Uncertain Expansion Example Notebook#

1 Preliminaries #

1.1 Model Setup#

The general structure for models to be solved using the expansion code can be written as:

In addition, there are a set of first-order conditions and co-state equations detailed in Chapter 8 of the book. These are compiled automatically by the code.

1.2 Inputs#

The Expansion Suite uses the function uncertain_expansion to approximate a solution to the above system locally. The user must specify several sets of inputs. Define the relevant variables:

Input |

Description |

Notation in text |

|---|---|---|

|

Variables chosen by the decision-maker at time \(t\) |

\(D_t\) |

|

Variables that describe the current state of the system |

\(X_t\) |

|

Variables representing different entries of the Brownian motion variable |

\(W_t\) |

The \(t+1\) variables will be automatically created from this. For example, if a state variable is inputted as Z_t, an additional state variable Z_tp1 will be automatically generated.

We also need to define the equilibrium conditions:

Input |

Description |

Notation in text |

|---|---|---|

|

Log share of capital not allocated to consumption |

\(\kappa(X_t(q),D_t(q))\) |

|

Law of motion for \(\hat{G}_{t+1}-\hat{G}_t\) |

\(\psi^g(D_t(q),X_t(q),qW_{t+1},q)\) |

|

Law of motion for state variables |

\(\psi^x(D_t(q),X_t(q),qW_{t+1},q)\) |

The remaining equilibrium conditions will be automatically computed by the code. The user must also define a list of parameters and their corresponding values. This can be done by specifying pairs of inputs such as beta = 0.99 or gamma = 1.01 within the body of the function create_args.

Note that the user must define the variables and parameters before defining the equations. Make sure that the equations use the same expressions for variables and parameters as previously defined by the user.

The output is of class ModelSolution, which stores the coefficients for the linear-quadratic approximation for the jump and state variables; continuation values; consumption growth; and log change of measure, as well as the steady-state values of each variables.

2 Example#

We will now walk through the computation using the example above. Begin by installing the following libraries and downloading RiskUncertaintyValue, which contains the functions required to solve the model:

import os

import sys

import sympy as sp

workdir = os.getcwd()

!git clone https://github.com/lphansen/RiskUncertaintyValue

workdir = os.getcwd() + '/RiskUncertaintyValue_automatic'

sys.path.insert(0, workdir+'/src')

import numpy as np

import seaborn as sns

import autograd.numpy as anp

from scipy import optimize

np.set_printoptions(suppress=True)

np.set_printoptions(linewidth=200)

from IPython.display import display, HTML

from BY_example_sol import disp

display(HTML("<style>.container { width:97% !important; }</style>"))

import warnings

warnings.filterwarnings("ignore")

import matplotlib.pyplot as plt

from scipy.stats import norm

from lin_quad import LinQuadVar

from lin_quad_util import E, concat, next_period, cal_E_ww, lq_sum, N_tilde_measure, E_N_tp1, log_E_exp, kron_prod, distance

from utilities import mat, vec, sym

from uncertain_expansion import uncertain_expansion, generate_symbols_and_args, compile_equations, get_parameter_value

from elasticity import exposure_elasticity, price_elasticity

from plot import plot_exposure_elasticity, plot_price_elasticity

np.set_printoptions(suppress=True)

import pickle

import pandas as pd

from scipy.optimize import fsolve

import sympy as sp

fatal: destination path 'RiskUncertaintyValue' already exists and is not an empty directory.

2.1 Parameters#

Use the following function to define and set the values for your parameters.

def create_args():

# Define parameters here

sigma_k1 = 0.92 * anp.sqrt(12)

sigma_k2 = 0.4 * anp.sqrt(12)

sigma_k3 = 0.0

sigma_z1 = 0.0

sigma_z2 = 5.7 * anp.sqrt(12)

sigma_z3 = 0.0

sigma_y1 = 0.0

sigma_y2 = 0.0

sigma_y3 = 0.00031 * anp.sqrt(12)

# Base parameters

delta = 0.01

a = 0.0922

epsilon = 1.0

gamma = 8.0 #Do not change this name

rho = 1.5 #Do not change this name

beta = anp.exp(-epsilon * delta) #Do not change this name

# Capital evolution parameters

phi_1 = 1 / 8

phi_2 = 8.0

beta_k = 0.04

alpha_k = 0.04

# Other states

beta_z = 0.056

beta_2 = 0.194

mu_2 = 6.3 * (10**(-6))

# Return as a dictionary

return locals()

2.2 Variables#

Define your variables as below. You may only have one growth variable and one perturbation variable. Apart from this, you may add more variables to the list as you wish.

# Define variable names

control_variables = ["imk_t"]

state_variables = ["Z_t", "Y_t"]

growth_variables = ["log_gk_t"]

perturbation_variable = ["q_t"]

shock_variables = ["W1_t", "W2_t", "W3_t"]

The user does not need to change the following code, which creates symbols for the defined parameters and variables.

parameter_names, args = generate_symbols_and_args(create_args)

globals().update(parameter_names)

variables = control_variables + state_variables + growth_variables + perturbation_variable + shock_variables

variables_tp1 = [var + "p1" for var in variables]

symbols = {var: sp.Symbol(var) for var in variables + variables_tp1}

globals().update(symbols)

2.3 Define Equilibrium Conditions#

Ensure that you use the same names for your variables and parameters from before. You must have one output constraint and one capital growth equation, but you may add as many state equations as you wish. The first-order conditions and co-state equations will be automatically handled and do not need to be specified.

# Output constraint

kappa = sp.log(a - imk_t)

# Capital growth equation

growth = epsilon * (phi_1 * sp.log(1. + phi_2 * imk_t) - alpha_k + beta_k * Z_t \

- q_t**2 * 0.5 * (sigma_k1**2 + sigma_k2**2 + sigma_k3**2) * sp.exp(Y_t)) \

+ sp.sqrt(epsilon) * sp.exp(0.5 * Y_t) * (sigma_k1 * W1_tp1 + sigma_k2 * W2_tp1 + sigma_k3 * W3_tp1)

# Technology growth equation

technology_growth = Z_tp1 - Z_t + epsilon * beta_z * Z_t \

- sp.sqrt(epsilon) * sp.exp(0.5 * Y_t) * (sigma_z1 * W1_tp1 + sigma_z2 * W2_tp1 + sigma_z3 * W3_tp1)

# Volatility growth equation

volatility_growth = Y_tp1 - Y_t + epsilon * beta_2 * (1 - mu_2 * sp.exp(-Y_t)) \

+ q_t**2 * 0.5 * (sigma_y1**2 + sigma_y2**2 + sigma_y3**2) * sp.exp(-Y_t) * epsilon \

- sp.exp(-0.5 * Y_t) * (sigma_y1 * W1_tp1 + sigma_y2 * W2_tp1 + sigma_y3 * W3_tp1) * sp.sqrt(epsilon)

# State equations

state_equations = [technology_growth, volatility_growth]

2.4 Code Settings#

You may additionally set the following:

Initial guess for steady-state variables. This must have the same length as the number of variables

Recursive terms initialization. These are initializations for terms like \(\log N_t^*\) and \(\hat{R}_t-\hat{V}_t\), which may be loaded from a previous solution.

Convergence tolerance. How small the maximum error across the approximated terms must be before the algorithm is considered to have converged.

Maximum iterations. The maximum number of iterations for the algorithm can take.

Save location. Save the model solution to this location so that it can be accessed later.

initial_guess = np.concatenate([np.array([-2.1968994 , -4.123193 , anp.exp(-2.57692626)]),np.ones(3),np.array([0.01937842, 0. , -11.97496092])])

savepath='output/res.pkl'

savepath = None

init_util = None

iter_tol = 1e-5

max_iter = 50

#Code for loading pre-solution

# with open(savepath,'rb') as f:

# preload = pickle.load(f)

# init_util = preload['util_sol']

2.5 Run Code#

You are now ready to run the function uncertain_expansion. You do not need to change anything in the following code.

ModelSol = uncertain_expansion(control_variables, state_variables, shock_variables, variables, variables_tp1,

kappa, growth, state_equations, initial_guess, parameter_names,

args, approach = '1', init_util = init_util, iter_tol = iter_tol, max_iter = max_iter,savepath=savepath)

[-beta*exp(rmv_t*(1 - rho)) - (1 - beta)*exp(log_cmk_t*(1 - rho))*exp(-vmk_t*(1 - rho)) + 1.0, log_cmk_t - log(a - imk_t), beta*epsilon*mg_tp1*phi_1*phi_2*exp(rmv_t*(1 - rho))/(imk_t*phi_2 + 1.0) - (1 - beta)*exp(log_cmk_t*(1 - rho))*exp(-vmk_t*(1 - rho))/(a - imk_t), beta*(beta_k*epsilon*mg_tp1 + m0_tp1*(beta_z*epsilon - 1))*exp(rmv_t*(1 - rho)) - m0_t, beta*(-0.5*sqrt(epsilon)*m0_tp1*(W1_tp1*sigma_z1 + W2_tp1*sigma_z2 + W3_tp1*sigma_z3)*exp(0.5*Y_t) + m1_tp1*(beta_2*epsilon*mu_2*exp(-Y_t) + 0.5*sqrt(epsilon)*(W1_tp1*sigma_y1 + W2_tp1*sigma_y2 + W3_tp1*sigma_y3)*exp(-0.5*Y_t) - 0.5*epsilon*q_t**2*(sigma_y1**2 + sigma_y2**2 + sigma_y3**2)*exp(-Y_t) - 1) + mg_tp1*(0.5*sqrt(epsilon)*(W1_tp1*sigma_k1 + W2_tp1*sigma_k2 + W3_tp1*sigma_k3)*exp(0.5*Y_t) - 0.5*epsilon*q_t**2*(sigma_k1**2 + sigma_k2**2 + sigma_k3**2)*exp(Y_t)))*exp(rmv_t*(1 - rho)) - m1_t, 1.0*beta*mg_tp1*exp(rmv_t*(1 - rho)) - mg_t + 1.0*(1 - beta)*exp(log_cmk_t*(1 - rho))*exp(-vmk_t*(1 - rho)), -sqrt(epsilon)*(W1_tp1*sigma_k1 + W2_tp1*sigma_k2 + W3_tp1*sigma_k3)*exp(0.5*Y_t) - epsilon*(Z_t*beta_k - alpha_k + phi_1*log(imk_t*phi_2 + 1.0) - 0.5*q_t**2*(sigma_k1**2 + sigma_k2**2 + sigma_k3**2)*exp(Y_t)) + log_gk_tp1, Z_t*beta_z*epsilon - Z_t + Z_tp1 - sqrt(epsilon)*(W1_tp1*sigma_z1 + W2_tp1*sigma_z2 + W3_tp1*sigma_z3)*exp(0.5*Y_t), -Y_t + Y_tp1 + beta_2*epsilon*(-mu_2*exp(-Y_t) + 1) - sqrt(epsilon)*(W1_tp1*sigma_y1 + W2_tp1*sigma_y2 + W3_tp1*sigma_y3)*exp(-0.5*Y_t) + 0.5*epsilon*q_t**2*(sigma_y1**2 + sigma_y2**2 + sigma_y3**2)*exp(-Y_t)]

[rmv_t, vmk_t, log_cmk_t, imk_t, m0_t, m1_t, mg_t, log_gk_t, Z_t, Y_t, q_t, W1_t, W2_t, W3_t]

Iteration 1: error = 0.150951282

Iteration 2: error = 0.0749792416

Iteration 3: error = 0.0436581537

Iteration 4: error = 0.0203399368

Iteration 5: error = 0.00917550775

Iteration 6: error = 0.00411690549

Iteration 7: error = 0.00184549174

Iteration 8: error = 0.000827151037

The iteration is not making good progress, as measured by the

improvement from the last ten iterations.

Iteration 9: error = 0.000370719802

Iteration 10: error = 0.000166151679

The iteration is not making good progress, as measured by the

improvement from the last ten iterations.

Iteration 11: error = 7.4466911e-05

Iteration 12: error = 3.33750469e-05

Iteration 13: error = 1.49582373e-05

Iteration 14: error = 6.70407636e-06

2.6 Plot Elasticities#

First, if you did not run the code above, you can load a pre-solved solution by specifying save_path as follows:

savepath='output/res.pkl'

with open(savepath,'rb') as f:

ModelSol = pickle.load(f)

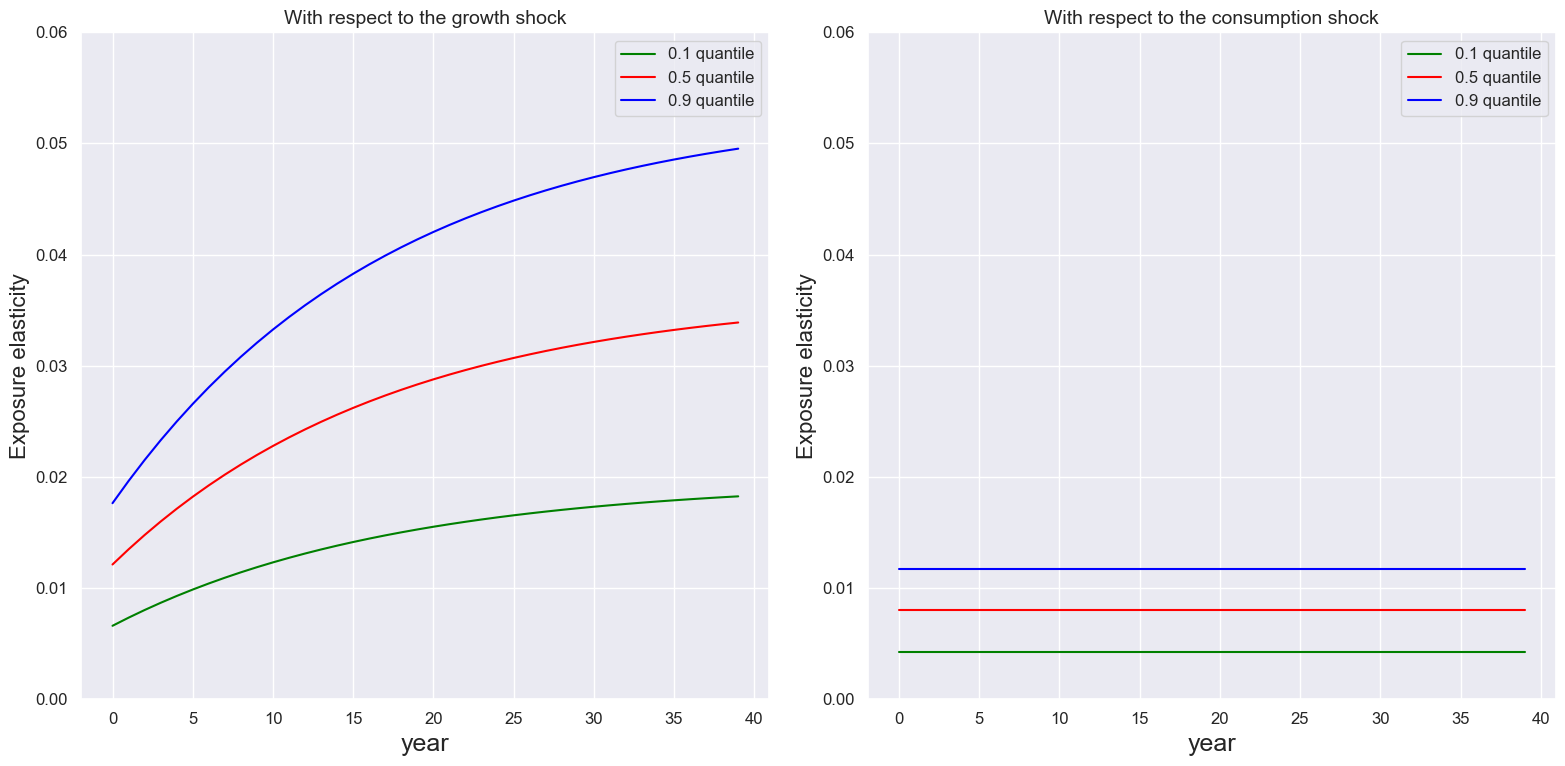

We use plot_exposure_elasticity to plot exposure elasticities.

quantilespecifies the quantiles to be plottedTspecifies the number of periods (using the time-unit that you specified the parameters in)(optional) The

ylimparameters are for setting the upper limits for the y axes

quantile = [0.1,0.5,0.9]

T = 40

ylim1, ylim2 = 0.06, 0.06

plot_exposure_elasticity(ModelSol,T,quantile,'year',ylim1, ylim2)

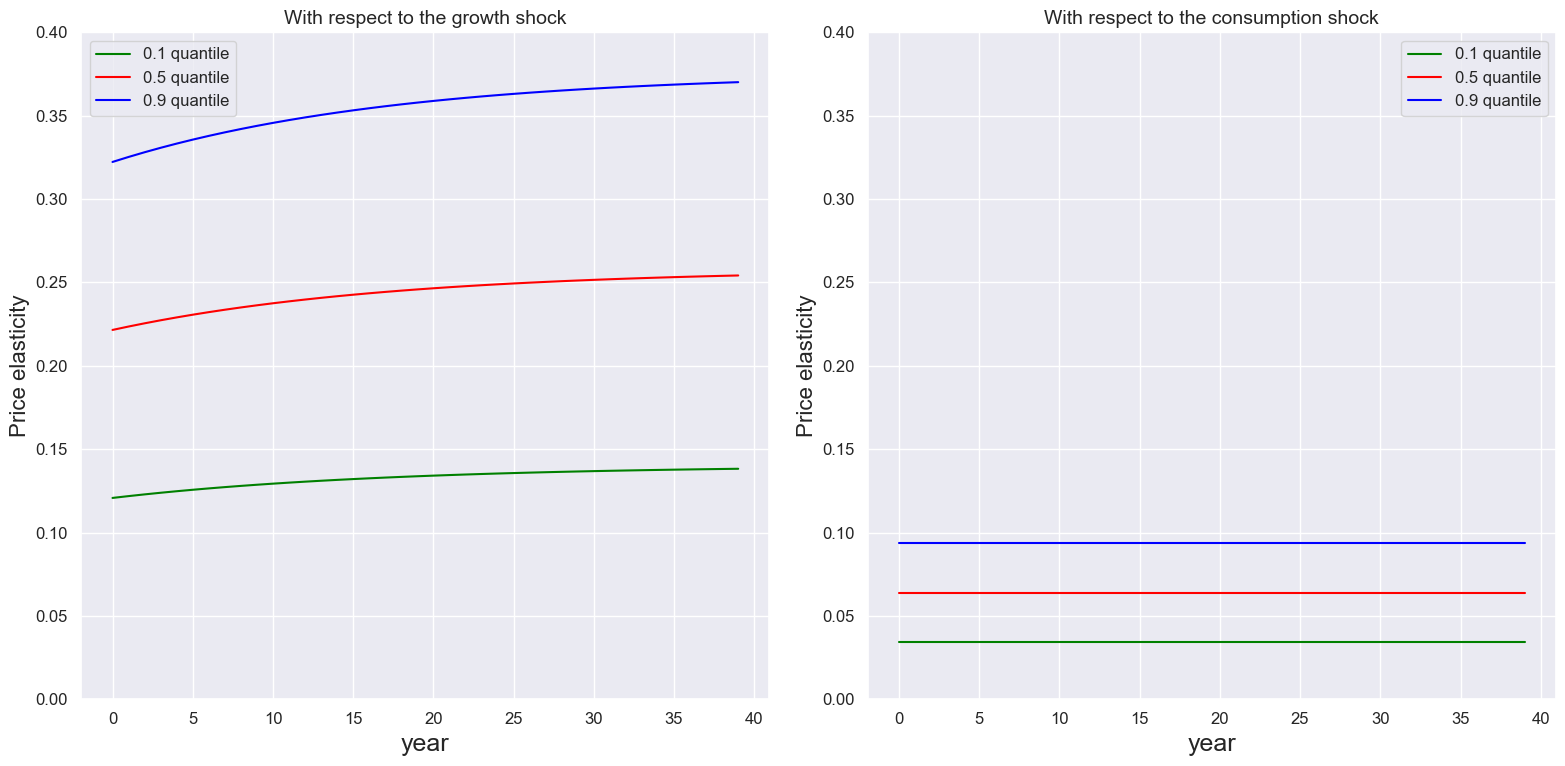

Similarly we can plot the price elasticities using price_elasticity.

quantile = [0.1,0.5,0.9]

T = 40

ylim1, ylim2 = 0.4, 0.4

plot_price_elasticity(ModelSol,T,quantile,'year',ylim1, ylim2)

3 Outputs#

3.1 List of Outputs #

We now examine the contents of ModelSol, which contains the attributes listed below. Each approximation is stored in a class LinQuadVar, which contains the coefficients for \(X_{1,t}, X_{2,t}, X_{1,t}'X_{1,t}, W_{t+\epsilon}, W_{t+\epsilon}'W_{t+\epsilon}, X_{1,t}'W_{t+\epsilon}\) and the constant.

Input |

Type |

Description |

|---|---|---|

|

LinQuadVar |

Approximation of jump and state variables at time \(t\). Replace |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

LinQuadVar |

Same as |

|

dict |

Dictionary containing solutions of the continuation values, including \(\mu^0, \Upsilon_0^2, \Upsilon_1^2,\) and \(\Upsilon_2^2\) etc. |

|

LinQuadVar |

Approximation of continuation values \(\widehat{V}^1_{t+\epsilon}-\widehat{R}^1_t\) . Replace |

|

LinQuadVar |

Approximation of consumption growth \(\widehat{C}_{t+\epsilon}-\widehat{C}_t\) . Replace |

|

dict |

Steady states for state and jump variables |

|

LinQuadVar |

Approximation for the log change of measure |

For example, we can obtain the coefficients for the first-order contribution of \(\log{C_t/K_t}\) in the following way, noting that cmk_t was listed as the first jump variable when we specified the equilibrum conditions.

## Log consumption over capital approximation results, shown in the LinQuadVar coefficients form

ModelSol['JX1_t'][0].coeffs

{'x': array([[-0. , 0.17006158, -0. ]]),

'c': array([[-0.06496613]])}

We can also display the full second-order approximation of \(\log{C_t/K_t}\) using the disp function, which renders a LinQuadVar object in LATEX form.

## Log consumption over capital approximation results, shown in the Latex analytical form

disp(ModelSol['JX_t'][0],'\\log\\frac{C_t}{K_t}')

Another example:

## Log capital growth process second order approximation results

disp(ModelSol['X2_tp1'][0],'\\log\\frac{K_{t+\epsilon}^2}{K_t^2}')

3.2 Simulate Variables #

Given a series of shock processes, we can simulate the path of our state and jump variables using the ModelSolution.simulate method. Here, we simulate 400 periods of i.i.d standard multivariate normal shocks.

Ws = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 400)

JX_sim = ModelSol.simulate(Ws)

4 Using LinQuadVar in Computation #

In the previous section, we saw how to use uncertain_expansion to approximate variables and store their coefficients as LinQuadVar objects. In this section, we explore how to manipulate LinQuadVar objects for different uses.

To aid our examples, we first extract the steady states for the state evolution processes from the previous model solution:

See src/lin_quad.py for source code of LinQuadVar definition.

ModelSol['ss']

array([ -3.66035793, 0.0664767 , 0.02039991, 0. , 1. , 0.01330655, 0. , -11.97496092])

n_J, n_X, n_W = ModelSol['var_shape']

X0_tp1 = LinQuadVar({'c':np.array([[ModelSol['ss'][0]],[ModelSol['ss'][1]],[ModelSol['ss'][2]]])}, shape = (n_X, n_X, n_W))

4.1 LinQuadVar Operations #

We can sum multiple LinQuads together in two different ways. Here we demonstrate this with an example by summing the zeroth, first and second order contributions of our approximation for capital growth.

gk_tp1 = X0_tp1[0] + ModelSol['X1_tp1'][0] + 0.5 * ModelSol['X2_tp1'][0]

disp(gk_tp1,'\\log\\frac{K_{t+\epsilon}}{K_t}')

In the next example, we sum together the contributions for both capital growth and technology:

lq_sum([X0_tp1, ModelSol['X1_tp1'], 0.5 * ModelSol['X2_tp1']]).coeffs

{'xw': array([[ 0. , 0. , 0. , 0. , 0. , 0. , 0.00399962, 0.00173897, 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0.02478025, 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , -0.21392032]]),

'c': array([[-3.65924752],

[ 0.0664767 ],

[-0.0711239 ]]),

'xx': array([[-0. , -0. , 0. , -0. , -0.00021926, 0. , -0. , -0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. ],

[ 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0. , 0.097 ]]),

'x2': array([[-0. , 0.0185721, 0. ],

[ 0. , 0.472 , 0. ],

[ 0. , 0. , 0.403 ]]),

'x': array([[-0. , 0.03728112, 0.00008691],

[ 0. , 0.944 , 0. ],

[ 0. , 0. , 0.806 ]]),

'w': array([[0.00799924, 0.00347793, 0. ],

[0. , 0.04956051, 0. ],

[0. , 0. , 0.42784065]])}

4.2 LinQuadVar Split and Concat #

split breaks multiple dimensional LinQuad into one-dimensional LinQuads, while concat does the inverse.

gk_tp1, Z_tp1, Y_tp1 = ModelSol['X1_tp1'].split()

concat([gk_tp1, Z_tp1, Y_tp1])

<lin_quad.LinQuadVar at 0x31b72a4e0>

4.3 Evaluate a LinQuadVar #

We can evaluate a LinQuad at specific state \((X_{t},W_{t+\epsilon})\) in time. As an example, we evaluate all 5 variables under steady state with a multivariate random normal shock.

x1 = np.zeros([n_X ,1])

x2 = np.zeros([n_X ,1])

w = np.random.multivariate_normal(np.zeros(n_W),np.eye(n_W),size = 1).T

ModelSol['JX_tp1'](*(x1,x2,w))

array([[ -3.71818036],

[ 0.06792475],

[ 0.02041077],

[ -0.00013651],

[ 0.99999734],

[ 0.01454234],

[ 0.05682728],

[-12.65749319]])

4.4 Next period expression for LinQuadVar #

ModelSol allows us to express a jump variable \(J_t\) as a function of \(t\) state and shock variables. Suppose we would like to compute its next period expression \(J_{t+\epsilon}\) with shocks. The function next_period expresses \(J_{t+\epsilon}\) in terms of \(t\) state variables and \(t+\epsilon\) shock variables. For example, we can express the \(t+\epsilon\) expression for the first-order contribution to consumption over capital as:

cmk1_tp1 = next_period(ModelSol['J1_t'][0], ModelSol['X1_tp1'])

disp(cmk1_tp1, '\\log\\frac{C_{t+\epsilon}^1}{K_{t+\epsilon}^1}')

cmk2_tp1 = next_period(ModelSol['J2_t'][0], ModelSol['X1_tp1'], ModelSol['X2_tp1'])

disp(cmk2_tp1, '\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}')

4.6 Compute the Expectation of time \(t+\epsilon\) LinQuadVar #

Suppose the distribution of shocks has a constant mean and variance (not state dependent). Then, we can use the E function to compute the expectation of a time \(t+\epsilon\) LinQuadVar as follows:

E_w = ModelSol['util_sol']['μ_0']

cov_w = np.eye(n_W)

E_ww = cal_E_ww(E_w, cov_w)

E_cmk2_tp1 = E(cmk2_tp1, E_w, E_ww)

disp(E_cmk2_tp1, '\mathbb{E}[\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}|\mathfrak{F_t}]')

Suppose the distribution of shock has a state-dependent mean and variance (implied by \(\tilde{N}_{t+\epsilon}\) shown in the notes), we can use E_N_tp1 and N_tilde_measure to compute the expectation of time \(t+\epsilon\) LinQuadVar.

N_cm = N_tilde_measure(ModelSol['util_sol']['log_N_tilde'],(1,n_X,n_W))

E_cmk2_tp1_tilde = E_N_tp1(cmk2_tp1, N_cm)

disp(E_cmk2_tp1_tilde, '\mathbb{\\tilde{E}}[\\log\\frac{C_{t+\epsilon}^2}{K_{t+\epsilon}^2}|\mathfrak{F_t}]')