau: [1.01, 0.9, 0.8, ..., 0.2]

# tau_values = [1.001, 0.9, 0.8,0.7,0.6,0.5,0.4, 0.3, 0.2, 0.15, 0.1, 0.05, 0.01, 0.0, -0.1, -0.2, -0.3, -0.4, -0.5, -0.6, -0.7 ]

tau_values = [1.001, 0.6,0.01 ]

initial_guess_baseline = initial_guess.copy()

# "use the last solution as next initial guess" (across ALL (lambda, tau) combos)

prev_ss_last = None

for gamma_i in gamma_values:

args = change_parameter_value('gamma', parameter_names, args, gamma_i)

print(f"gamma: {gamma_i}")

for llambda_i in lambda_values:

llambda_i = float(llambda_i)

args = change_parameter_value('llambda', parameter_names, args, llambda_i)

print(f" lambda: {llambda_i}")

for tau_i in tau_values:

tau_i = float(tau_i)

args = change_parameter_value('tau', parameter_names, args, tau_i)

print(f" tau: {tau_i}")

tau_str = f"{tau_i:.3f}"

lambda_str = f"{llambda_i:.1f}"

savepath = f"output/res_gamma_{gamma_i}_lambda_{lambda_str}_tau_{tau_str}.pkl"

# 0) If already solved, load it and use as the next initial guess

if os.path.exists(savepath):

with open(savepath, "rb") as f:

res = pickle.load(f)

prev_ss_last = res["ss"]

print(" -> loaded existing solution from disk (warm-start updated)")

continue

# 1) Initial guess: always warm-start from the most recently solved combo if available

if prev_ss_last is not None:

initial_guess = np.concatenate([np.array([-10.40379947]), prev_ss_last])

else:

initial_guess = initial_guess_baseline

# 2) Solve at (gamma_i, llambda_i, tau_i)

res = uncertain_expansion(

control_variables, state_variables, shock_variables,

variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints,

initial_guess, parameter_names,

args, approach="2", init_util=init_util,

iter_tol=iter_tol, max_iter=max_iter,

savepath=savepath,

)

# 3) Warm-start the next point

prev_ss_last = res["ss"]

gamma: 1.001

lambda: -1.0

tau: 1.001

Iteration 1: mu_0 error = 2.6427428e-19

Iteration 1: J1 error = 0.000919146607

Iteration 1: J2 error = 0.000940954302

Iteration 1: error = 0.000940954302

Iteration 2: mu_0 error = 1.82959117e-19

Iteration 2: J1 error = 2.23369241e-07

Iteration 2: J2 error = 2.21425295e-07

Iteration 2: error = 2.23369241e-07

tau: 0.6

Iteration 1: mu_0 error = 2.74438675e-19

Iteration 1: J1 error = 0.000695657395

Iteration 1: J2 error = 0.000789904985

Iteration 1: error = 0.000789904985

Iteration 2: mu_0 error = 1.93123512e-19

Iteration 2: J1 error = 1.2998525e-07

Iteration 2: J2 error = 1.50145667e-07

Iteration 2: error = 1.50145667e-07

tau: 0.01

Iteration 1: mu_0 error = 1.42301535e-19

Iteration 1: J1 error = 0.000544146216

Iteration 1: J2 error = 0.000511294666

Iteration 1: error = 0.000544146216

Iteration 2: mu_0 error = 4.7433845e-20

Iteration 2: J1 error = 8.31676037e-08

Iteration 2: J2 error = 7.78133107e-08

Iteration 2: error = 8.31676037e-08

gamma: 4.0

lambda: -1.0

tau: 1.001

Iteration 1: mu_0 error = 3.46944695e-17

Iteration 1: J1 error = 0.0101458025

Iteration 1: J2 error = 0.0209661763

Iteration 1: error = 0.0209661763

Iteration 2: mu_0 error = 4.51028104e-16

Iteration 2: J1 error = 1.12699286e-05

Iteration 2: J2 error = 1.41537142e-06

Iteration 2: error = 1.12699286e-05

Iteration 3: mu_0 error = 3.1918912e-16

Iteration 3: J1 error = 1.57617441e-08

Iteration 3: J2 error = 3.1926457e-09

Iteration 3: error = 1.57617441e-08

tau: 0.6

Iteration 1: mu_0 error = 5.41233725e-16

Iteration 1: J1 error = 0.00997359781

Iteration 1: J2 error = 0.0207076969

Iteration 1: error = 0.0207076969

Iteration 2: mu_0 error = 2.01227923e-16

Iteration 2: J1 error = 1.20182962e-05

Iteration 2: J2 error = 3.02414754e-06

Iteration 2: error = 1.20182962e-05

Iteration 3: mu_0 error = 6.17561557e-16

Iteration 3: J1 error = 1.37463582e-08

Iteration 3: J2 error = 4.74746475e-09

Iteration 3: error = 1.37463582e-08

tau: 0.01

Iteration 1: mu_0 error = 4.16333634e-17

Iteration 1: J1 error = 0.0110164038

Iteration 1: J2 error = 0.0203704283

Iteration 1: error = 0.0203704283

Iteration 2: mu_0 error = 4.37150316e-16

Iteration 2: J1 error = 1.15368617e-05

Iteration 2: J2 error = 1.0236902e-06

Iteration 2: error = 1.15368617e-05

Iteration 3: mu_0 error = 4.64905892e-16

Iteration 3: J1 error = 1.10811155e-08

Iteration 3: J2 error = 2.0238039e-09

Iteration 3: error = 1.10811155e-08

gamma: 8.0

lambda: -1.0

tau: 1.001

Iteration 1: mu_0 error = 2.63677968e-15

Iteration 1: J1 error = 0.0236735392

Iteration 1: J2 error = 0.0490929176

Iteration 1: error = 0.0490929176

Iteration 2: mu_0 error = 2.19269047e-15

Iteration 2: J1 error = 2.65994357e-05

Iteration 2: J2 error = 5.99795348e-06

Iteration 2: error = 2.65994357e-05

Iteration 3: mu_0 error = 1.11022302e-15

Iteration 3: J1 error = 3.68514773e-08

Iteration 3: J2 error = 1.11329699e-08

Iteration 3: error = 3.68514773e-08

tau: 0.6

Iteration 1: mu_0 error = 8.60422844e-16

Iteration 1: J1 error = 0.0242040149

Iteration 1: J2 error = 0.0485869979

Iteration 1: error = 0.0485869979

Iteration 2: mu_0 error = 9.15933995e-16

Iteration 2: J1 error = 2.8221406e-05

Iteration 2: J2 error = 1.1982034e-05

Iteration 2: error = 2.8221406e-05

Iteration 3: mu_0 error = 1.16573418e-15

Iteration 3: J1 error = 3.21088444e-08

Iteration 3: J2 error = 1.74065756e-08

Iteration 3: error = 3.21088444e-08

tau: 0.01

Iteration 1: mu_0 error = 3.60822483e-16

Iteration 1: J1 error = 0.0264356103

Iteration 1: J2 error = 0.047875198

Iteration 1: error = 0.047875198

Iteration 2: mu_0 error = 5.13478149e-16

Iteration 2: J1 error = 2.70354003e-05

Iteration 2: J2 error = 8.85365581e-06

Iteration 2: error = 2.70354003e-05

Iteration 3: mu_0 error = 1.52655666e-15

Iteration 3: J1 error = 2.58735113e-08

Iteration 3: J2 error = 1.1831286e-08

Iteration 3: error = 2.58735113e-08

# Grids

gamma_values = [1.001, 4.0, 8.0]

# 0.5-step grid from 0 down to -9

lambda_values = [-0.7]

# lambda_values = [ -4, -6]

tau_fixed = 2.0

stored_models ={}

initial_guess_baseline = initial_guess.copy()

preloadpath = None

for gamma_i in gamma_values:

args = change_parameter_value('gamma', parameter_names, args, gamma_i)

print(f"gamma: {gamma_i}")

# fix tau = 2.0

args = change_parameter_value('tau', parameter_names, args, tau_fixed)

print(f" tau: {tau_fixed}")

prev_ss_lambda = None # warm-start across lambda at tau=2.0 for this gamma

for llambda_i in lambda_values:

llambda_i = float(llambda_i)

args = change_parameter_value('llambda', parameter_names, args, llambda_i)

print(f" lambda: {llambda_i}")

tau_str = f"{tau_fixed:.2f}"

lambda_str = f"{llambda_i:.1f}"

# file for this (gamma, lambda, tau=2.0)

savepath = f'output/res_gamma_{gamma_i}_lambda_{lambda_str}_tau_{tau_str}.pkl'

# 1. initial_guess hierarchy (NO tau=1.01 baseline)

if prev_ss_lambda is not None:

# previous lambda at tau=2.0 for this gamma

initial_guess = np.concatenate([np.array([-10.40379947]), prev_ss_lambda])

elif preloadpath is not None and os.path.exists(preloadpath):

# last solved parameter combo (any gamma, lambda)

with open(preloadpath, 'rb') as f:

preload = pickle.load(f)

initial_guess = np.concatenate([np.array([-10.40379947]), preload['ss']])

else:

# global fallback

initial_guess = initial_guess_baseline

# 2. Solve at (gamma_i, llambda_i, tau_fixed)

res = uncertain_expansion(

control_variables, state_variables, shock_variables,

variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints,

initial_guess, parameter_names,

args, approach='2', init_util=init_util,

iter_tol=iter_tol, max_iter=max_iter,

savepath=savepath,

)

stored_models[gamma_i] = res

# 3. warm-start next lambda and remember last solved solution

prev_ss_lambda = res['ss']

preloadpath = savepath

gamma: 1.001

tau: 2.0

lambda: -0.7

Iteration 1: mu_0 error = 1.34847645e-18

Iteration 1: J1 error = 0.00824409812

Iteration 1: J2 error = 2.30317556

Iteration 1: error = 2.30317556

Iteration 2: mu_0 error = 4.50621528e-19

Iteration 2: J1 error = 1.15287213e-05

Iteration 2: J2 error = 0.00398208257

Iteration 2: error = 0.00398208257

Iteration 3: mu_0 error = 1.28749008e-19

Iteration 3: J1 error = 1.8149322e-08

Iteration 3: J2 error = 6.35118317e-06

Iteration 3: error = 6.35118317e-06

gamma: 4.0

tau: 2.0

lambda: -0.7

Iteration 1: mu_0 error = 9.36750677e-16

Iteration 1: J1 error = 0.0473814511

Iteration 1: J2 error = 11.8012178

Iteration 1: error = 11.8012178

Iteration 2: mu_0 error = 4.37150316e-16

Iteration 2: J1 error = 0.000272087818

Iteration 2: J2 error = 0.0745181164

Iteration 2: error = 0.0745181164

Iteration 3: mu_0 error = 2.09554596e-15

Iteration 3: J1 error = 1.76813302e-06

Iteration 3: J2 error = 0.000484779568

Iteration 3: error = 0.000484779568

Iteration 4: mu_0 error = 2.59514632e-15

Iteration 4: J1 error = 1.18110304e-08

Iteration 4: J2 error = 3.24811117e-06

Iteration 4: error = 3.24811117e-06

gamma: 8.0

tau: 2.0

lambda: -0.7

Iteration 1: mu_0 error = 4.19109192e-15

Iteration 1: J1 error = 0.0995819886

Iteration 1: J2 error = 24.4044909

Iteration 1: error = 24.4044909

Iteration 2: mu_0 error = 4.16333634e-16

Iteration 2: J1 error = 0.000619615789

Iteration 2: J2 error = 0.168974351

Iteration 2: error = 0.168974351

Iteration 3: mu_0 error = 5.91193761e-15

Iteration 3: J1 error = 4.10222269e-06

Iteration 3: J2 error = 0.00113400246

Iteration 3: error = 0.00113400246

Iteration 4: mu_0 error = 2.88657986e-15

Iteration 4: J1 error = 2.75212422e-08

Iteration 4: J2 error = 7.70379779e-06

Iteration 4: error = 7.70379779e-06

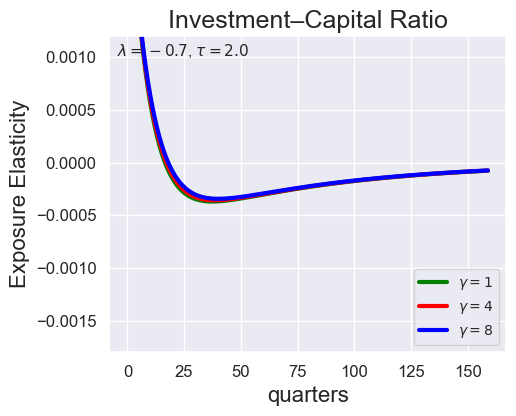

# Investment-Capital Ratio Elasticity with negative Tau

import numpy as np

import sympy as sp

import matplotlib.pyplot as plt

import seaborn as sns

def plot_growth_shock_investment_gamma_only(models_dict, T, ylim_i=None, save_path=None,

llambda=-0.7, tau=2.0):

"""

Exposure Elasticity for GROWTH SHOCK only.

Single figure: Investment-Capital Ratio (for gamma = 1.001, 4.001, 8.001) at fixed lambda, tau.

"""

sns.set_style("darkgrid")

gammas_ordered = [1.001, 4.0, 8.0]

colors = ['green', 'red', 'blue']

labels = [r'$\gamma=1$', r'$\gamma=4$', r'$\gamma=8$']

fig, ax = plt.subplots(1, 1, figsize=(5.5, 4.5))

time_axis = np.arange(T)

imk_t_sym = sp.Symbol('imk_t')

target_expression = sp.log(imk_t_sym)

for idx, g in enumerate(gammas_ordered):

if g not in models_dict:

print(f"Warning: Model for gamma={g} not found.")

continue

mod = models_dict[g]

# dict-like access (ModelSolution) should work with []

log_IK_t, _, _, _ = approximate_fun(

fun=target_expression,

ss=mod["ss"],

ss_variables=mod["ss_variables"],

ss_variables_tp1=mod["ss_variables_tp1"],

parameter_names=mod["parameter_names"],

args=mod["args"],

var_shape=mod["var_shape"],

JX1_t=mod["JX1_t"],

JX2_t=mod["JX2_t"],

X1_tp1=mod["X1_tp1"],

X2_tp1=mod["X2_tp1"],

recursive_ss=mod["recursive_ss"],

second_order=True

)

log_IK_tp1 = next_period(log_IK_t, mod["X1_tp1"], mod["X2_tp1"])

log_IK_growth = log_IK_tp1 - log_IK_t

elas_i = exposure_elasticity(

log_IK_growth, mod["X1_tp1"], mod["X2_tp1"], T, shock=1, percentile=0.5

).flatten()

sns.lineplot(x=time_axis, y=elas_i, ax=ax, color=colors[idx], label=labels[idx], linewidth=3.0)

ax.set_title("Investment–Capital Ratio", fontsize=18)

ax.set_ylabel(r"Exposure Elasticity", fontsize=16)

ax.set_xlabel("quarters", fontsize=16)

ax.tick_params(axis="both", labelsize=12)

ax.legend(fontsize=10, loc="lower right")

ax.text(0.02, 0.98, rf"$\lambda={llambda}$, $\tau={tau}$",

transform=ax.transAxes, va="top", ha="left", fontsize=11)

if ylim_i is not None:

ax.set_ylim(ylim_i)

else:

ax.set_ylim(bottom=0)

plt.tight_layout()

if save_path is not None:

plt.savefig(save_path, dpi=300, bbox_inches="tight")

plt.show()

plot_growth_shock_investment_gamma_only(

stored_models,

T=160,

ylim_i=[-0.0018, 0.0012],

llambda=-0.7,

tau=2.0

)

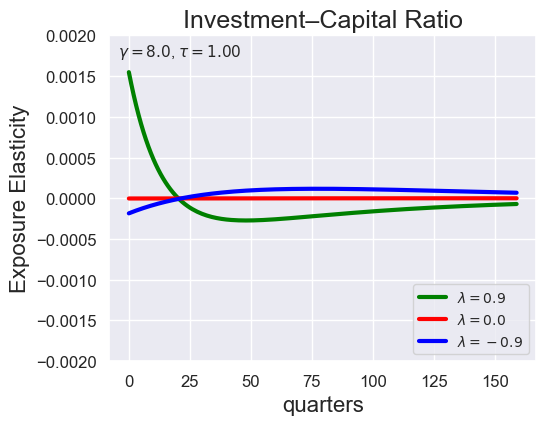

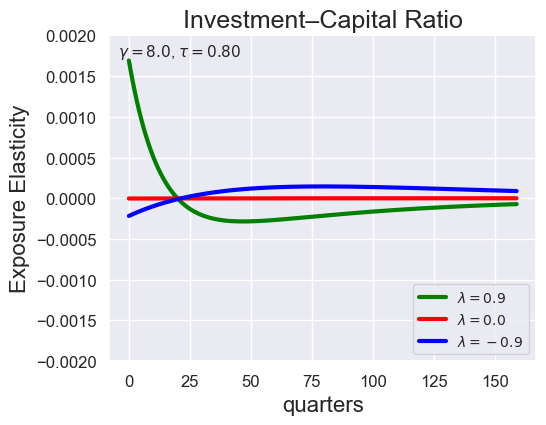

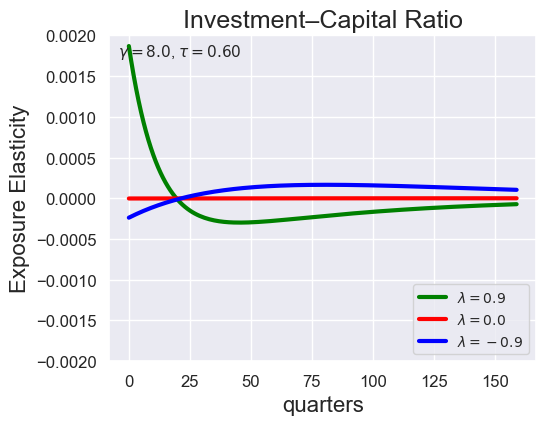

import os, pickle

import numpy as np

import sympy as sp

import matplotlib.pyplot as plt

import seaborn as sns

def load_models_for_tau_three_lambdas(

tau,

lambdas=(0.9, 0.0, -9.0),

gamma=8.0,

output_dir="output",

):

"""

Load models for a fixed (gamma, tau) across multiple lambdas.

Returns: dict keyed by lambda -> loaded model dict (the pickle content).

"""

models_by_lambda = {}

tau_str = f"{float(tau):.2f}"

for lam in lambdas:

lam = float(lam)

lam_str = f"{lam:.1f}"

path = os.path.join(output_dir, f"res_gamma_{gamma}_lambda_{lam_str}_tau_{tau_str}.pkl")

if not os.path.exists(path):

print(f"[load warning] missing: {path}")

continue

with open(path, "rb") as f:

models_by_lambda[lam] = pickle.load(f)

return models_by_lambda

def plot_growth_shock_investment_lambda_only(

models_by_lambda,

T,

tau,

lambdas=(0.9, 0.0, -9.0),

gamma=8.0,

ylim_i=(-2e-3, 2e-3),

save_path=None,

shock=1,

percentile=0.5,

):

"""

Exposure Elasticity for GROWTH SHOCK only.

Single figure: Investment–Capital Ratio elasticity for 3 lambdas at fixed (gamma, tau).

"""

sns.set_style("darkgrid")

lambdas_ordered = [float(x) for x in lambdas]

colors = ["green", "red", "blue"]

labels = [rf"$\lambda={l:.1f}$" for l in lambdas_ordered]

fig, ax = plt.subplots(1, 1, figsize=(5.8, 4.6))

time_axis = np.arange(T)

imk_t_sym = sp.Symbol("imk_t")

target_expression = sp.log(imk_t_sym)

for idx, lam in enumerate(lambdas_ordered):

if lam not in models_by_lambda:

print(f"[plot warning] model not found for lambda={lam}")

continue

mod = models_by_lambda[lam]

log_IK_t, _, _, _ = approximate_fun(

fun=target_expression,

ss=mod["ss"],

ss_variables=mod["ss_variables"],

ss_variables_tp1=mod["ss_variables_tp1"],

parameter_names=mod["parameter_names"],

args=mod["args"],

var_shape=mod["var_shape"],

JX1_t=mod["JX1_t"],

JX2_t=mod["JX2_t"],

X1_tp1=mod["X1_tp1"],

X2_tp1=mod["X2_tp1"],

recursive_ss=mod["recursive_ss"],

second_order=True,

)

log_IK_tp1 = next_period(log_IK_t, mod["X1_tp1"], mod["X2_tp1"])

log_IK_growth = log_IK_tp1 - log_IK_t

elas = exposure_elasticity(

log_IK_growth, mod["X1_tp1"], mod["X2_tp1"],

T, shock=shock, percentile=percentile

).flatten()

sns.lineplot(

x=time_axis, y=elas, ax=ax,

color=colors[idx % len(colors)],

label=labels[idx],

linewidth=3.0,

)

ax.set_title("Investment–Capital Ratio", fontsize=18)

ax.set_ylabel("Exposure Elasticity", fontsize=16)

ax.set_xlabel("quarters", fontsize=16)

ax.tick_params(axis="both", labelsize=12)

ax.legend(fontsize=10, loc="lower right")

ax.text(

0.02, 0.98,

rf"$\gamma={gamma}$, $\tau={float(tau):.2f}$",

transform=ax.transAxes, va="top", ha="left", fontsize=11

)

if ylim_i is not None:

ax.set_ylim(ylim_i)

plt.tight_layout()

if save_path is not None:

plt.savefig(save_path, dpi=300, bbox_inches="tight")

plt.show()

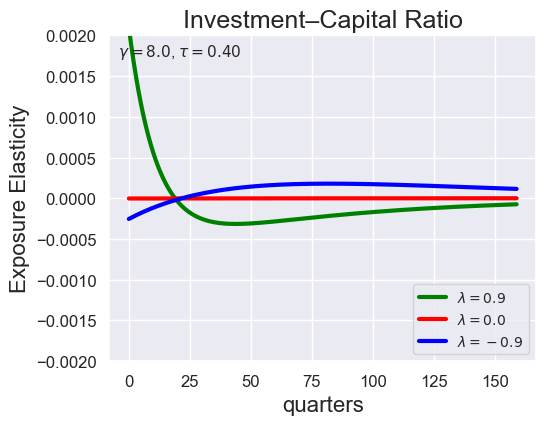

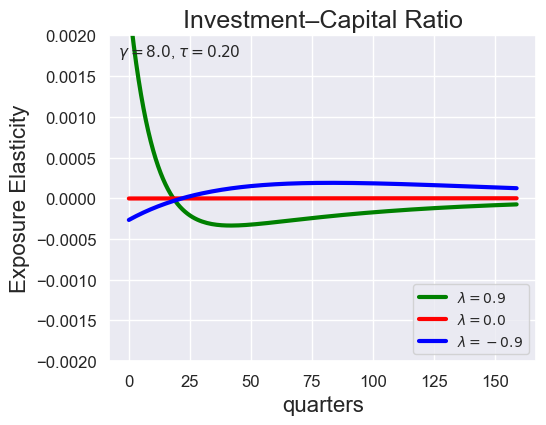

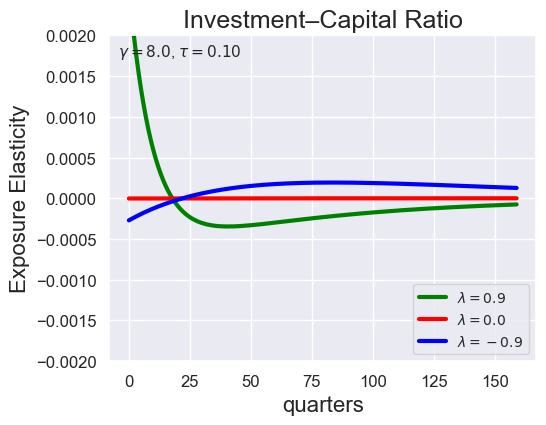

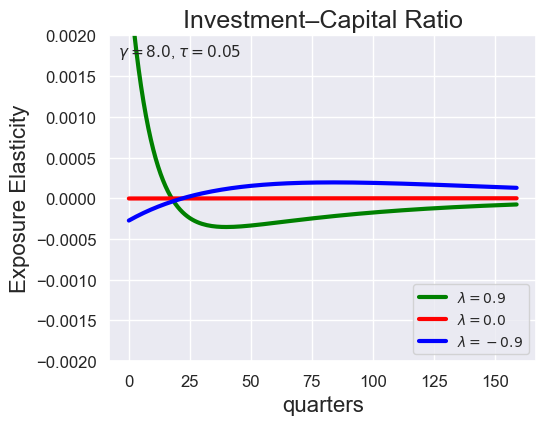

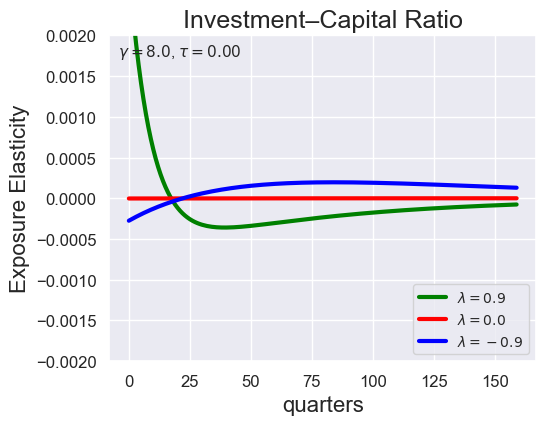

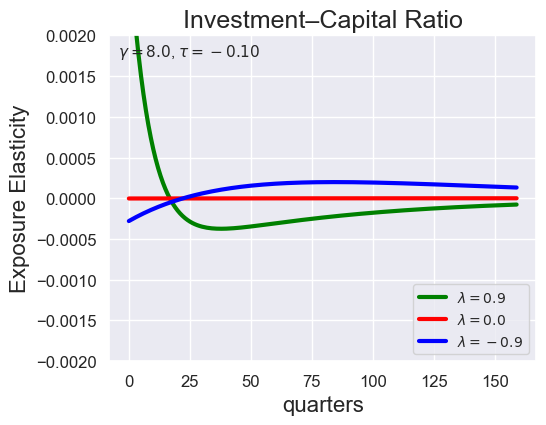

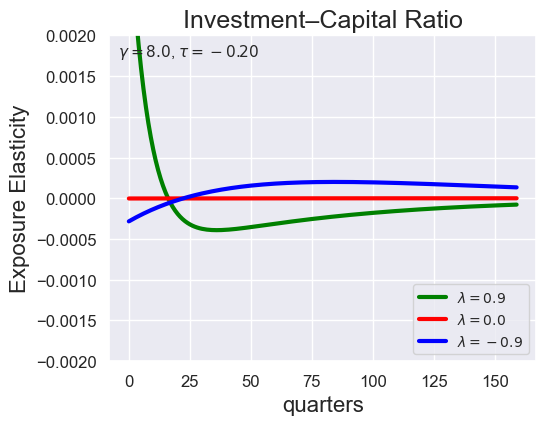

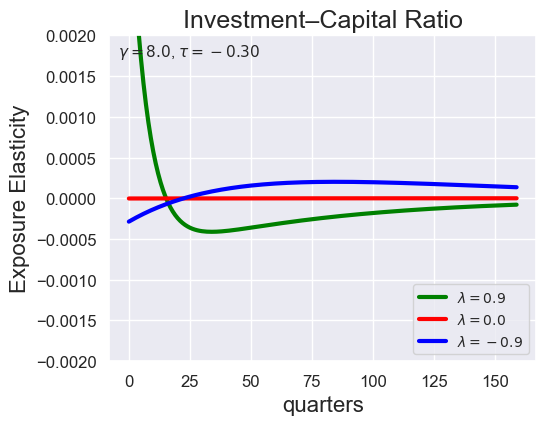

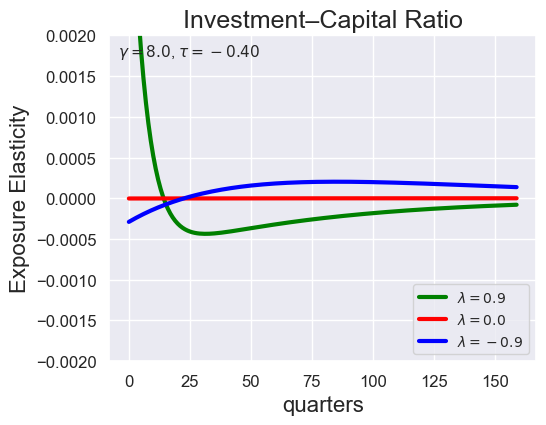

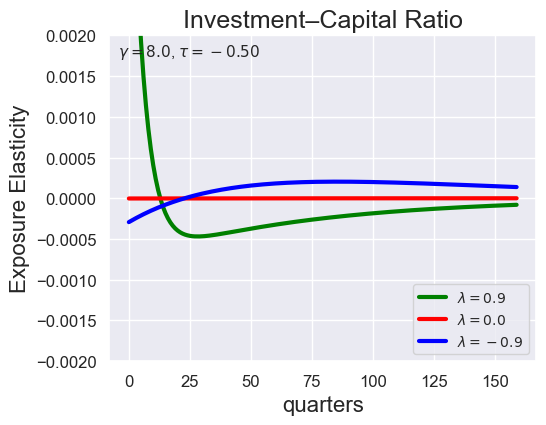

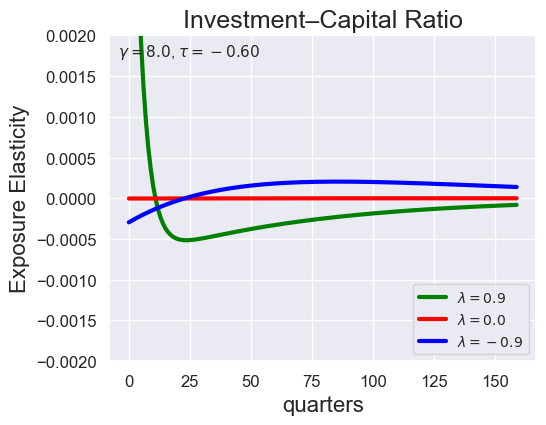

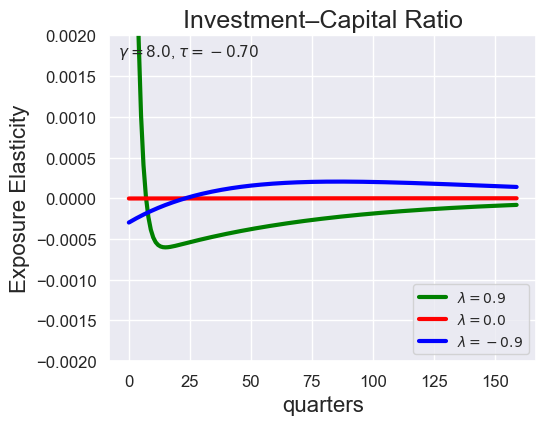

tau_values = [ 1.001, 0.8, 0.6, 0.4, 0.2, 0.1, 0.05, 0.0, -0.1, -0.2, -0.3, -0.4, -0.5, -0.6, -0.7 ]

lambdas = (0.9, 0.0, -0.9)

for tau in tau_values:

models_tau = load_models_for_tau_three_lambdas(tau=tau, lambdas=lambdas, gamma=8.0)

plot_growth_shock_investment_lambda_only(models_tau, T=160, tau=tau, lambdas=lambdas, gamma=8.0)

Note that the order of the variables listed in the solution is the same as before, except with \({\widehat V_t} - {\widehat C_t}\) removed:

2.6 Plot Elasticities#

After you used the loop above, you can also use the following code to load all your solutions dynamically:

models = {}

gamma_values = [1.001, 4.001, 8.001]

lambda_values = [-9.0, 0.0, 0.9]

for gamma_i in gamma_values:

for llambda_i in lambda_values:

llambda_i = round(llambda_i,2)

save_path = 'output/res_gamma_{}_lambda_{}.pkl'.format(gamma_i, llambda_i)

try:

with open(save_path, 'rb') as f:

# models = pickle.load(save_path)

model_key = f"gamma_{gamma_i}_lambda_{llambda_i}"

models[model_key] = pickle.load(f)

except FileNotFoundError:

print(f"File not found: {save_path}")

We can use plot_exposure_elasticity_shocks to plot exposure elasticities for different shocks.

model_listis a list of solutions you want to use to compute elasticitieslogMtM0specifies the quantity for which you are calculating the elasticityTspecifies the number of periods (using the time-unit that you specified the parameters in)num_shocksspecifies the number of shocks to calculate

def plot_exposure_elasticity_shocks(

model_list,

Mtgrowth_list,

quantile,

T,

num_shocks,

time_unit='quarters',

ylimits=None,

labels=None,

title=None,

shock_names=None,

colors=None,

save_path=None

):

"""

Plot exposure elasticity for multiple models across different shocks.

Parameters:

- model_list: List of model results to plot.

- quantile: List of quantiles to calculate.

- T: Integer, time horizon.

- num_shocks: Integer, number of shocks to include.

- time_unit: String, label for x-axis time units (e.g., "quarters").

- ylimits: List, optional y-axis limits for the subplots.

- labels: List of strings, labels for the models.

- title: String, optional title for the plot.

- shock_names: List of strings, names for the shocks.

- colors: List of strings, colors for the models.

- save_path: String, optional path to save the plot.

"""

sns.set_style("darkgrid")

# Default settings

if labels is None:

labels = [f'Model {i + 1}' for i in range(len(model_list))]

if shock_names is None:

shock_names = ['Growth Shock', 'Capital Shock', 'Volatility Shock']

if colors is None:

colors = generate_red_to_green_colors(len(model_list))

# colors = []

# from colour import Color

# red = Color("red")

# colors = list(red.range_to(Color("green"),len(model_list)))

# colors = ['orange','green', 'red', 'blue','black']

# for i in range(len(model_list)):

# colors.append('#%06X' % randint(0, 0xFFFFFF))

# Initialize figure and axes

fig, axes = plt.subplots(1, num_shocks, figsize=(8 * num_shocks, 7), squeeze=False)

axes = axes.flatten() # Flatten to ensure direct indexing works

# Main plotting loop

for idx, res in enumerate(model_list):

X1_tp1 = res['X1_tp1']

X2_tp1 = res['X2_tp1']

# Calculate exposure elasticity for each shock

Mtgrowth = Mtgrowth_list[idx]

expo_elas_shocks = [

[exposure_elasticity(Mtgrowth, X1_tp1, X2_tp1, T, shock=i, percentile=p) for p in quantile]

for i in range(min(num_shocks + 1, 2))

]

# return expo_elas_shocks

# Reorder shocks

reordered_shocks = [expo_elas_shocks[1]] + [expo_elas_shocks[i] for i in range(num_shocks) if i != 1]

# Prepare data for plotting

index = ['T'] + [f'{q} quantile' for q in quantile]

shock_data = [

pd.DataFrame([np.arange(T), *[e.flatten() for e in reordered_shocks[i]]], index=index).T

for i in range(num_shocks)

]

# return shock_data

# Plot each shock

for i in range(num_shocks):

for j in range(len(quantile)):

sns.lineplot(data=shock_data[i], x='T', y=index[j + 1], ax=axes[i],

color=colors[idx], label=labels[idx])

# Customize each subplot

axes[i].set_xlabel('')

axes[i].set_ylabel('Exposure elasticity', fontsize=20)

axes[i].set_title(f'{shock_names[i]}', fontsize=20)

axes[i].tick_params(axis='y', labelsize=20)

axes[i].tick_params(axis='x', labelsize=20)

axes[i].legend(fontsize=20, loc='lower right')

# Set y-axis limits if provided

if ylimits:

axes[i].set_ylim(ylimits)

if i != 0: # Skip the legend for the second subplot

axes[i].legend(fontsize=20, loc='lower right')

else:

axes[i].legend().remove() # Ensure no legend appears on the second plot

# Set scientific notation for the y-axis

axes[i].yaxis.set_major_formatter(mticker.ScalarFormatter(useMathText=True))

axes[i].ticklabel_format(style='sci', axis='y', scilimits=(0, 0))

# Set x-axis label for all subplots

for ax in axes:

ax.set_xlabel(f'{time_unit}', fontsize=20)

# Set the main figure title, if provided

if title:

fig.suptitle(title, fontsize=20)

plt.tight_layout()

# Save and/or display the plot

if save_path:

plt.savefig(save_path, dpi=500)

plt.show()

def generate_red_to_green_colors(n):

cmap = cm.get_cmap('RdYlGn', n) # 'RdYlGn' colormap from red to green

return [cmap(i) for i in range(n)]

def compute_logMtM0(model):

alpha = get_parameter_value('a', model['parameter_names'], model['args'])

return model['JX1_tp1'][3] - 0.5 * model['JX2_tp1'][3] - (

model['J1_t'][3] - 0.5 * model['J2_t'][3]

)

We then feed this into the exposure elasticity function:

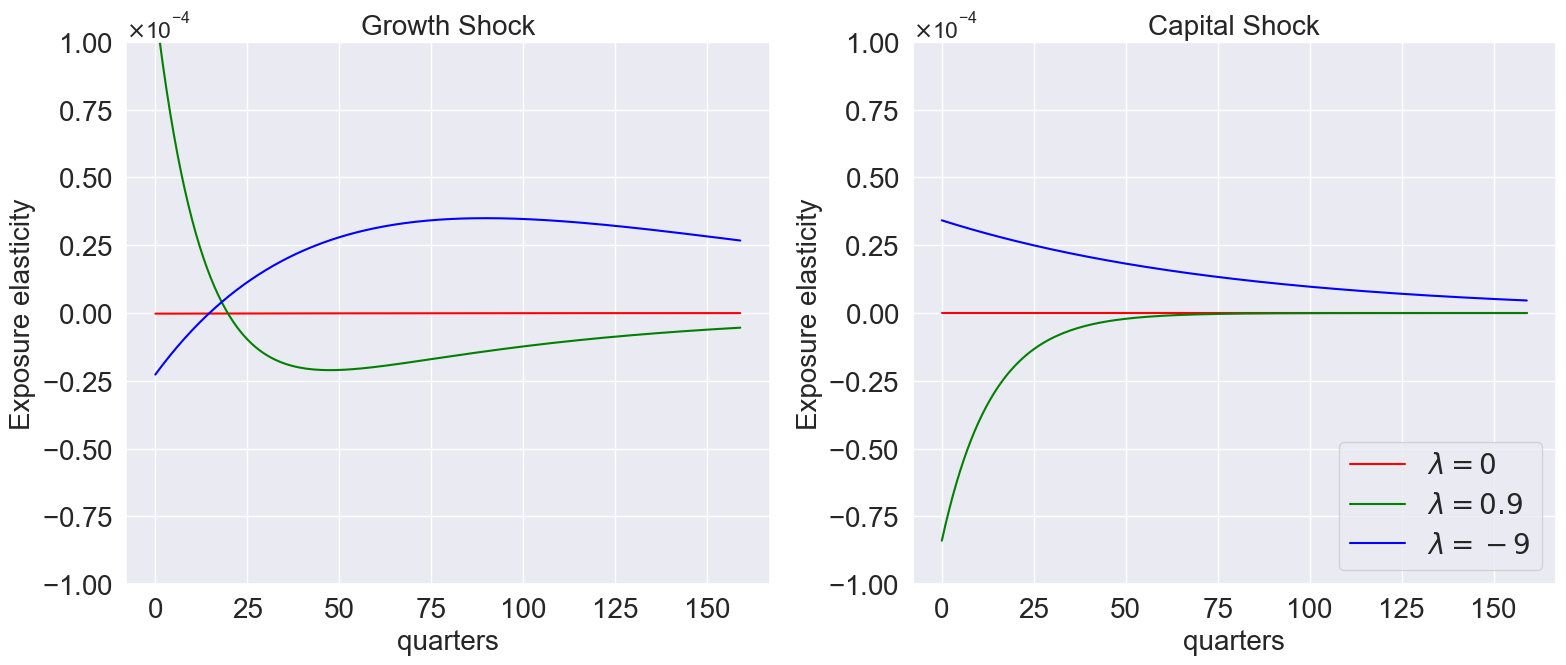

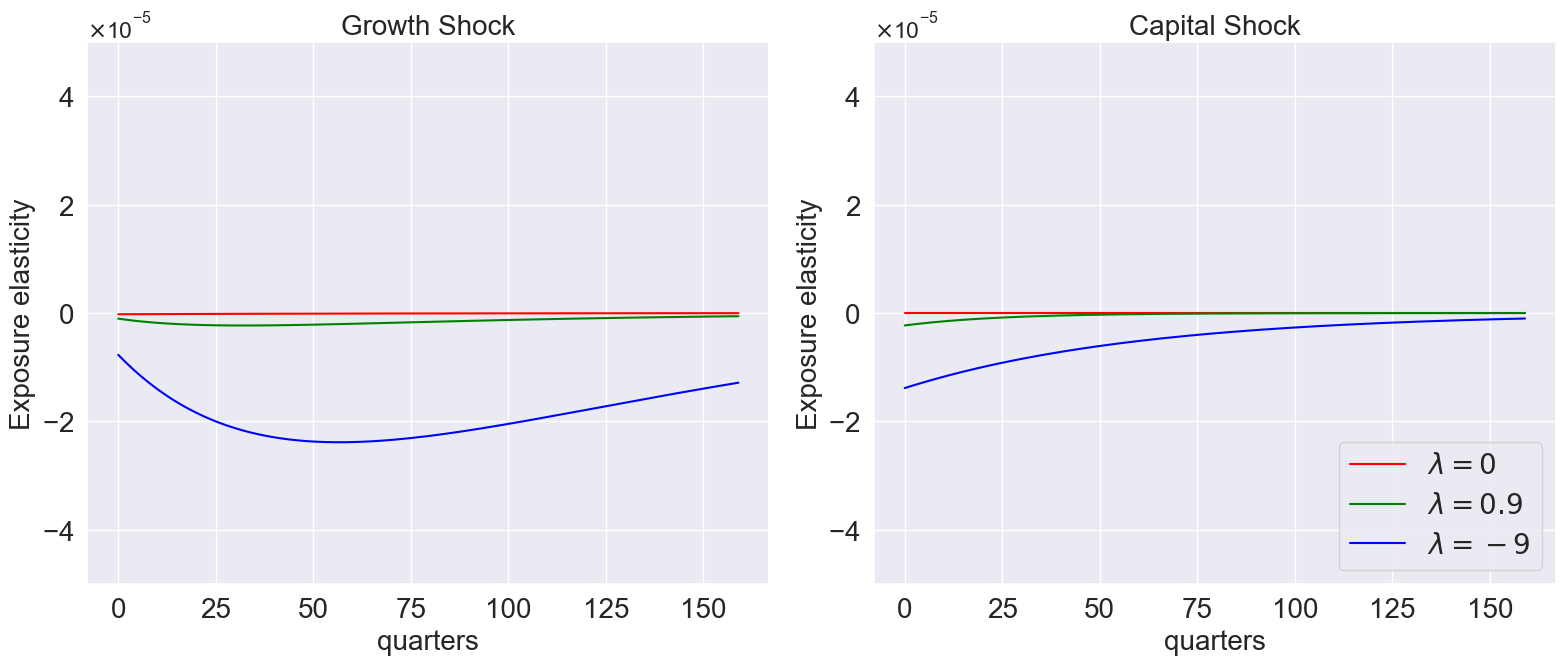

model_list=[models['gamma_1.001_lambda_0.0'],

models['gamma_1.001_lambda_0.9'],

models['gamma_1.001_lambda_-9.0']]

plot_exposure_elasticity_shocks(

model_list,

Mtgrowth_list = [compute_logMtM0(model) for model in model_list],

quantile=[0.5],

T=160,

num_shocks=2,

time_unit='quarters',

ylimits=[-1e-4, 1e-4],

labels=[r'$\lambda=0$', r'$\lambda=0.9$', r'$\lambda=-9$'],

colors=['red','green','blue'],

title=None,

# save_path='/plots_external/lambda_varying.png' # Figure 8.6

)

We can also illustrate exposure elasticities by varying over quantiles:

def plot_exposure_quantiles(

model_list,

quantile,

Mtgrowth_list,

T,

num_shocks,

time_unit='quarters',

ylimits=None,

titles=None,

title=None,

shock_names=None,

colors=None,

save_path=None

):

"""

Plot exposure elasticity quantiles for multiple models across subplots.

Parameters:

- model_list: List of model results to plot.

- quantile: List of quantiles to calculate.

- T: Integer, time horizon.

- num_shocks: Integer, number of shocks to include.

- time_unit: String, label for x-axis time units (e.g., "quarters").

- ylimits: List, optional y-axis limits for the subplots.

- titles: List of titles for individual subplots.

- title: String, optional title for the overall figure.

- shock_names: List of strings, names for the shocks (optional, not used in this specific plot).

- colors: List of strings, colors for the quantiles.

- save_path: String, optional path to save the plot.

"""

sns.set_style("darkgrid")

num_models = len(model_list)

# Default settings

if titles is None:

titles = [f'Model {i + 1}' for i in range(num_models)]

if colors is None:

colors = ['green', 'red', 'blue']

# Initialize figure and axes

fig, axes = plt.subplots(1, num_models, figsize=(8 * num_models, 7), squeeze=False)

axes = axes.flatten() # Flatten to ensure direct indexing works

# Main plotting loop

for idx, res in enumerate(model_list):

Mtgrowth = Mtgrowth_list[idx]

X1_tp1 = res['X1_tp1']

X2_tp1 = res['X2_tp1']

# Calculate exposure elasticity for each shock

expo_elas_shocks = [

[exposure_elasticity(Mtgrowth, X1_tp1, X2_tp1, T, shock=i, percentile=p) for p in quantile]

for i in range(min(num_shocks + 1, 2))

]

# Reorder shocks

reordered_shocks = [expo_elas_shocks[1]] + [expo_elas_shocks[i] for i in range(num_shocks) if i != 1]

# Prepare data for plotting

index = ['T'] + [f'{q} quantile' for q in quantile]

shock_data = [

pd.DataFrame([np.arange(T), *[e.flatten() for e in reordered_shocks[i]]], index=index).T

for i in range(num_shocks)

]

# Plot each shock for the current model

for i in range(num_shocks):

for j in range(len(quantile)):

sns.lineplot(data=shock_data[i], x='T', y=index[j + 1], ax=axes[idx],

color=colors[j], label=index[j + 1])

# Customize the subplot

axes[idx].set_xlabel('')

axes[idx].set_ylabel('Exposure elasticity', fontsize=20)

axes[idx].set_title(titles[idx], fontsize=20)

axes[idx].tick_params(axis='y', labelsize=20)

axes[idx].tick_params(axis='x', labelsize=20)

axes[idx].legend(fontsize=20, loc='lower right')

# Set y-axis limits if provided

if ylimits:

axes[idx].set_ylim(ylimits)

if i != 0: # Skip the legend for the second subplot

axes[i].legend(fontsize=15, loc='lower right')

else:

axes[i].legend().remove() # Ensure no legend appears on the second plot

# Set scientific notation for the y-axis

axes[idx].yaxis.set_major_formatter(mticker.ScalarFormatter(useMathText=True))

axes[idx].ticklabel_format(style='sci', axis='y', scilimits=(0, 0))

# Set x-axis label for all subplots

for ax in axes:

ax.set_xlabel(f'{time_unit}', fontsize=20)

# Set the main figure title, if provided

if title:

fig.suptitle(title, fontsize=24)

plt.tight_layout()

# Save and/or display the plot

if save_path:

plt.savefig(save_path, dpi=500)

plt.show()

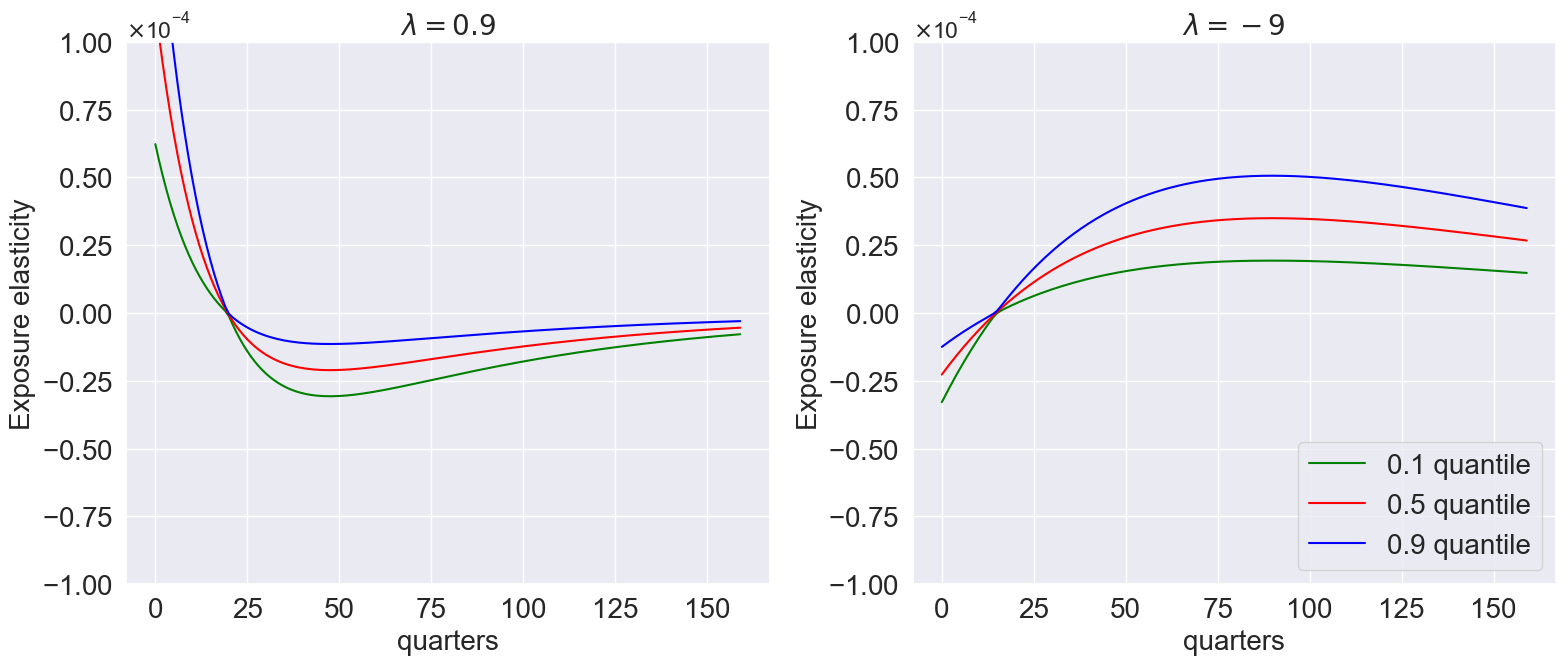

model_list=[

models['gamma_1.001_lambda_0.9'],

models['gamma_1.001_lambda_-9.0']

]

plot_exposure_quantiles(

model_list,

quantile=[0.1, 0.5, 0.9],

Mtgrowth_list = [compute_logMtM0(model) for model in model_list],

T=160,

num_shocks=1,

time_unit='quarters',

ylimits=[-1e-4, 1e-4],

titles=[r'$\lambda=0.9$', r'$\lambda=-9$'],

title=None,

# save_path='../plots/quantiles.png' # Figure 8.7

)

Finally we can plot price elasticities:

def plot_price_elasticity(models, T, quantile, time_unit, title=None, ylimits=None, save_path=None):

"""

Calculate and plot price elasticity for different models across subplots.

Parameters:

- models: List of result dictionaries to plot.

- T: Integer, time horizon.

- quantile: List of quantiles to calculate.

- time_unit: String, label for x-axis time units (e.g., "quarters").

- ylimits: Optional, list of y-axis limits for each subplot.

- save_path: Optional, path to save the figure.

"""

sns.set_style("darkgrid")

num_models = len(models)

# Initialize figure and axes for subplots

fig, axes = plt.subplots(1, num_models, figsize=(8 * num_models, 8), squeeze=False)

axes = axes.flatten() # Ensure axes are flattened for easy iteration

titles = [r'$\gamma=1$',r'$\gamma=4$',r'$\gamma=8$']

for idx, res in enumerate(models):

# Extract data from the current model

X1_tp1 = res['X1_tp1']

X2_tp1 = res['X2_tp1']

gc_tp1 = res['gc_tp1']

vmr_tp1 = res['vmr1_tp1'] + 0.5 * res['vmr2_tp1']

logNtilde = res['log_N_tilde']

# Calculate log_SDF

β = get_parameter_value('beta', res['parameter_names'], res['args'])

ρ = get_parameter_value('rho', res['parameter_names'], res['args'])

log_SDF = np.log(β) - ρ * gc_tp1 + (ρ - 1) * vmr_tp1 + logNtilde

# Calculate price elasticity for each shock

price_elas_shock = [

price_elasticity(gc_tp1, log_SDF, X1_tp1, X2_tp1, T, shock=1, percentile=p) for p in quantile

]

# Prepare data for plotting

index = ['T'] + [f'{q} quantile' for q in quantile]

shock_data = pd.DataFrame(

[np.arange(T), *[e.flatten() for e in price_elas_shock]],

index=index

).T

# Plot on the respective subplot

ax = axes[idx]

qt = [f'{q} quantile' for q in quantile]

colors = ['green', 'red', 'blue']

for j in range(len(quantile)):

sns.lineplot(data=shock_data, x='T', y=qt[j], ax=ax, color=colors[j], label=qt[j])

# Customize the subplot

ax.set_xlabel(time_unit, fontsize=30)

ax.set_ylabel('Price elasticity', fontsize=30)

ax.set_title(titles[idx], fontsize=30)

ax.tick_params(axis='y', labelsize=30)

ax.tick_params(axis='x', labelsize=30)

if idx == 0:

ax.legend(fontsize=25)

else:

ax.legend().set_visible(False)

if ylimits:

ax.set_ylim(ylimits)

# plt.suptitle('$\lambda=$'+title,fontsize=35)

plt.tight_layout()

# Save and/or display the plot

if save_path:

plt.savefig(save_path, dpi=500)

plt.show()

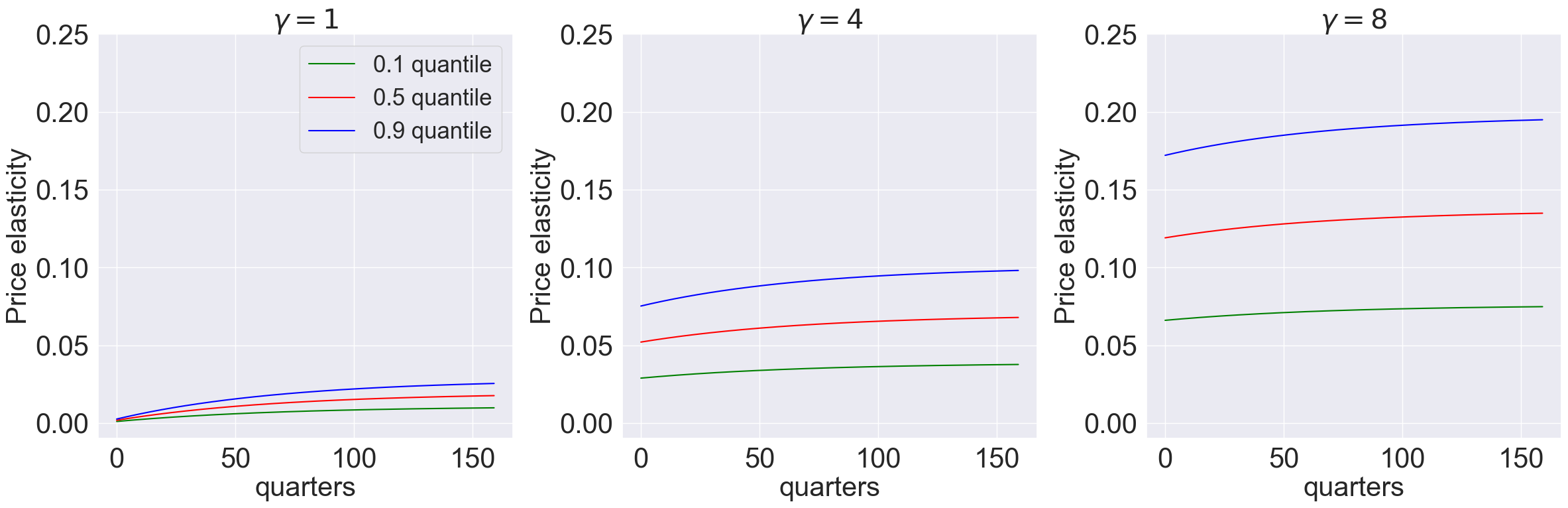

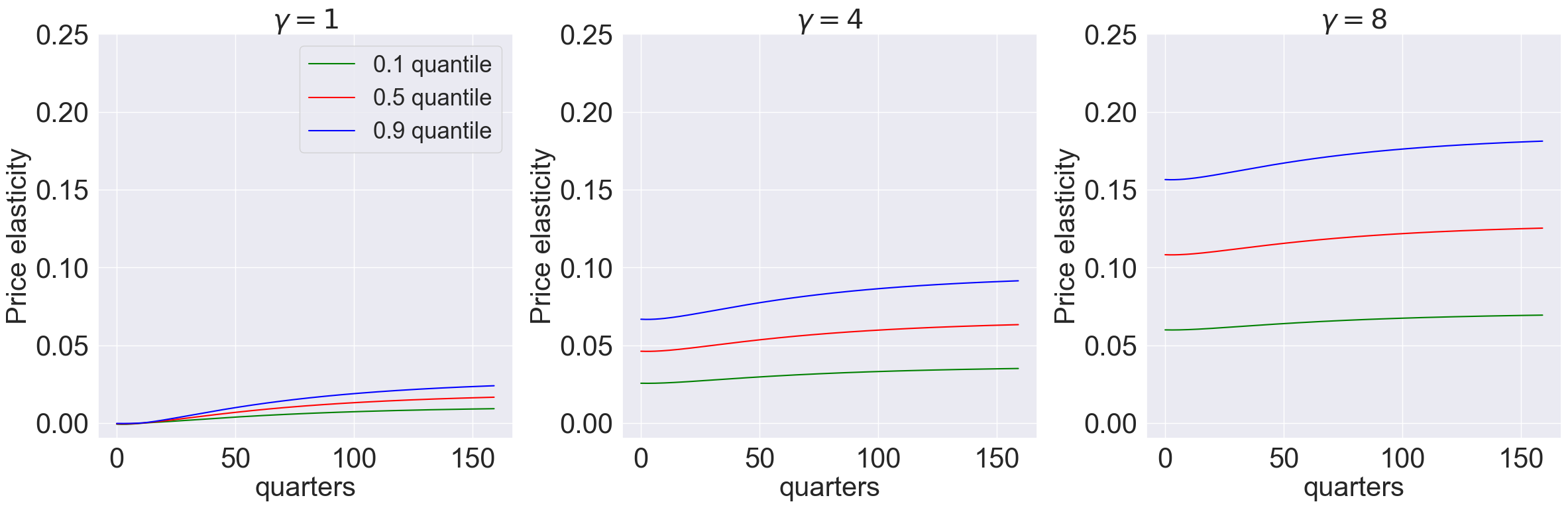

model_list = [models['gamma_1.001_lambda_0.0'],models['gamma_4.001_lambda_0.0'],models['gamma_8.001_lambda_0.0']]

T = 160

plot_price_elasticity(model_list,T,[0.1,0.5,0.9],'quarters','0',[-0.01,0.25]) #,r'plots/lambda0')

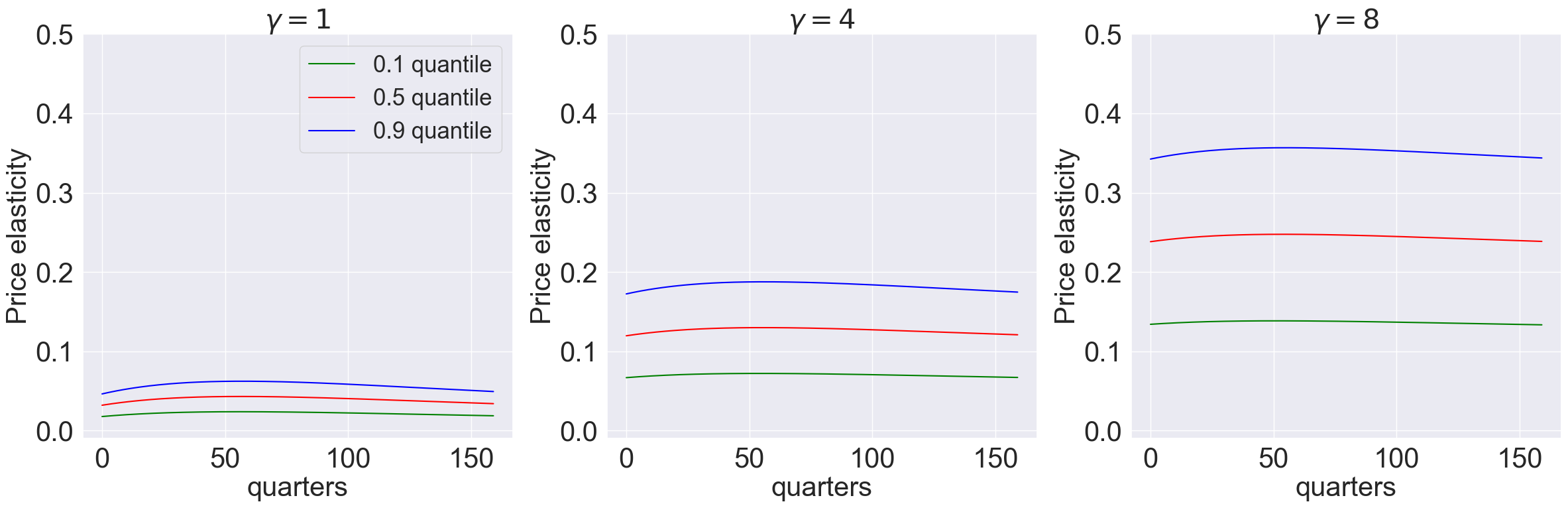

model_list = [models['gamma_1.001_lambda_-9.0'],models['gamma_4.001_lambda_-9.0'],models['gamma_8.001_lambda_-9.0']]

T = 160

plot_price_elasticity(model_list,T,[0.1,0.5,0.9],'quarters','-1',[-0.01,0.5]) #,r'plots/-lambda-9')

model_list = [models['gamma_1.001_lambda_0.9'],models['gamma_4.001_lambda_0.9'],models['gamma_8.001_lambda_0.9']]

T = 160

plot_price_elasticity(model_list,T,[0.1,0.5,0.9],'quarters','0.5',[-0.01,0.25]) #,r'plots/lambda09')

2.6 External Habit Model#

For internal habit model, our First-order condition (FOC) is

For external habit, our FOC is

In order to modify the FOC in the codes, we need to change the function compile_equations in uncertain_expansion.py. compile_equations compiles FOC and costate following

where

In our case, the \(\psi_{d'}^x (D_t, X_t, W_{t+1})\) should be \( 3 \times 2\) matrix as we have state variable \([Z_{1,t}, Z_{2,t}, X_{1,t}]\) and two controls \([\frac{I_{h,t}}{K_t}, \frac{I_{k,t}}{K_t}]\). To implement external habit model, we need the derivative of \(X_{1,t}\) process w.r.t \(\frac{I_{h,t}}{K_t}\) equal to zero.

Fortunately, we implemented this exercise and made it very easy to use for exploring the external habit model. In the equation uncertainty_expansion, when a user turns on the option ExternalHabit=True and keeps everything unchanged from the internal habit model, the code will solve the external habit model. Here is the example:

gamma_values = [1.001, 4.001, 8.001]

lambda_values = [-9.0,-8.0, -7.0, -6.0, -5.0, -4.0,-3.0,-2.0 ,-1.0,0.0, 0.1, 0.2, 0.3, 0.4,0.5,0.6, 0.7, 0.8, 0.9]

initial_guess_baseline = initial_guess.copy() # whatever you used before

preloadpath = None # optional: external warm start (e.g. from a very easy case)

for gamma_i in gamma_values:

# update gamma once per outer loop

args = change_parameter_value('gamma', parameter_names, args, gamma_i)

print(f"gamma: {gamma_i}")

# store the last solution’s steady state for this gamma

prev_ss = None

for llambda_i in lambda_values:

llambda_i = round(llambda_i, 2)

args = change_parameter_value('llambda', parameter_names, args, llambda_i)

print(f"lambda: {llambda_i}")

savepath = f'output_external/res_gamma_{gamma_i}_lambda_{llambda_i}.pkl'

# 0. If this parameter combo was already solved before, just load & move on

if os.path.exists(savepath):

with open(savepath, 'rb') as f:

res = pickle.load(f)

prev_ss = res['ss']

print(" -> loaded existing solution from disk")

continue

# 1. Choose initial_guess:

if prev_ss is not None:

# use solution from previous λ for this γ

initial_guess = np.concatenate([np.array([-3.40379947]), prev_ss])

elif preloadpath is not None and os.path.exists(preloadpath):

# optional: use some external “easy” case as a starting point

with open(preloadpath, 'rb') as f:

preload = pickle.load(f)

initial_guess = np.concatenate([np.array([-3.40379947]), preload['ss']])

else:

# fall back to your original global guess

initial_guess = initial_guess_baseline

# 2. Solve at (gamma_i, llambda_i)

res = uncertain_expansion(

control_variables, state_variables, shock_variables,

variables, variables_tp1,

kappa, capital_growth, state_equations, static_constraints,

initial_guess, parameter_names,

args, approach='1', init_util=init_util,

iter_tol=iter_tol, max_iter=max_iter,

savepath=savepath, # still writes to disk inside

ExternalHabit=True # <- here is the change

)

# 3. Store this steady state to warm-start the next λ

prev_ss = res['ss']

# and optionally make this the preload for future runs / sessions

preloadpath = savepath

models = {}

gamma_values = [1.001, 4.001, 8.001]

lambda_values = [-9.0, 0.0, 0.9]

for gamma_i in gamma_values:

for llambda_i in lambda_values:

llambda_i = round(llambda_i,2)

save_path = 'output_external/res_gamma_{}_lambda_{}.pkl'.format(gamma_i, llambda_i)

try:

with open(save_path, 'rb') as f:

# models = pickle.load(save_path)

model_key = f"gamma_{gamma_i}_lambda_{llambda_i}"

models[model_key] = pickle.load(f)

except FileNotFoundError:

print(f"File not found: {save_path}")

model_list=[models['gamma_1.001_lambda_0.0'],

models['gamma_1.001_lambda_0.9'],

models['gamma_1.001_lambda_-9.0']]

plot_exposure_elasticity_shocks(

model_list,

Mtgrowth_list = [compute_logMtM0(model) for model in model_list],

quantile=[0.5],

T=160,

num_shocks=2,

time_unit='quarters',

ylimits=[-5e-5, 5e-5],

labels=[r'$\lambda=0$', r'$\lambda=0.9$', r'$\lambda=-9$'],

colors=['red','green','blue'],

title=None,

# save_path='/plots_external/lambda_varying.png' # Figure 10.6

)

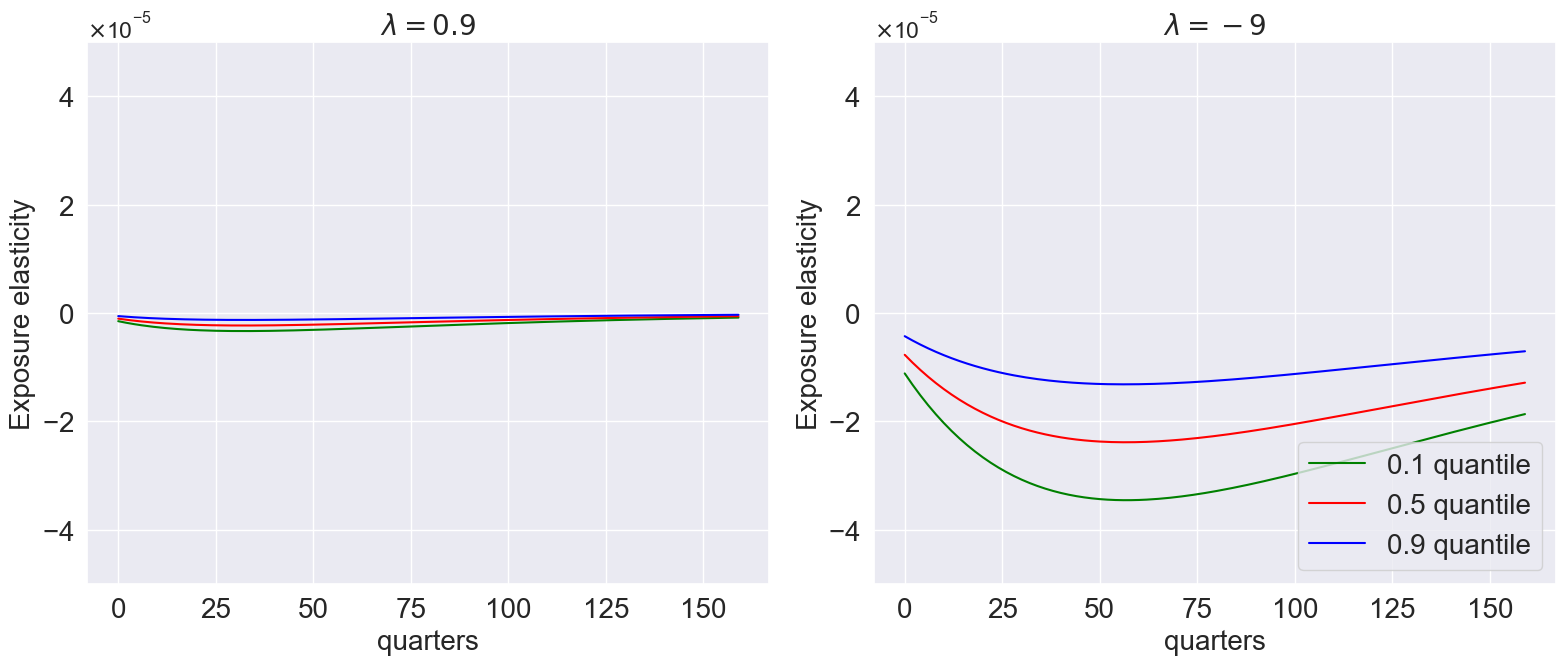

model_list=[

models['gamma_1.001_lambda_0.9'],

models['gamma_1.001_lambda_-9.0']

]

plot_exposure_quantiles(

model_list,

quantile=[0.1, 0.5, 0.9],

Mtgrowth_list = [compute_logMtM0(model) for model in model_list],

T=160,

num_shocks=1,

time_unit='quarters',

ylimits=[-5e-5, 5e-5],

titles=[r'$\lambda=0.9$', r'$\lambda=-9$'],

title=None,

# save_path='/plots_external/quantiles.png' # Figure 10.7

)

3 Outputs#

3.1 List of Outputs #

We now examine the contents of ModelSol, which contains the attributes listed below. Each approximation is stored in a class LinQuadVar, which contains the coefficients for \(X_{1,t}, X_{2,t}, X_{1,t}'X_{1,t}, W_{t+\epsilon}, W_{t+\epsilon}'W_{t+\epsilon}, X_{1,t}'W_{t+\epsilon}\) and the constant.

Input |

Type |

Description |

|---|---|---|

|

LinQuadVar |

Approximation of jump and state variables at time \(t\). Replace |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

dict |

Dictionary containing solutions of the continuation values, including \(\mu^0, \Upsilon_0^2, \Upsilon_1^2,\) and \(\Upsilon_2^2\) etc. |

|

LinQuadVar |

Approximation of continuation values \(\widehat{V}^1_{t+\epsilon}-\widehat{R}^1_t\) . Replace |

|

LinQuadVar |

Approximation of consumption growth \(\widehat{C}_{t+\epsilon}-\widehat{C}_t\) . Replace |

|

dict |

Steady states for state and jump variables |

|

LinQuadVar |

Approximation for the log change of measure |

For example, we can obtain the coefficients for the first-order contribution of \(\log{C_t/K_t}\) in the following way, noting that cmk_t was listed as the first jump variable when we specified the equilibrum conditions.

## Log consumption over capital approximation results, shown in the LinQuadVar coefficients form

ModelSol['JX1_t'][0].coeffs

{'x': array([[ 0. , 0.10420544, -0. , -0.52822907]]),

'c': array([[-0.0191216]])}

We can also display the full second-order approximation of \(\log{C_t/K_t}\) using the disp function, which renders a LinQuadVar object in LATEX form.

## Log consumption over capital approximation results, shown in the Latex analytical form

disp(ModelSol['JX_t'][0],'\\log\\frac{C_t}{K_t}')

Another example:

## Log capital growth process second order approximation results

disp(ModelSol['X2_tp1'][0],'\\log\\frac{K_{t+\epsilon}^2}{K_t^2}')

## Log consumption over capital approximation results, shown in the LinQuadVar coefficients form

ModelSol['JX1_t'][0].coeffs

{'x': array([[ 0. , 0.10420544, -0. , -0.52822907]]),

'c': array([[-0.0191216]])}

We can also display the full second-order approximation of \(\log{C_t/K_t}\) using the disp function, which renders a LinQuadVar object in LATEX form.

ModelSol['JX_t'][0]["x"]

array([[ 0. , 0.10821926, -0.0063016 , -0.52504922]])

## Log consumption over capital approximation results, shown in the Latex analytical form

disp_new(ModelSol['JX_t'][0],'\\log\\frac{C_t}{K_t}')

Another example:

## Log capital growth process second order approximation results

disp_new(ModelSol['X2_tp1'][0],'\\log\\frac{K_{t+\epsilon}^2}{K_t^2}')

3.2 Simulate Variables #

Given a series of shock processes, we can simulate the path of our state and jump variables using the ModelSolution.simulate method. Here, we simulate 400 periods of i.i.d standard multivariate normal shocks.

n_J, n_X, n_W = ModelSol['var_shape']

Ws = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 400)

JX_sim = ModelSol.simulate(Ws)

4 Using LinQuadVar in Computation #

In the previous section, we saw how to use uncertain_expansion to approximate variables and store their coefficients as LinQuadVar objects. In this section, we explore how to manipulate LinQuadVar objects for different uses.

To aid our examples, we first extract the steady states for the state evolution processes from the previous model solution:

See src/lin_quad.py for source code of LinQuadVar definition.

ModelSol['ss'][[0,1,2]]

array([-4.33215389, 0.0259344 , 0.02039568])

n_J, n_X, n_W = ModelSol['var_shape']

print(n_J, n_X, n_W)

X0_tp1 = LinQuadVar({'c':np.array([[ModelSol['ss'][0]],[ModelSol['ss'][1]],[ModelSol['ss'][2]], [ModelSol["ss"][3]]])}, shape = (n_X, n_X, n_W))

6 4 3

4.1 LinQuadVar Operations #

We can sum multiple LinQuads together in two different ways. Here we demonstrate this with an example by summing the zeroth, first and second order contributions of our approximation for capital growth.

gk_tp1 = X0_tp1[0] + ModelSol['X1_tp1'][0] + 0.5 * ModelSol['X2_tp1'][0]

disp(gk_tp1,'\\log\\frac{K_{t+\epsilon}}{K_t}')

In the next example, we sum together the contributions for both capital growth and technology:

lq_sum([X0_tp1, ModelSol['X1_tp1'], 0.5 * ModelSol['X2_tp1']]).coeffs

{'xx': array([[-0. , -0. , 0. , 0. , 0. , -0.00022514, 0. , 0.00001292, 0. , 0. , -0. , 0. , 0. , 0.00001093,

0. , -0.00003523],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. ,

0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0.097 , 0. , 0. , 0. ,

0. , 0. ],

[ 0. , 0. , -0. , 0. , -0. , 0.00025426, -0. , 0.00000844, -0. , -0. , 0. , -0. , 0. , 0.00001072,

-0. , 0.00005381]]),

'c': array([[-4.33102269],

[ 0.0259344 ],

[-0.07112813],

[-0.00131024]]),

'w': array([[ 0.00799924, 0.00347793, 0. ],

[ 0. , 0.04956051, 0. ],

[ 0. , 0. , 0.42784065],

[-0.00799924, -0.00347793, 0. ]]),

'x': array([[-0. , 0.03724612, 0.00008824, 0.00005908],

[ 0. , 0.944 , 0. , 0. ],

[ 0. , 0. , 0.806 , 0. ],

[ 0. , -0.03682226, -0.00010169, -0.10517424]]),

'xw': array([[ 0. , 0. , 0. , 0. , 0. , 0. , 0.00399962, 0.00173897, 0. , 0. , 0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0.02478025, 0. , 0. , 0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , -0.21392032, 0. , 0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , -0.00399962, -0.00173897, 0. , 0. , 0. , 0. ]]),

'x2': array([[-0. , 0.01855206, -0. , 0.00003412],

[ 0. , 0.472 , 0. , 0. ],

[ 0. , 0. , 0.403 , 0. ],

[ 0. , -0.0183313 , 0. , -0.05258344]])}

4.2 LinQuadVar Split and Concat #

split breaks multiple dimensional LinQuad into one-dimensional LinQuads, while concat does the inverse.

gk_tp1, Z_tp1, Y_tp1, X_tp1 = ModelSol['X1_tp1'].split()

concat([gk_tp1, Z_tp1, Y_tp1])

<lin_quad.LinQuadVar at 0x25f969bd8b0>

4.3 Evaluate a LinQuadVar #

We can evaluate a LinQuad at specific state \((X_{t},W_{t+\epsilon})\) in time. As an example, we evaluate all 5 variables under steady state with a multivariate random normal shock.

x1 = np.zeros([n_X ,1])

x2 = np.zeros([n_X ,1])

x3 = np.zeros([n_X, 1])

w = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 1).T

ModelSol['JX_tp1'](*(x1,x2,w))

array([[ -4.40157174],

[ 0.02420615],

[ 0.02040907],

[ -0.0002646 ],

[ -0.00021192],

[ 0.99999632],

[ 0.02218119],

[ 0.01258757],

[-12.16998153],

[ -0.01876417]])

4.4 Next period expression for LinQuadVar #

ModelSol allows us to express a jump variable \(J_t\) as a function of \(t\) state and shock variables. Suppose we would like to compute its next period expression \(J_{t+\epsilon}\) with shocks. The function next_period expresses \(J_{t+\epsilon}\) in terms of \(t\) state variables and \(t+\epsilon\) shock variables. For example, we can express the \(t+\epsilon\) expression for the first-order contribution to consumption over capital as:

ModelSol["X1_tp1"].coeffs

{'x': array([[-0. , 0.03710412, -0. , 0.00006824],

[-0. , 0.944 , -0. , -0. ],

[-0. , -0. , 0.806 , -0. ],

[ 0. , -0.0366626 , 0. , -0.10516689]]),

'w': array([[ 0.00799924, 0.00347793, -0. ],

[-0. , 0.04956051, -0. ],

[-0. , -0. , 0.42784065],

[-0.00799924, -0.00347793, -0. ]]),

'c': array([[ 0.00111162],

[ 0. ],

[ 0. ],

[-0.0012811 ]])}

cmk1_tp1 = next_period(ModelSol['J1_t'][0], ModelSol['X1_tp1'])

disp(cmk1_tp1, '\\log\\frac{C_{t+\epsilon}^1}{K_{t+\epsilon}^1}')

cmk2_tp1 = next_period(ModelSol['J2_t'][0], ModelSol['X1_tp1'], ModelSol['X2_tp1'])

disp(cmk2_tp1, '\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}')

4.6 Compute the Expectation of time \(t+\epsilon\) LinQuadVar #

Suppose the distribution of shocks has a constant mean and variance (not state dependent). Then, we can use the E function to compute the expectation of a time \(t+\epsilon\) LinQuadVar as follows:

E_w = ModelSol['util_sol']['μ_0']

cov_w = np.eye(n_W)

E_ww = cal_E_ww(E_w, cov_w)

E_cmk2_tp1 = E(cmk2_tp1, E_w, E_ww)

disp(E_cmk2_tp1, '\mathbb{E}[\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}|\mathfrak{F_t}]')

Suppose the distribution of shock has a state-dependent mean and variance (implied by \(\tilde{N}_{t+\epsilon}\) shown in the notes), we can use E_N_tp1 and N_tilde_measure to compute the expectation of time \(t+\epsilon\) LinQuadVar.

N_cm = N_tilde_measure(ModelSol['util_sol']['log_N_tilde'],(1,n_X,n_W))

E_cmk2_tp1_tilde = E_N_tp1(cmk2_tp1, N_cm)

disp(E_cmk2_tp1_tilde, '\mathbb{\\tilde{E}}[\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}|\mathfrak{F_t}]')