5 Elasticities#

This Python notebook covers shock elasticities. Shock elasticites are computed by solving:

Shock price-elasticities can be computed using: $\( \varepsilon_M(t,x) - \varepsilon_{SM}(t,x) \)$

Where \(S\) is the stochastic discount factor.

This can either be solved using finite differences or simulated. We describe both methods here.

5.1 Finite Differences#

We compute elasticities using the finite differences method described in Supplemental Appendix C.3. Where \({\hat{M}}=\log{M}\):

The finite differences elasticities code is implemented for all model environments in the paper, but we will focus on the baseline model in this section. The main function for calculating elasticities is main_pde_shock_elasticity, which takes in the same inputs as the solution script, which in this case is main_onecapital. These inputs are used to identify a saved solution; therefore, this function must be run after the solution script has finished running.

There are several parameters which can be changed inside the body of main_pde_shock_elasticity. Notably, dt controls the time step, where dt=1 is one year, while T controls the total number of dt periods for which the elasticity is computed.

Within main_pde_shock_elasticity, the function compute_pde_shock_elasticity computes shock-exposure and shock-price elasticities for a given cash flow variable \(M\) and stochastic discount factor \(S\). These variables are specified by inputting their drift - mulogM and mulogS - and diffusion terms - sigmalogM and sigmalogS. For the baseline model, by default, the code computes drifts and diffusions for the following \(M\) variables:

\(\hat{M}\) |

Notation in paper |

Description |

|---|---|---|

|

\(\log{\frac{C}{K}}\) |

Log consumption-capital ratio |

|

\(\log{\frac{I}{Y}}\) |

Log investment-output ratio |

|

\(\log{C}\) |

Log consumption |

And the following \(S\) variables:

\(\hat{S}\) |

Notation in paper |

Description |

|---|---|---|

|

\(\hat{S}\) |

Log stochastic discount factor |

|

\(\hat{N}\) |

Log uncertainty component of SDF |

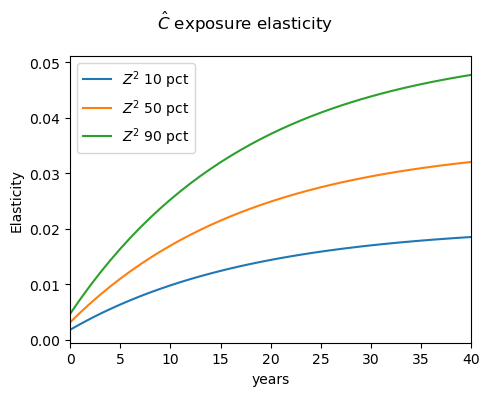

The user can also set the initial state. marginal_quantile is a dictionary which computes the quantiles of the marginal stationary distribution of each state. For example, marginal_quantile['Z'](0.5) computes the median of the marginal distribution of Z. Since the states consist of \(Z^1\) (Z in the code) and \(Z^2\) (Y in the code), we can define the initial state as follows:

initial_points = [[marginal_quantile['Z'](0.5),marginal_quantile['Y'](0.1)],

[marginal_quantile['Z'](0.5),marginal_quantile['Y'](0.5),

marginal_quantile['Z'](0.5),marginal_quantile['Y'](0.9)]]

In the above example, we initialize \(Z^2\) at its 10th, 50th and 90th percentiles while holding \(Z^1\) at its median.

First we import the necessary libraries:

import os

import sys

import numpy as np

from scipy.interpolate import RegularGridInterpolator as RGI

import argparse

import matplotlib.pyplot as plt

os.chdir("src/1/")

from main_pde_shock_elasticity import main

from utils_FDM import finiteDiff_2D_first, finiteDiff_2D_second, finiteDiff_2D_cross

from utils_pde_shock_elasticity import computeElas

from plot_function import return_solution, plot_solution

os.chdir("../../")

Next, we set the elasticity inputs. Remember that a solution must be saved under the same parameters before the elasticities can be computed.

alpha = 0.0922

delta = 0.01

gamma = 1.0

Delta = 1.0

rho = 1.0

action_name = "test"

After changing these settings to your liking, we can run main_pde_shock_elasticity. Using default settings, this takes 20 seconds.

main(Delta, delta, gamma, rho, alpha, action_name)

--- 12.889362812042236 seconds for the elasticity computation ---

--- 4.820237636566162 seconds for the elasticity computation ---

--- 3.97141170501709 seconds for the elasticity computation ---

Once the above function has finished running, we can load in the results. The elasticity for each \(M\) is saved as a separate npz file, but we can load all of them at once using the return_solution function.

res = return_solution(rho, gamma, Delta, delta, alpha, action_name)

res

Show code cell output

{'res': NpzFile './output/test/Delta_1.0/delta_0.01/gamma_1.0_rho_1.0_alpha_0.0922/res.npz' with keys: ymax, V, dy, a22, zz...,

'elasticity_logc': NpzFile './output/test/Delta_1.0/delta_0.01/gamma_1.0_rho_1.0_alpha_0.0922/elasticity_logc.npz' with keys: exposure_elasticity, price_elasticity,

'elasticity_logimo': NpzFile './output/test/Delta_1.0/delta_0.01/gamma_1.0_rho_1.0_alpha_0.0922/elasticity_logimo.npz' with keys: exposure_elasticity, price_elasticity,

'uncertainty_priceelas': NpzFile './output/test/Delta_1.0/delta_0.01/gamma_1.0_rho_1.0_alpha_0.0922/uncertainty_priceelas.npz' with keys: exposure_elasticity, price_elasticity}

For example, we can load the first-type exposure elasticities for \(\hat{C}\) by accessing ['elasticity_logc']['exposure_elasticity'].item().firstType. The first index of this object is the initial state; 0 represents the first initialization, which in this case is \(Z^1\) at median and \(Z^2\) at 10th percentile. The second index is the shock index; in this case, 1 represents a growth-rate shock. The third index is time. To illustrate this, we have written a simple plot_solution function, but the user can edit this to display their desired results.

plot_solution(rho, gamma, Delta, delta, alpha, action_name)

5.2 Simulation#

Alternatively, we can compute elasticities by simulation. Specifically, we use simulations to estimate:

Currently, this method is only implemented for the heterogeneous agents environment in Section 5, but the user can easily modify the code to adapt to the other environments.

The solution scripts give us the objects we need: [\mu_X, \sigma_X, \mulogM, \sigmalogM, \mulogS, \sigmalogS] to perform simulations. These objects are interpolated on the state space grid using the scipy.interpolate.RegularGridInterpolator function. We initialize the states at \(X_0\) and simulate sim_num*100 independent Brownian motion processes \({B_t}\) with length \(T\), use these to evaluate \({X_t}\). Using the interpolations, we can compute \({M_t/M_0}\) and \({S_t/S_0}\) and thus estimate the expectation term. We repeat this with initial state \(X_0+dx\) and use this to estimate the derivative of the expectation.

Similar to the finite differences code, main_sim_shock_elasticity takes the same inputs as the main solution script, with the addition of the state percentiles [W_percentile,Z_percentile,V_percentile], which characterise the initial state \(X_0\). We recommend using a remote computing resource to run this program, which may take around an hour per elasticity computed.

In addition, the main_sim_shock_elasticity script can be edited to change the following parameters:

Parameter |

Description |

Default Value for 3D case |

|---|---|---|

|

Number of simulations is |

100 |

|

Simulation length in years |

50 |

|

Shock index: 0 for the capital shock, 1 for growth shock and 2 for volatility shock |

0 |

|

Step-size for state derivative |

|

|

Time step |

1 |

|

State space |

|

|

State variable drift terms |

|

|

State variable diffusion terms |

|

|

Log drift term for the response variable M |

|

|

Log diffusion terms for the response variable M |

|

|

Log drift term for the SDF |

|

|

Log diffusion terms for the SDF |

|

The script saves the exposure_elasticity and price_elasticity. There is a chance that the simulation fails as \(X_t\) may move outside the state space grid. The total number of successful simulations for \(X_0\) and \(X_0+dx\) are recorded as initial_success_count and derivative_success_count, respectively. By default, intermediate variables, such as \(X_t/X_0\), are not saved; this can be altered by setting return_type=0.

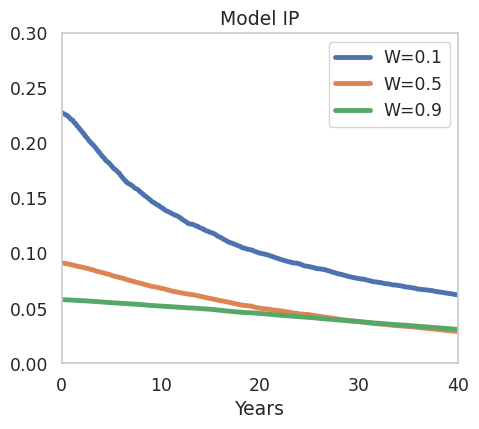

Now we demonstrate the code for the 2D Model IP case.

import numpy as np

np.set_printoptions(suppress=True, linewidth=200)

import os

from scipy import interpolate

os.chdir("src/5")

from main_sim_shock_elasticity import main, read_txt_stationary_density, marginal_quantile_func_factory,read_dat_state

from plot import return_fdm_solution, return_elasticity

os.chdir("../..")

import warnings

warnings.filterwarnings("ignore")

import argparse

import matplotlib.pyplot as plt

import seaborn as sns

sns.set(style="whitegrid", font_scale=1.13, rc={"lines.linewidth": 3.5})

plt.rcParams['axes.formatter.useoffset'] = True

We provide example parameters which follow the default example in Chapter 4 of this notebook. For illustration, we initialize \(W\) at its 10th, 50th and 90th percentiles, with \(Z_1\) fixed at its median.

chiUnderline=1.0

a_e=0.0922

a_h=0.085

gamma_e=2.0

gamma_h=2.0

delta_e=0.03

delta_h=0.01

lambda_d=0.0

rho_e=1.0

rho_h=1.0

nu=0.1

dt=0.1

nW=180

nZ=30

shock_expo='upper_triangular'

action_name='test'

W_percentiles=[0.1,0.5,0.9]

Z_percentile=0.5

initial_index=1

Next, we run the simulation for each \(W\) percentile. This can take more than an hour using default settings.

for W_percentile in W_percentiles:

main(chiUnderline=1.0, a_e=0.0922, a_h=0.085, gamma_e=2.0, gamma_h=2.0, delta_e=0.03, delta_h=0.01, lambda_d=0.0,

rho_e=1.0, rho_h=1.0, nu=0.1, dt=0.1, nW=180, nZ=30, shock_expo='upper_triangular', action_name='test', W_percentile=W_percentile, Z_percentile=0.5, initial_index=1)

Simulating elasticities for W

Submitting tasks: 100%|██████████| 10/10 [00:00<00:00, 23.80it/s]

Processing tasks: 0%| | 0/10 [00:01<?, ?it/s]

We now load the results and plot an example.

elasticities = {}

for W_percentile in W_percentiles:

elasticities[W_percentile] = return_elasticity(shock_expo, dt, nW, chiUnderline, a_e, a_h, gamma_e, gamma_h, rho_e, rho_h, delta_e, delta_h, lambda_d, nu, action_name, nZ, W_percentile, Z_percentile, initial_index)

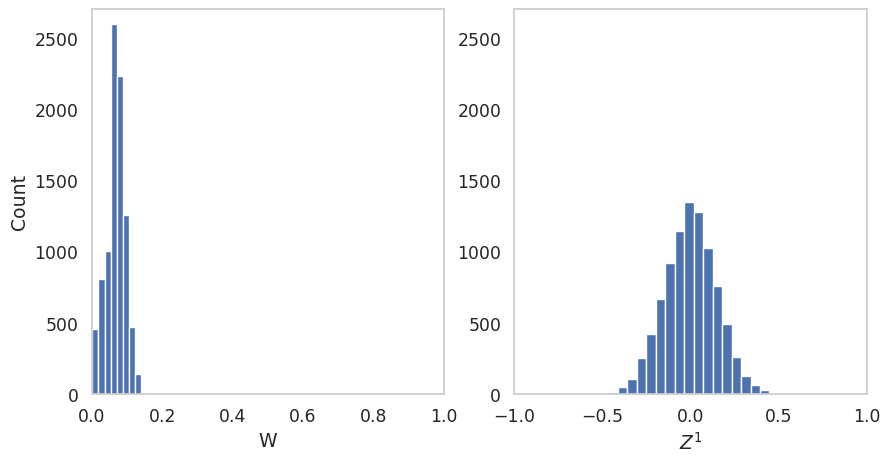

Here we plot the simulated distribution of the state variables.

fig, ax = plt.subplots(1, 2, figsize=(10, 5))

ax[0].hist(elasticities[0.1]['X_processes'][:,0,479],bins=10)

ax[0].set_xlim(0,1)

ax[0].grid(False)

ax[0].set_xlabel('W')

ax[0].set_ylim(0,2700)

ax[1].hist(elasticities[0.1]['X_processes'][:,1,479],bins=20)

ax[1].set_xlim(-1,1)

ax[1].grid(False)

ax[1].set_xlabel(r'$Z^1$')

ax[1].set_ylim(0,2700)

ax[0].set_ylabel('Count')

Text(0, 0.5, 'Count')

Finally, we plot the simulated elasticities:

fig, axes = plt.subplots(1,1, figsize=(5,4.5))

sns.lineplot(x=np.linspace(0,49,480),y=elasticities[0.1]['exposure_elasticity'], ax = axes, label='W=0.1')

sns.lineplot(x=np.linspace(0,49,480),y=elasticities[0.5]['exposure_elasticity'], ax = axes, label='W=0.5')

sns.lineplot(x=np.linspace(0,49,480),y=elasticities[0.9]['exposure_elasticity'], ax = axes, label='W=0.9')

axes.set_title(r'Model IP')

axes.grid(False)

axes.set_ylim([0,0.3])

axes.set_xlabel('Years')

axes.set_xlim(0,40)

plt.subplots_adjust(wspace=0.3, hspace=0.25)

plt.tight_layout()